From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Resilient Despite Construction Slowdown: Plant Activity Analysis

Europe’s steel market demonstrates resilience despite headwinds in the construction sector, as evidenced by divergent activity levels at key steel plants. The impact of the construction downturn reported in “Euro area construction output down 0.8 percent in June 2025 from May” and “Construction in the European Union fell by 0.5% m/m in June” appears to be uneven across different steel producers, with some plants maintaining relatively stable activity. However, the steel industry’s challenges are further underscored by the article “Improving German economic sentiment misses out manufacturing, construction,” where a service center manager notes the worst summer since the mid-1980s.

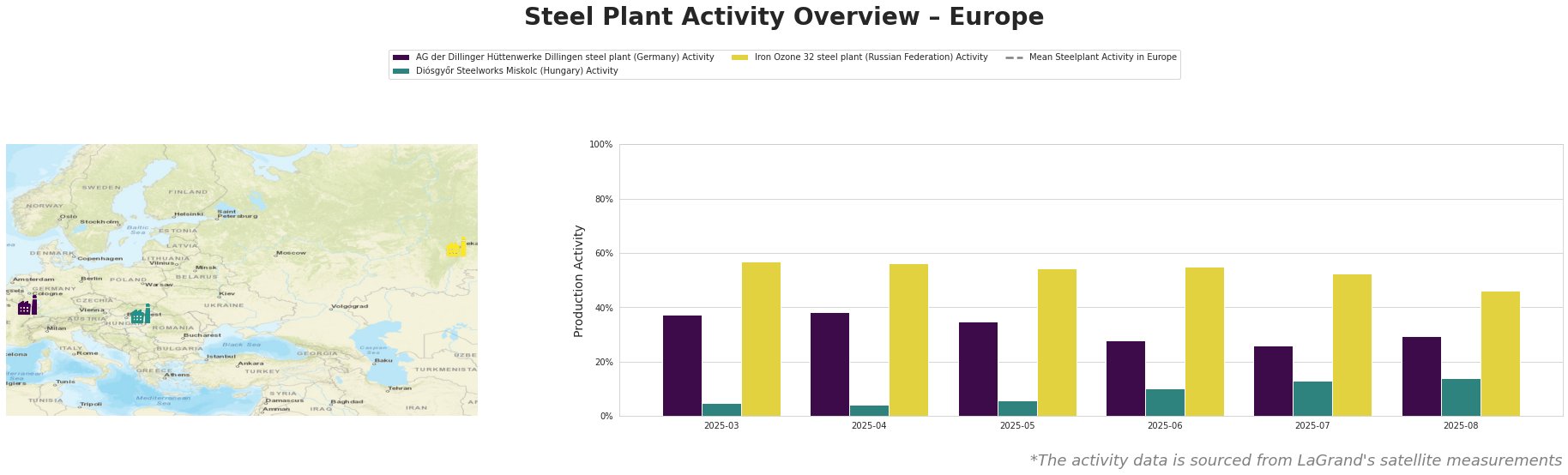

The average steel plant activity across Europe, as indicated in the table, presents significant fluctuations, with no clear trend identifiable over the observed period. AG der Dillinger Hüttenwerke experienced a notable activity decrease, from 38% in April to 26% in July, before recovering to 30% in August. Diósgyőr Steelworks demonstrates consistently low activity, with a gradual increase over the observed period. Iron Ozone 32 steel plant shows a declining activity level, decreasing from 57% in March to 46% in August.

AG der Dillinger Hüttenwerke Dillingen steel plant, a major integrated steel producer in Germany with a crude steel capacity of 2760 ttpa and BF/BOF production route, saw its activity decline from 38% in April 2025 to 26% in July 2025, before increasing to 30% in August. This dip, potentially reflecting reduced demand from sectors highlighted in “Improving German economic sentiment misses out manufacturing, construction“, which points out the downturn in the German construction sector. Dillinger’s product portfolio, including heavy-plate products used in building and infrastructure, makes it susceptible to construction sector fluctuations.

Diósgyőr Steelworks Miskolc, Hungary, an EAF-based plant with a crude steel capacity of 550 ttpa, focuses on semi-finished and finished rolled products. While its overall activity is substantially lower than the European mean, it shows a continuous increase from 5% in March to 14% in August. This rise could indicate increased demand within its niche construction steels market. While the article “Construction in the European Union fell by 0.5% m/m in June” notes that Hungary experienced one of the largest monthly declines in construction, no direct correlation between the general construction sector and specific plant activity could be established.

Iron Ozone 32 steel plant, an EAF-based steel plant located in the Russian Federation, witnessed a decline in activity from 57% in March to 46% in August. Given the absence of specific news directly related to this plant, no explicit connection can be established between the observed activity and any specific market event.

Based on the information provided:

-

Potential Supply Disruption: The activity decline at AG der Dillinger Hüttenwerke, a major plate producer, combined with struggles in the German construction sector (“Improving German economic sentiment misses out manufacturing, construction“) could lead to potential supply constraints for heavy-plate products in the near term.

-

Recommended Procurement Action: Steel buyers who rely on heavy plate from AG der Dillinger Hüttenwerke Dillingen should proactively:

- Diversify their supply base to mitigate potential disruptions, particularly given the observed activity decline.

- Closely monitor order lead times from Dillinger and other plate suppliers, expecting possible extensions due to reduced production capacity.

- Consider placing orders earlier than usual to secure supply and avoid potential price increases driven by supply constraints.