From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Report: Rising Activity Amid Challenges from Imports

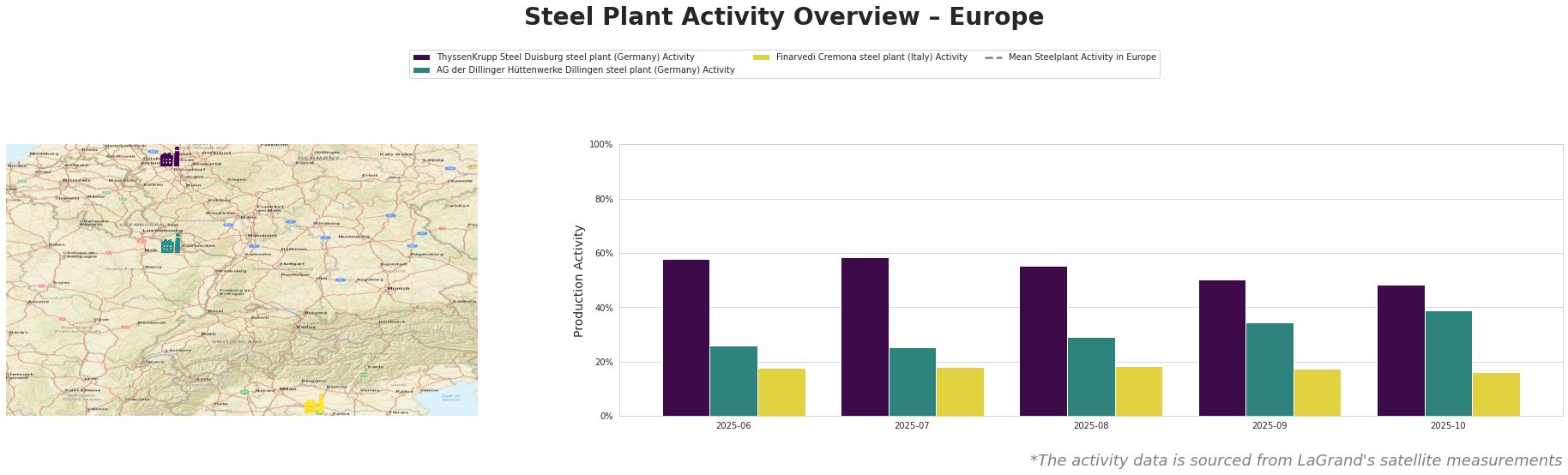

In Europe, positive market sentiment prevails, despite challenges depicted in notable news articles such as “Thyssenkrupp Electrical Steel to suspend operations at two plants in Germany and France” and “Thyssenkrupp stops production of Electric steel in Gelsenkirchen and Isberg”. These reports highlight Thyssenkrupp’s decision to halt operations at its German and French plants due to an influx of low-cost imports affecting the electrical steel market. Despite this, satellite data indicates varying activity levels across key plants.

The ThyssenKrupp Steel Duisburg plant, with noted significant activity at 59% in July, shows a downward trend, culminating in a 48% activity rate in October. This reduction aligns with Thyssenkrupp’s decision to reduce capacity amid market pressure outlined in “Thyssenkrupp Steel Europe to Temporarily Halt Electrical Steel Production…”. Meanwhile, AG der Dillinger Hüttenwerke fluctuated, peaking at 39% in October, and despite a downward trajectory, maintained better relative performance than other observed plants. The Finarvedi Cremona plant remained relatively stable but consistently recorded low activity rates, averaging only 18% during this period, with no direct links to the mentioned articles.

ThyssenKrupp, facing challenges from imports tripling since 2022, is predicted to lose €800 million in the fiscal year ending 2026. This creates potential supply disruptions primarily for electrical steel, which is critical for sectors such as automotive and renewables.

Steel buyers should consider the following actions:

– Anticipate supply constraints for electrical steel from ThyssenKrupp plants; exploring alternative suppliers is advisable.

– Monitor AG der Dillinger Hüttenwerke’s production, as its higher activity offers opportunities but needs close attention due to the volatility.

– Engage with Finarvedi Cremona to evaluate its offerings in lightweight steel solutions; emerging demands within automotive need addressing despite lower overall activity.

As the European market adjusts, proactive procurement strategies are essential to navigate the complexities stemming from continued import pressures and domestic capacity fluctuations.