From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineGerman Rebar Market Stays Soft: Plant Activity Mixed Amid Price Pressures

Rebar prices in Germany remain under pressure, as indicated by the news articles “German fittings remain soft” and “German rebar remains soft.” These articles suggest a stabilization of prices is more likely than a rebound before summer, impacting German steel plants differently. While a direct connection between these price pressures and observed plant activity is difficult to ascertain definitively without further data, the trends at individual plants offer some insights.

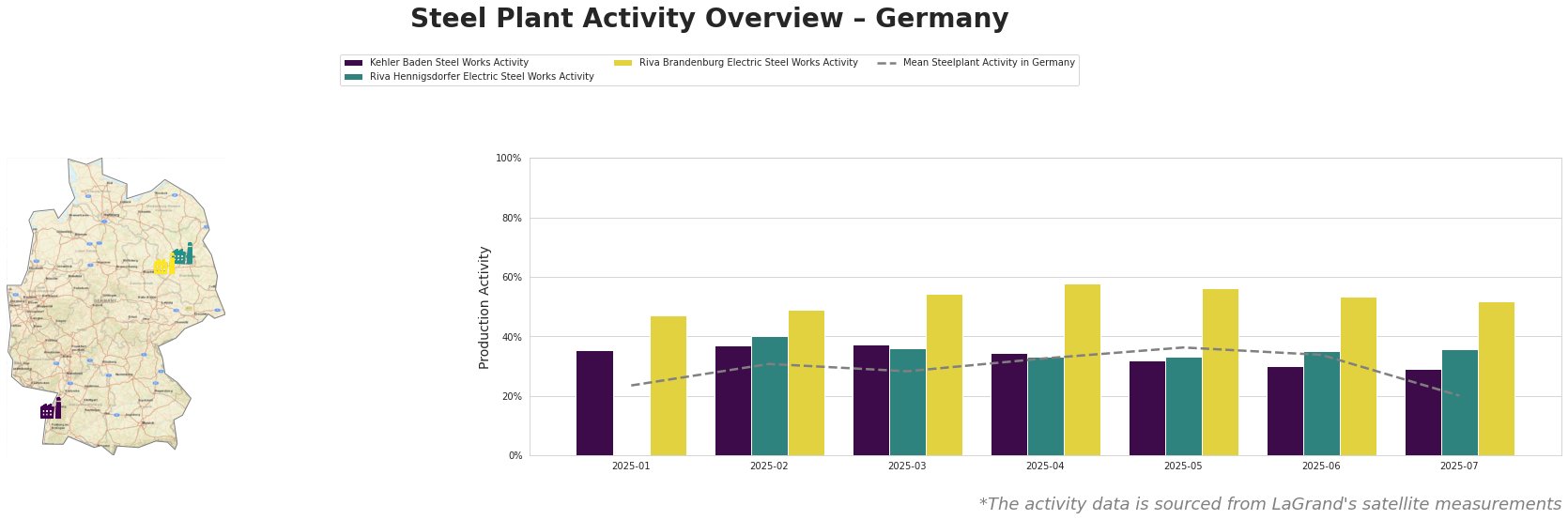

Overall steel plant activity in Germany averaged at 34% from January to June, dropping significantly to 20% in July. Riva Brandenburg consistently operated above the mean, peaking at 58% in April, and gradually decreasing to 52% in July. Riva Hennigsdorfer activity has been largely stable, with 33-36% activity, since Feburary. Kehler Baden Steel Works saw a steady decline from 36% in January to 29% in July.

Kehler Baden Steel Works, located in Baden-Württemberg, operates two EAFs with a total crude steel capacity of 2.5 million tonnes, focusing on semi-finished and finished rolled products, including rebar, primarily for the building and infrastructure sectors. The activity at Kehler Baden Steel Works experienced a notable decline from 36% in January to 29% in July. Given the reported softness in rebar prices discussed in “German fittings remain soft” and “German rebar remains soft,” this drop might reflect a reduced production rate in response to margin pressures, although a definitive causal relationship cannot be explicitly established with the available data.

Riva Hennigsdorfer Electric Steel Works, situated in Brandenburg, possesses a crude steel capacity of 1 million tonnes via EAF, producing steel billets, rebar, and bright steel for the automotive industry. The plant’s activity has been stable over the observed period. A direct connection between this stable operation and news of rebar prices cannot be established from the current data.

Riva Brandenburg Electric Steel Works, also in Brandenburg, has a larger crude steel capacity of 1.8 million tonnes, utilizing EAF technology. Its product range includes wire rod, rebar, and steel billets, catering to diverse sectors like automotive, building, and energy. The activity at Riva Brandenburg has been consistently high relative to other plants but saw a steady decline since April, from 58% to 52% in July. While no direct link to the rebar market softness reported in “German fittings remain soft” and “German rebar remains soft” can be definitively proven, this overall downward trend could be a delayed reaction to market conditions.

Given the continued softness in the rebar market as evidenced by “German fittings remain soft” and “German rebar remains soft,” and the observed decline in activity at Kehler Baden Steel Works, steel buyers should prioritize securing contracts with staggered delivery schedules to mitigate potential supply volatility from this plant. Buyers should also closely monitor Riva Brandenburg’s activity, as a further decline could signal broader production adjustments impacting availability. While Italian imports currently offer only marginal price advantages, monitoring Italian market dynamics remains crucial as potential shifts could alter import competitiveness and influence regional pricing.