From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Shows Positive Trends Amidst Ukrainian Coke Production Boost

Europe’s steel market demonstrates positive trends, partly driven by increasing coke production in Ukraine, as reported in “Zaporizhcoke increased production to 593,000 tons in January-August” and “Ukraine’s Zaporizhkoks posts higher coke output for August 2025.” These news articles link to potential improvements in the supply chain resilience for Ukrainian steel producers, although no direct link to activity levels at European steel plants observed by satellite can be explicitly established.

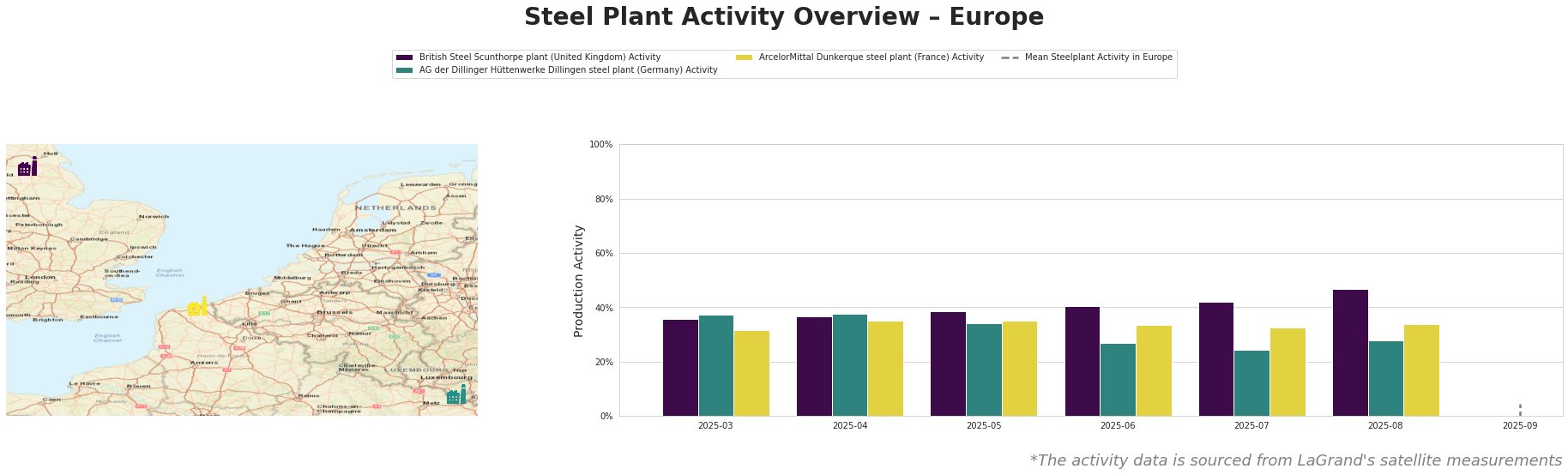

Monthly Activity Trends:

The mean steel plant activity in Europe is not readily interpretable due to data anomalies (negative values). However, examining individual plant activity shows distinct trends. British Steel Scunthorpe plant demonstrated a consistent increase in activity from March to August 2025, reaching 47.0 in August, its highest observed level, with a notable increase of 5 points between July and August. AG der Dillinger Hüttenwerke experienced a decrease, reaching a low of 24.0 in July, then increased slightly to 28.0 in August. ArcelorMittal Dunkerque exhibited relatively stable activity levels, fluctuating slightly and remaining consistently around the mid-30s. There is no direct link from news articles to the activity levels of the British Steel Scunthorpe plant, AG der Dillinger Hüttenwerke, and ArcelorMittal Dunkerque.

British Steel Scunthorpe, an integrated BF-BOF plant with a crude steel capacity of 3.2 million tonnes, saw its activity climb steadily throughout the observed period, culminating in a peak activity level in August. No news articles are explicitly linking this rise to specific events.

AG der Dillinger Hüttenwerke, with a capacity of 2.76 million tonnes of crude steel produced via the BF-BOF route, experienced a declining activity, which recovered slightly in August. There’s no explicit connection from available news articles to this activity pattern.

ArcelorMittal Dunkerque, a major integrated steel plant (6.75 million tonnes crude steel capacity), has exhibited stable activity. There’s no explicit connection from available news articles to this activity pattern.

Evaluated Market Implications:

While the news from Ukraine indicates a strengthening of the domestic coke supply for Ukrainian steel production, the satellite data doesn’t establish a clear impact on the activity levels of the observed European steel plants. The increase in activity at the British Steel Scunthorpe plant in August, without corresponding news events, signals the need for steel buyers to closely monitor spot market prices for finished rolled products, as well as semi-finished products such as slabs and blooms, potentially driven by increased demand or capacity utilization. Given the rising coke production in Ukraine, as mentioned in “Zaporizhcoke increased production to 593,000 tons in January-August“, and the increased reliance on coke imports highlighted in “Ukraine imported 364,700 tons of metallurgical coke in January-July“, steel buyers sourcing from Ukrainian mills should ensure that supply contracts include clauses addressing potential disruptions in coke supply, especially from Poland, and the associated price volatility.