From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market: Rebar Prices Rise Amid Summer Lull, HRC Gains Momentum

Europe’s steel market presents a mixed picture in mid-July 2025. While a seasonal slowdown impacts some sectors, rising prices in rebar and HRC suggest underlying strength. According to the article “EU plate, slab spot liquidity drops amid summer lull“, the spot market for plate and slab is experiencing reduced activity, but no direct relationship to plant activity changes could be established from the provided satellite-observed data. The article “Steel reinforcement manufacturers in Italy are seeing price increases due to increased costs and demand” highlights rising rebar prices, potentially impacting downstream construction. The article “Stainless steel prices in Europe continue to fall amid summer lull” reports continued price declines in stainless steel due to low demand, while “Prices are rising in the European HRC market amid a lull” signals a slight upward price trend in HRC despite weak seasonal demand.

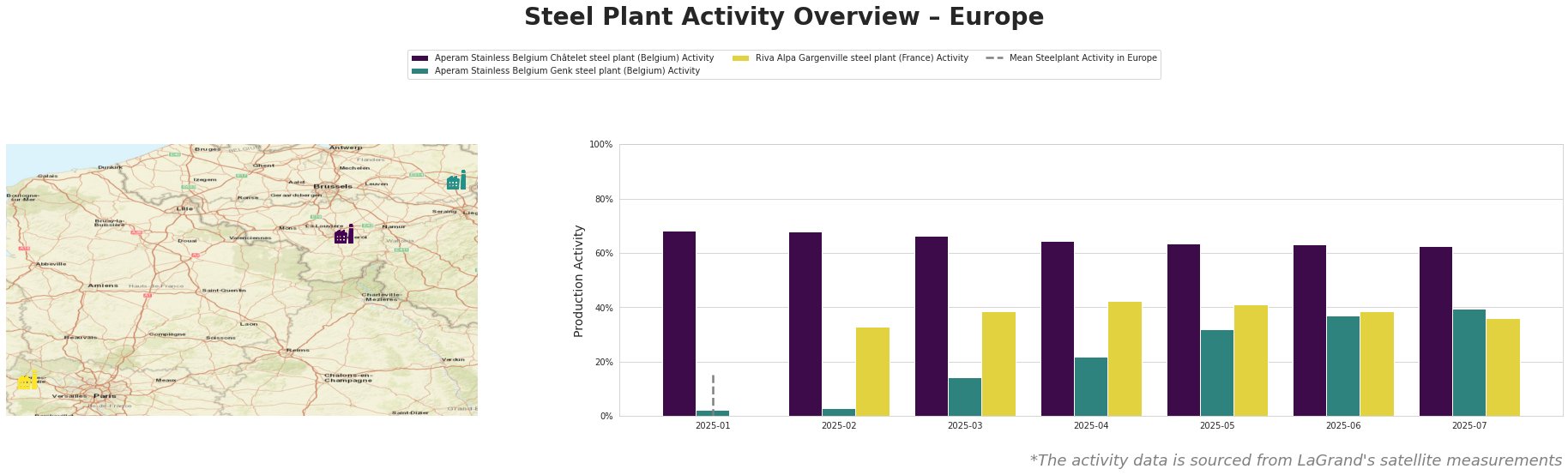

The provided mean steelplant activity data shows invalid negative values and is therefore not suitable for meaningful interpretation. However, the activity levels for each plant can still be compared. Aperam Stainless Belgium Châtelet maintained a consistently high activity level, around 63-68%, across the observed months. Aperam Stainless Belgium Genk shows a steady increase in activity from 2% in January to 39% in July. Riva Alpa Gargenville shows a more moderate increase followed by a decline from April’s peak of 42% to 36% in July.

Aperam Stainless Belgium Châtelet, an EAF-based stainless steel producer in Wallonie with a 1000 ktpa capacity focused on slabs and cold-rolled products, demonstrates very stable activity levels. The plant activity remained high throughout the first half of 2025, fluctuating only slightly between 68% and 63%. Despite the overall decline reported in the “Stainless steel prices in Europe continue to fall amid summer lull” article, the Châtelet plant’s high activity suggests continued production, potentially driven by pre-existing orders or specific contracts.

Aperam Stainless Belgium Genk, another EAF-based stainless steel producer located in Limburg with a larger 1200 ktpa capacity, shows a consistent upward trend in activity, more than 19-fold from 2% in January 2025 to 39% in July 2025. Despite the overall stainless steel price declines reported in the “Stainless steel prices in Europe continue to fall amid summer lull” article, the increasing activity suggests a strategic ramp-up in production, potentially to capitalize on future demand or offset lower prices with higher volumes.

Riva Alpa Gargenville, an EAF-based rebar producer in Île-de-France with a 700 ktpa capacity, exhibited increasing activity from February to April (33% to 42%), followed by a slight decrease to 36% in July. This could potentially reflect the increased demand mentioned in the “Steel reinforcement manufacturers in Italy are seeing price increases due to increased costs and demand” article, as Riva Alpa produces rebar, but the decrease might be related to standard seasonal fluctuations.

Evaluated Market Implications:

Given the observed trends and news, there is an increased likelihood of price increases in the rebar market due to factors outlined in the article “Steel reinforcement manufacturers in Italy are seeing price increases due to increased costs and demand,” and potentially further impacted by reduced plant activity at Riva Alpa Gargenville towards the end of the observation period.

- Procurement Action for Rebar Buyers: Steel buyers should secure rebar contracts now to avoid potential price hikes through September, as anticipated by the Italian manufacturers. Negotiate fixed-price contracts or explore hedging strategies to mitigate risk.