From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Production Rises Amidst Consumption Concerns: Germany and Italy Lead Growth

In Europe, steel production shows signs of recovery in some regions, though consumption trends remain a concern. According to the news articles, “Germany increased steel production by 5.1% m/m in October” and “Italy increased steel production by 6% m/m in October“, indicating a potential upturn in output. However, these increases should be viewed in the context of “Italy’s apparent consumption is declining, Germany’s trade balance is becoming scarce“, suggesting potential challenges for sustained growth. These news articles do not provide clear explanations for the satellite-observed changes in activity, and it is hard to relate them directly.

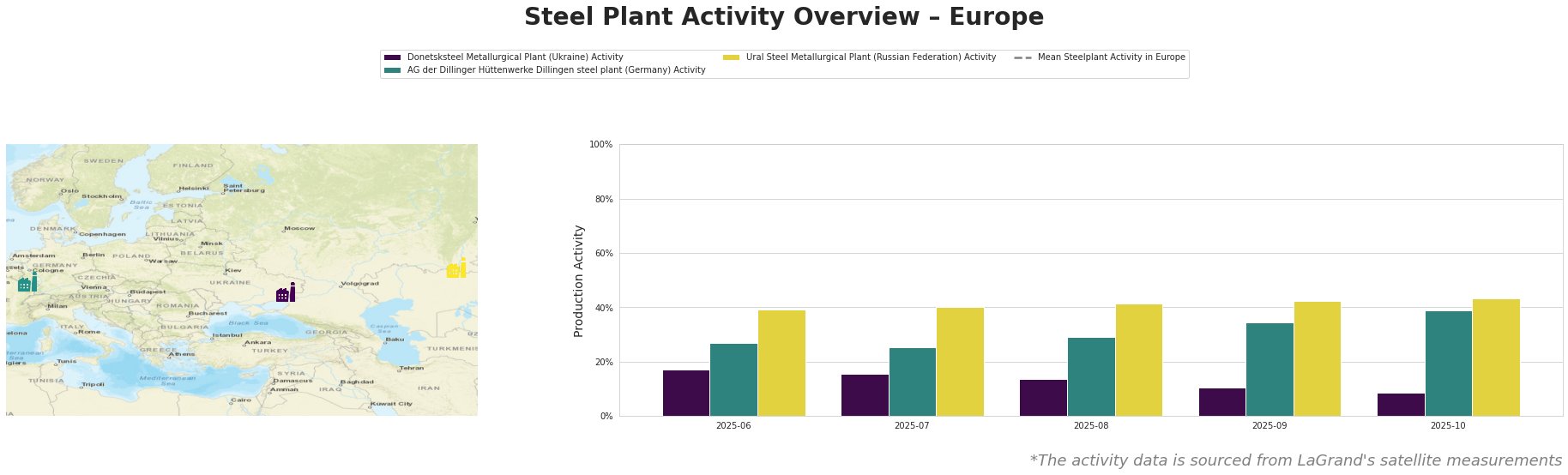

The mean steel plant activity in Europe experienced fluctuations, peaking in July-August before declining through October. Donetsksteel Metallurgical Plant, an integrated (BF) plant in Ukraine producing mainly pig iron, showed a consistent decline in activity from June (17%) to October (9%). This decline cannot be directly linked to the provided news articles. AG der Dillinger Hüttenwerke, a German integrated (BF) steel plant producing semi-finished and finished rolled products, demonstrated a steady increase in activity from 27% in June to 39% in October. This observed increase in activity correlates with the news article “Germany increased steel production by 5.1% m/m in October”. Ural Steel Metallurgical Plant, a Russian integrated (BF) steel plant producing crude, semi-finished, and finished rolled products, exhibited a continuous rise in activity from 39% in June to 43% in October. This trend occurs independently of the steel production reports for Germany and Italy.

Donetsksteel Metallurgical Plant, located in Donetsk, Ukraine, operates with integrated (BF) process. Its activity has been steadily declining, reaching 9% in October, suggesting ongoing operational challenges. There is no direct correlation to be found with the named news articles.

AG der Dillinger Hüttenwerke Dillingen steel plant, situated in Saarland, Germany, also uses an integrated (BF) process and produces a range of semi-finished and finished rolled products. Its activity increased significantly from 27% in June to 39% in October. This aligns with “Germany increased steel production by 5.1% m/m in October”, indicating the plant is contributing to Germany’s overall production growth.

Ural Steel Metallurgical Plant, in the Orenburg region of Russia, also employs an integrated (BF) process alongside EAF. This plant’s activity showed a consistent increase, reaching 43% in October. There are no direct links to the European market news reported in the articles.

Given the observed increases in German and Italian steel production, coupled with the decrease in consumption in Italy and scarce trade balances with Germany, procurement professionals should consider the following:

- Potential supply tightness in specific product categories: The German production increase, particularly linked to AG der Dillinger Hüttenwerke Dillingen steel plant, suggests a potentially stable supply of heavy-plate products. Buyers requiring these products should leverage this information to secure favorable contracts.

- Increased monitoring of import dynamics: With “Italy’s apparent consumption is declining, Germany’s trade balance is becoming scarce” and with Indian steel imports rising in Italy, carefully monitor import prices and lead times. Diversify sourcing strategies where possible to mitigate risks from shifting trade flows.

- Donetsksteel Risk Mitigation: The continued, sustained decline in production at Donetsksteel (from 17% to 9% during the reported period) should be factored into risk assessments and sourcing decisions. Consider potential supply disruptions and delays from this source.