From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineFrench Steel Market Poised for Growth: ArcelorMittal and Marcegaglia Investments Drive Optimism

France’s steel market exhibits a very positive sentiment, driven by significant investments and strategic realignments. ArcelorMittal’s reaffirmed commitment to decarbonization projects, as highlighted in “ArcelorMittal committed to restarting French decarbonization plan following EU measures,” and “ArcelorMittal has committed to resume the implementation of the French decarbonization plan in line with EU measures,” signals a long-term vision despite past delays. Simultaneously, “Marcegaglia increases investment in the restart of its plant in France to €800 million” underscores a boost to domestic supply capacity. No direct relationships can be established with the activity in the FOS-sur-Mer steel plant, since activity data is not available in the provided CSV data.

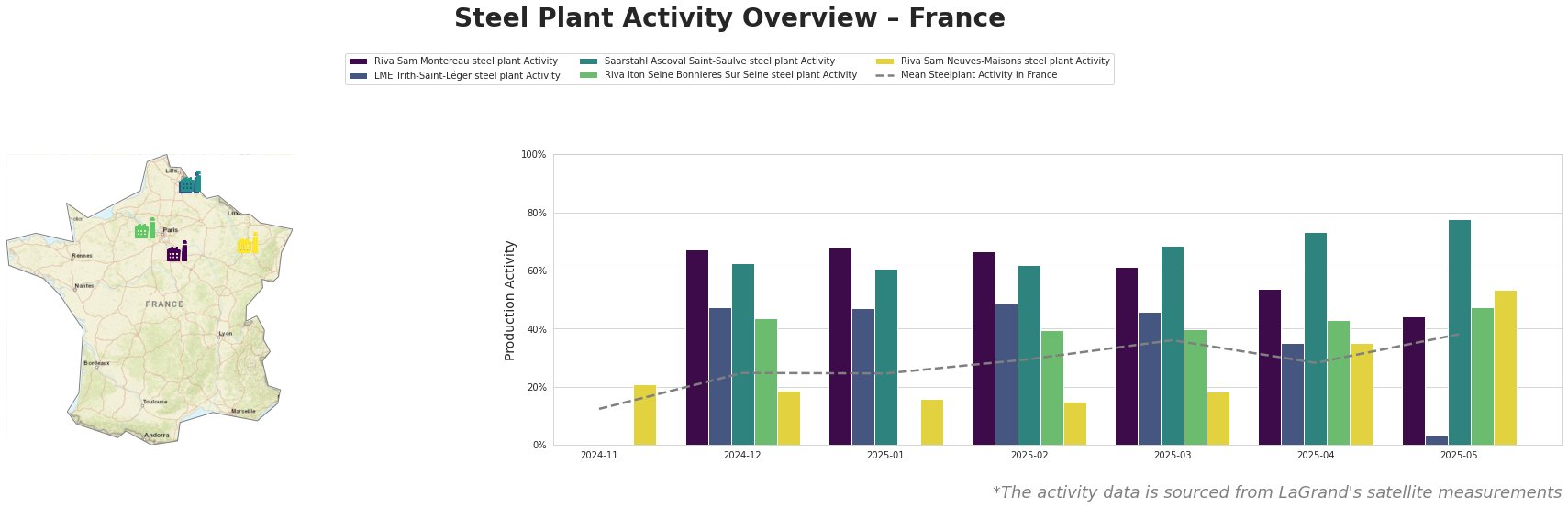

Overall, the mean steel plant activity in France has increased from 12% in November 2024 to 38% in May 2025, indicating a positive trend. The most substantial increase across all plants occurred between November and December 2024.

The Riva Sam Montereau steel plant, an EAF-based facility in Île-de-France with a capacity of 720ktpa crude steel, experienced a significant decrease in activity, dropping from 68% in January 2025 to 44% in May 2025. No direct connection to the provided news articles can be established.

The LME Trith-Saint-Léger steel plant in Hauts-de-France, also an EAF-based facility with a slightly higher capacity of 850ktpa crude steel, shows a drastic activity decrease, plummeting from 47% in January to a mere 3% in May 2025. No direct connection to the provided news articles can be established.

The Saarstahl Ascoval Saint-Saulve steel plant, another EAF-based plant in Hauts-de-France producing semi-finished and finished rolled products with a capacity of 730ktpa, has consistently shown high activity. Its activity rose to 78% in May 2025, the highest value of all plants considered and time periods, significantly above the mean steel plant activity in France. No direct connection to the provided news articles can be established.

The Riva Iton Seine Bonnieres Sur Seine steel plant, an EAF-based facility located in Île-de-France with a 550ktpa capacity, shows fluctuating activity levels, ending at 48% in May 2025. No direct connection to the provided news articles can be established.

The Riva Sam Neuves-Maisons steel plant in Grand Est, an EAF-based plant with a capacity of 850ktpa, has gradually increased activity, reaching 53% in May 2025, marking a substantial increase from November 2024. No direct connection to the provided news articles can be established.

ArcelorMittal’s investments, mentioned in “ArcelorMittal Confirms Intention to Build €1.2 Billion EAF in Dunkirk,” aim to modernize facilities in Dunkirk and Fos-sur-Mer. These investments, alongside the broader EU Steel and Metal Action Plan referenced across multiple articles, suggest a strategic shift towards sustainable steel production in France, but have yet to show effects in the observed plant activity.

The planned EAF construction in Dunkirk and the increased investment by Marcegaglia signal increased future supply. However, current data indicates potential localized disruptions stemming from reduced activity at the Riva Sam Montereau and LME Trith-Saint-Léger plants, especially in the Île-de-France and Hauts-de-France regions, respectively. Steel buyers should closely monitor these regional trends and potentially diversify suppliers in the short term to mitigate risks. Given the rising mean steel plant activity in France, procurement professionals should anticipate potential price increases driven by growing demand and activity. Monitoring the progress of ArcelorMittal’s decarbonization projects and Marcegaglia’s plant restart, in conjunction with monthly activity data, will be crucial for informed decision-making in the evolving French steel market.