From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Shows Mixed Signals: Production Declines in Germany & Ukraine Amidst Global Growth

Europe’s steel market presents a complex picture, with contrasting trends across the region. Declines in German output, as reported in “German crude steel output down 11.9 percent in January-August 2025,” coincide with decreased Ukrainian steel exports, detailed in “Ukraine’s steel exports down 13% as domestic consumption rises“. However, the connection between observed plant activity and these specific news events is not directly discernible through satellite data alone, as plant activity data does not explicitly state reasons for production changes.

Here’s an overview of activity:

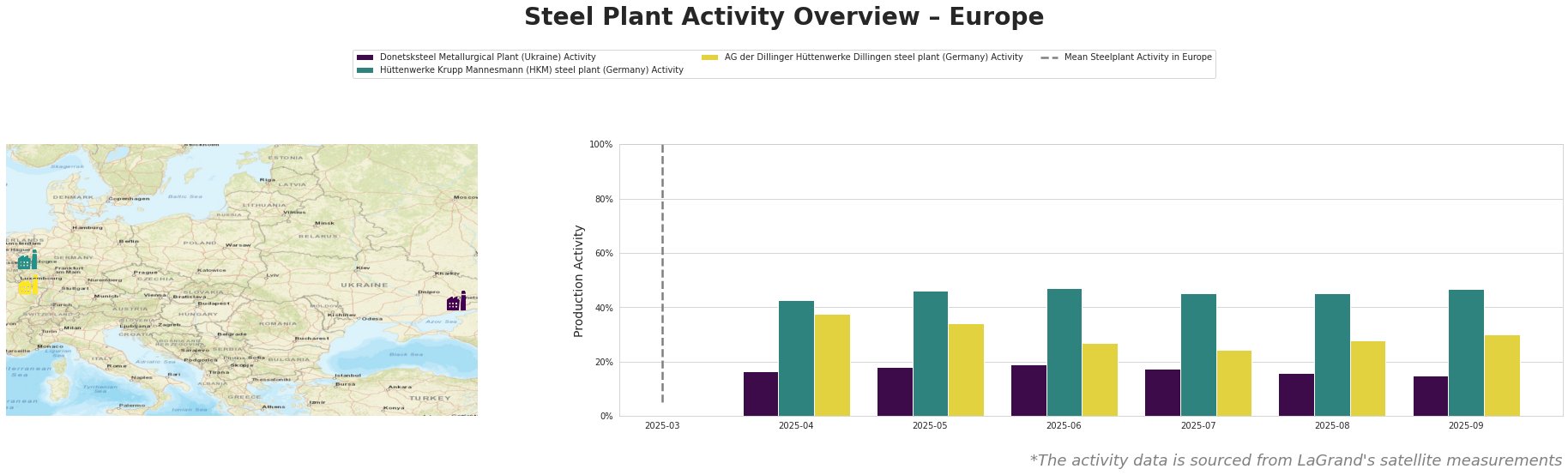

The mean steel plant activity in Europe, aggregated from all observed plants, has fluctuated significantly between March and September 2025.

Donetsksteel Metallurgical Plant, an integrated BF-based steel plant in Ukraine focused on pig iron production, shows a relatively stable but low activity level, ranging from 15% to 19% throughout the observed period. This consistent low level activity, may indicate challenges in its operations, as well as the wider steel production downturn in the country as highlighted in “Steel production in Ukraine decreased by 6.1% YoY in August“, although a direct, explicit causal link cannot be definitively established from the provided satellite data.

Hüttenwerke Krupp Mannesmann (HKM), a major integrated BF-BOF steel plant in Germany, exhibits more robust activity. Activity ranges from 43% to 47%, with a peak in June and September. While “German crude steel output down 11.9 percent in January-August 2025” reports a general decline in German steel production, HKM’s activity levels remain relatively strong, potentially indicating resilience or a different production focus compared to the broader German steel sector.

AG der Dillinger Hüttenwerke, another integrated BF-BOF plant in Germany, displays fluctuating activity, from a high of 38% in April to a low of 24% in July, before recovering to 30% in September. Like HKM, no direct connection between “German crude steel output down 11.9 percent in January-August 2025” and observed satellite activity can be explicitly confirmed.

Given the declining exports from Ukraine reported in “Ukraine’s steel exports down 13% as domestic consumption rises” coupled with only low level activity observed at Donetsksteel Metallurgical Plant, procurement professionals should:

- Prioritize securing alternative sources for pig iron currently or potentially sourced from Ukraine to mitigate potential supply disruptions. The news article Ukraine’s steel exports down 13% as domestic consumption rises indicates an increased domestic demand which can be seen as a reason for the decreased exports.

- Closely monitor German steel production trends despite the relatively stable activity at HKM. The article “German crude steel output down 11.9 percent in January-August 2025” reports on crude steel, whereas HKM may produce more semi-finished or finished goods. It is recommended to consider diversifying supply chains.