From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Surges: Feralpi’s Green Investments Fuel Rebar Production Amidst Energy Concerns

Europe’s steel market exhibits a very positive sentiment, driven by infrastructure investments and innovative green technologies, particularly in Germany. The positive outlook is supported by “Feralpi foresees Germany recovery, launches FERGreen brand“ and several news titles focusing on Feralpi’s production increases. These trends may be linked to observed steel plant activities, though a direct link for each could not be explicitly established.

Feralpi’s significant investments in green steel production, as highlighted in “Feralpi Stahl launches new steel rolling mill in Riesa for €220 million“, suggest a shift towards more sustainable practices, yet the company also faces challenges related to energy costs, as mentioned in “Feralpi anticipates German recovery and launches FERGreen brand.” The news articles “Feralpi company launches new rolling mill in Germany“, “Germany’s Feralpi Stahl inaugurates new spooler rolling mill in Riesa“, and “Feralpi Germany starts up new rolling mill“ all corroborate the launch of the Riesa mill, emphasizing its green credentials and advanced technologies.

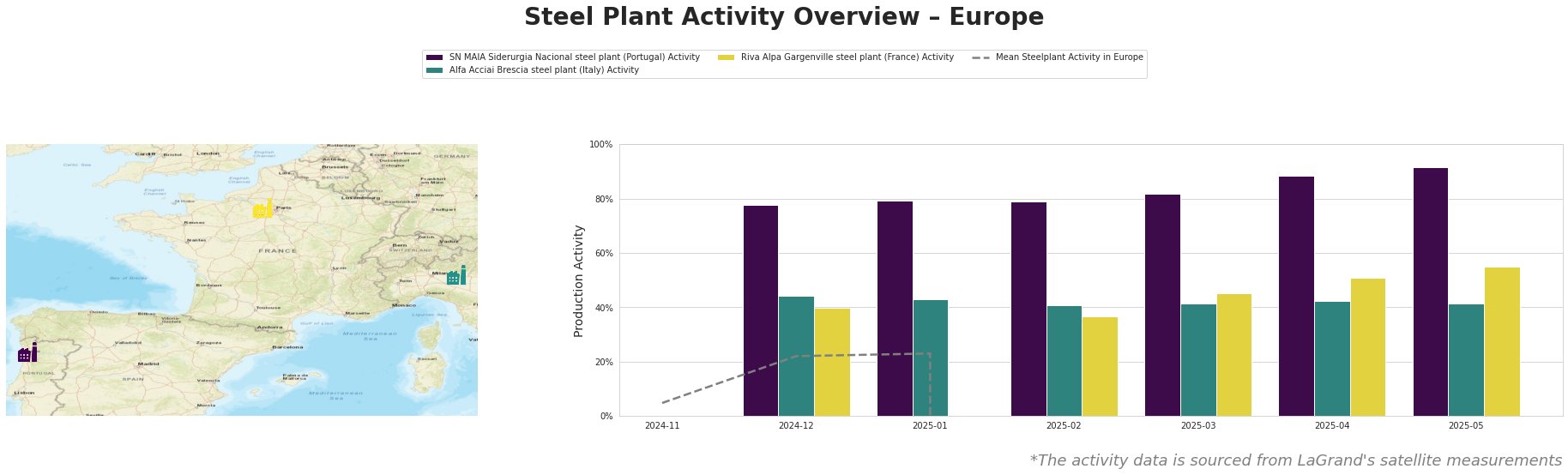

Across Europe, mean steel plant activity cannot be reliably calculated based on available data due to errors, displaying unrealistic negative values.

SN MAIA Siderurgia Nacional steel plant: Located in Porto, Portugal, this plant operates with an EAF-based production of 600,000 tonnes of crude steel annually and is ResponsibleSteel certified. Satellite data reveals a consistently high activity level, climbing from 78% in December 2024 to 92% by May 2025. Given its focus on rebar production and the stable consumption levels supported by infrastructure projects (as mentioned in “Feralpi foresees Germany recovery, launches FERGreen brand” in relation to Italy’s PNRR), this sustained high activity may reflect strong regional demand. No direct connection to the provided news could be explicitly established.

Alfa Acciai Brescia steel plant: Situated in the Province of Brescia, Italy, this EAF-based plant boasts a crude steel capacity of 1.7 million tonnes and is also ResponsibleSteel certified. The plant’s activity has remained relatively stable, fluctuating between 41% and 44% from December 2024 to May 2025. The stability of output might align with the stable consumption levels in Italy mentioned in “Feralpi anticipates German recovery and launches FERGreen brand”, which notes infrastructure projects as a key factor. No direct connection to the provided news could be explicitly established.

Riva Alpa Gargenville steel plant: Based in Île-de-France, France, this EAF-based plant has a crude steel capacity of 700,000 tonnes and is ResponsibleSteel certified. Its activity has shown an upward trend, increasing from 40% in December 2024 to 55% in May 2025. This increase could be linked to general positive market sentiment, but no direct relationship to the provided news articles can be explicitly established.

The launch of Feralpi’s new rolling mill in Riesa, Germany, signals increased rebar production capacity within Europe. However, potential supply disruptions may arise from high energy costs, as emphasized in multiple news articles.

Procurement Action: Steel buyers should proactively engage with Feralpi and other European rebar suppliers to secure contracts, leveraging the increased production capacity from the new Riesa mill. Given Feralpi’s emphasis on green steel (FERGreen brand), procurement strategies should explore options for incorporating low-emission steel into projects, aligning with sustainability goals. Buyers should closely monitor German energy policy developments and factor potential energy cost fluctuations into their pricing agreements.