From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurozone Steel Production Rises Amidst Climate Concerns: An Uneven Recovery

Europe’s steel market shows signs of recovery, though unevenly distributed and shadowed by climate policy challenges. Recent increases in Euro area industrial output reported in “Euro area industrial output up 2.6 percent in March from February,” contrast with the climate concerns raised in “Deutschland hält Klimaziele ein – dank schlecht laufender Wirtschaft” and “Deutschland ist laut Expertenrat vorerst auf Klimakurs.” While industrial output suggests growing demand for steel, particularly in capital goods, the German economy’s struggles and resultant emissions reductions are not sustainable drivers for meeting climate goals. No direct relationship could be established between these news articles and satellite-observed changes in plant activity levels.

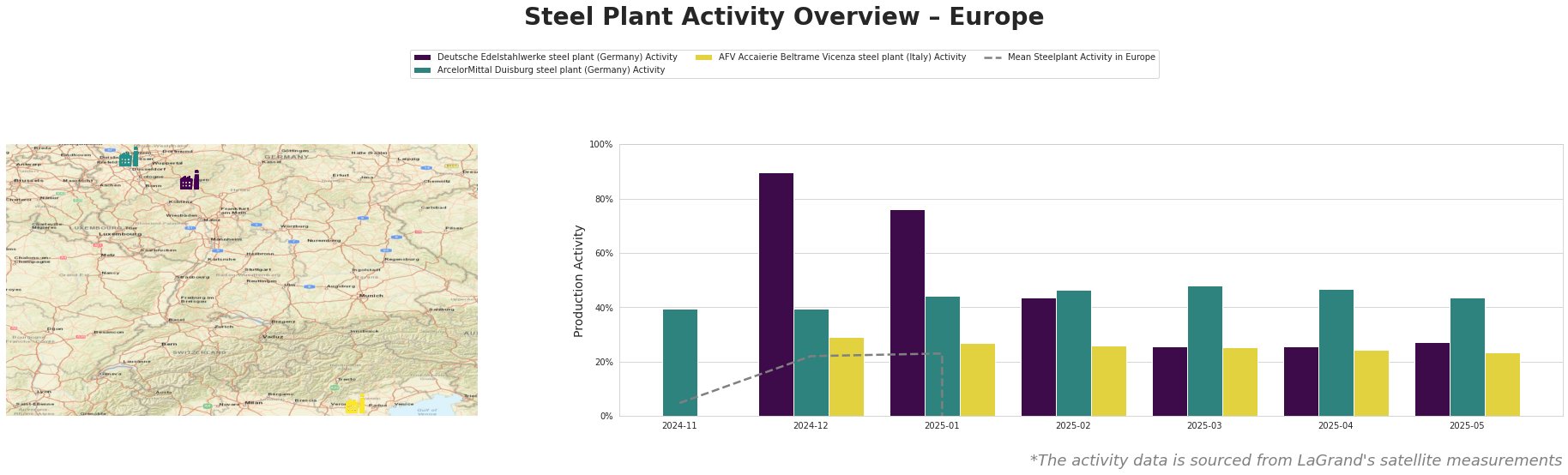

The data reveals volatile activity levels across observed plants, contrasted by a steady decline in the mean activity, beginning with extreme negative values in February 2025 which skewed the data significantly and do not accurately reflect market conditions.

-

Deutsche Edelstahlwerke: This German steel plant, with an EAF capacity of 600ktpa, saw a significant activity spike to 90% in December 2024, followed by a steady decline to 27% by May 2025. This drop does not directly correlate with the news articles, suggesting potential plant-specific factors or localized market dynamics at play. The facility focuses on special steel products like billets and forged products, serving automotive, energy, and machinery sectors.

-

ArcelorMittal Duisburg: Activity at this BOF-based plant remained relatively stable around 40-48%, peaking at 48% in March 2025. It has been trending lower from March to May, ending at 43% in May. ArcelorMittal Duisburg produces wire rod, reinforcing bars, and steel bars, supporting automotive and machinery industries. No explicit link can be established between the observed activity levels and cited news articles.

-

AFV Accaierie Beltrame Vicenza: This Italian EAF steel plant, with a capacity of 1200ktpa, experienced a gradual decline in activity from 29% in December 2024 to 23% in May 2025. Like Deutsche Edelstahlwerke, no direct connection can be established to the provided news articles.

Given the increase of industrial output as cited in “Euro area industrial output up 2.6 percent in March from February” procurement professionals should note that despite fluctuations in plant activity, overall demand appears to be rising, especially for capital goods.

Recommendations:

- Monitor German Economic Policy: Given Germany’s significant role in the European steel market and the concerns raised in “Deutschland hält Klimaziele ein – dank schlecht laufender Wirtschaft“, steel buyers should closely monitor upcoming policy changes and their potential impact on industrial output and steel demand.

- Negotiate Flexible Contracts: Considering the observed volatility in plant activity, particularly at Deutsche Edelstahlwerke, procurement strategies should include flexible contracts that allow for adjustments based on regional economic conditions and potential supply chain disruptions.

- Diversify Sourcing: With potential risks associated with reliance on specific plants or regions, diversifying sourcing across multiple suppliers within and outside the Eurozone is advisable to mitigate supply chain vulnerabilities.