From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Poised for Growth: Marcegaglia’s New Mill Drives Optimism Amidst Regional Activity Shifts

Europe’s steel market shows strong positive sentiment with significant capacity expansions. This growth is fueled by Marcegaglia’s strategic investments, specifically the “Mistral Project” outlined in articles like “Danieli to Deliver Hot-Rolled Coil Mini-Mill Project for Marcegaglia” and “Marcegaglia moves to the engineering phase of construction of its plant in Fos-sur-Mer“. These articles directly relate to observed expansions in steel production capabilities and anticipated supply dynamics starting in 2028.

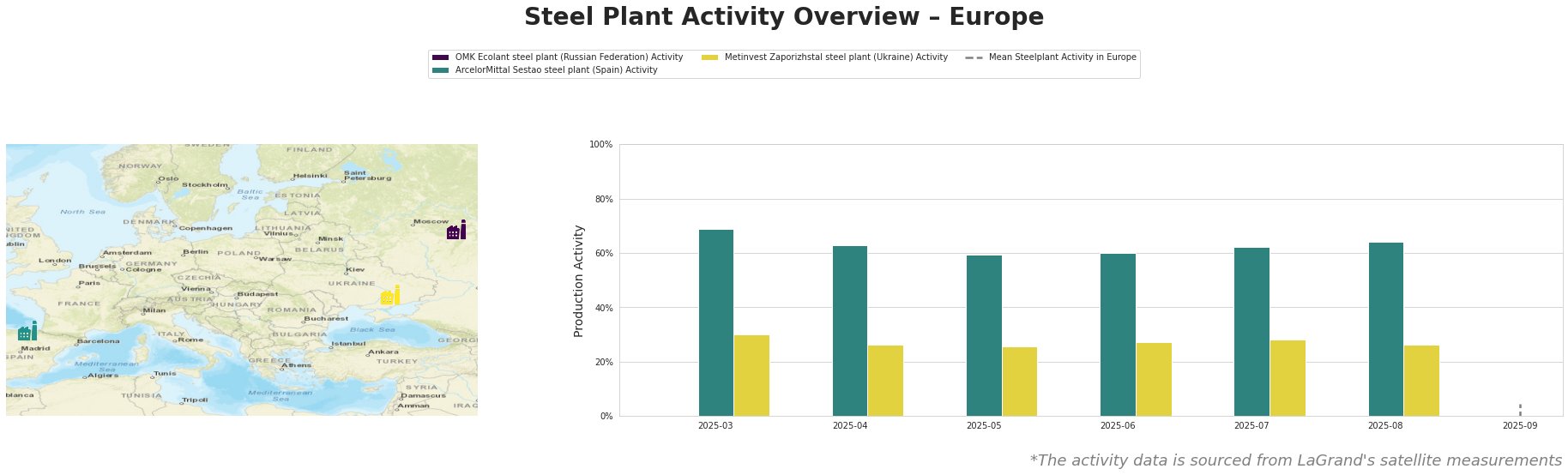

Observed activity data indicates varying trends across European steel plants. OMK Ecolant in Russia shows consistently low activity. ArcelorMittal Sestao in Spain shows moderate activity, fluctuating between 59% and 69% between March and August, with a slight upward trend. Metinvest Zaporizhstal in Ukraine shows similarly moderate activity, fluctuating between 25% and 30% during the same period. The Mean Steelplant Activity in Europe is difficult to intepret. The rise in the “Mean Steelplant Activity in Europe” for September is not clearly connected to any specific news article.

Steel Plant Details:

OMK Ecolant steel plant: This Russian plant, with a capacity of 1.8 million tons of crude steel via EAF and 2.5 million tons of DRI, focuses on semi-finished products like slabs and round billets for building, energy, and transport sectors. Satellite data indicates consistently low activity levels. No explicit connection can be established between this data and the provided news articles.

ArcelorMittal Sestao steel plant: Located in Spain, this plant has a 2 million ton EAF-based crude steel capacity, targeting automotive and construction sectors with hot-rolled coil, and plans to receive 1 million tons of DRI from ArcelorMittal Asturias Gijon plant by 2025. Observed activity has been relatively stable, ranging from 59% to 69%. There is no explicit connection to the provided news articles.

Metinvest Zaporizhstal steel plant: Located in Ukraine, this integrated BF-OHF plant has a 4.1 million ton crude steel capacity and produces a range of finished rolled products including hot and cold-rolled sheets, primarily serving automotive, packaging, and transport industries. The activity level has remained stable, fluctuating from 25% to 30% between March and August 2025. There is no explicit connection to the provided news articles.

Evaluated Market Implications:

The construction of Marcegaglia’s new mini-mill in Fos-sur-Mer, France, as described in “Marcegaglia moves to the engineering phase of construction of its plant in Fos-sur-Mer“, “Marcegaglia awards Danieli contract for new Fos-sur-Mer mill“, “Marcegaglia signs a contract with Danieli for the construction of a new mill in Foz-sur-Mer“, “Marcegaglia selects Danieli for new project“, and “Italy’s Marcegaglia partners with Danieli to build mini-mill in France“, will significantly increase European HRC production capacity by 2028.

Recommended Procurement Actions:

* For steel buyers: Given Marcegaglia’s plans to supply 30% of their HRC demand from the new Fos-sur-Mer plant, as stated in “Marcegaglia moves to the engineering phase of construction of its plant in Fos-sur-Mer“, consider exploring potential long-term supply agreements with Marcegaglia starting in 2028.

* For market analysts: Focus on monitoring the progress of the Fos-sur-Mer plant construction, especially given that the news “Marcegaglia moves to the engineering phase of construction of its plant in Fos-sur-Mer” explicitly states the start of production is planned for 2028, to evaluate the potential impact on HRC prices and supply dynamics in the European market.