From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Poised for Growth: ArcelorMittal Investments Drive Production Surge Amidst Stable Plant Activity

Europe’s steel market shows promising signs of growth, driven by strategic investments and stable plant activity. ArcelorMittal’s expansion plans, as highlighted in “ArcelorMittal Luxembourg SteelUp project advances to completion phase,” “ArcelorMittal receives environmental permit for steel powder production in Spain,” “ArcelorMittal to build steel-powder production plant in Spain,” and “ArcelorMittal to build a powder steel plant in Spain,” are set to boost production capacity and introduce advanced steel grades. While these developments signal increased future output, direct correlations between these announcements and immediate changes in satellite-observed plant activity levels at Emmenbrücke Swiss Steel, Voestalpine BÖHLER Aerospace, and Voestalpine BÖHLER Edelstahl cannot be established based on the provided data.

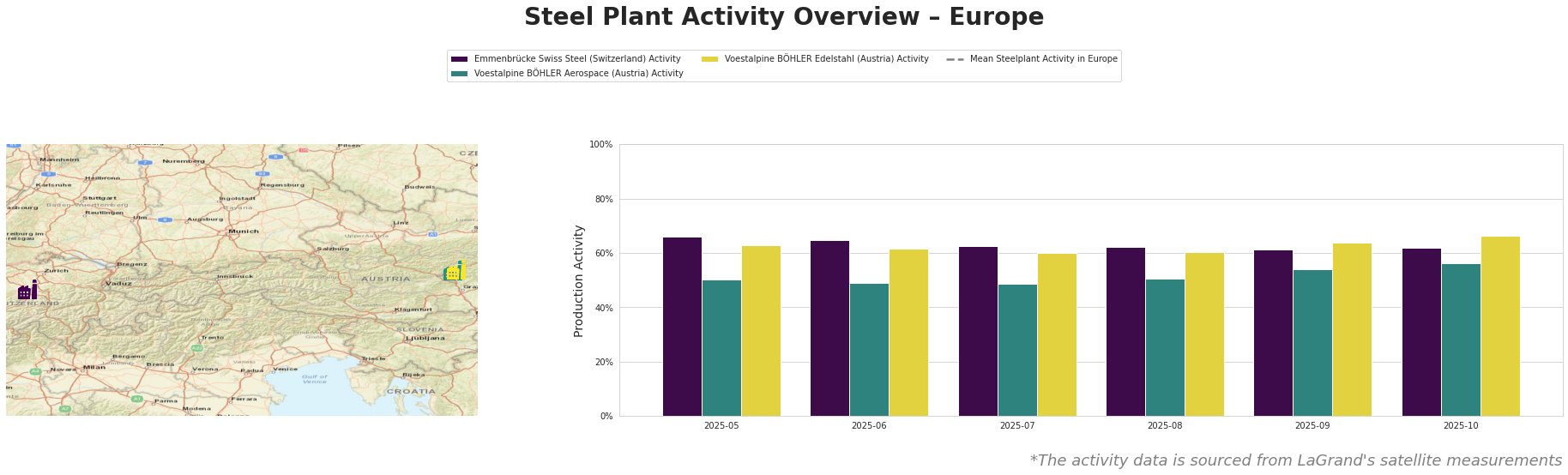

Recent monthly activity trends across several European steel plants are as follows:

The mean steel plant activity in Europe fluctuated between approximately 271 million and 407 million units during the observed period.

Emmenbrücke Swiss Steel, a plant utilizing electric arc furnace (EAF) technology with a ResponsibleSteelCertification, experienced a gradual decrease in activity from 66% in May to 61% in September, followed by a slight increase to 62% in October. This plant focuses on electric steelmaking and does not appear to have a direct connection to the ArcelorMittal announcements.

Voestalpine BÖHLER Aerospace, also using EAF technology, saw a low activity level of 49% between June and July, reaching a high of 56% in October. As a producer of specialized steel for the aerospace sector, no direct link can be made between its activity and the ArcelorMittal developments based on the provided information.

Voestalpine BÖHLER Edelstahl, with an EAF capacity of 145kt, showed a decline from 63% in May to 60% in July and August, followed by an increase to 66% in October. This plant, employing 2500 workers, could potentially benefit from the increased availability of steel powder produced by ArcelorMittal if its product lines align, though the current data and news do not provide sufficient detail to confirm this.

The news regarding ArcelorMittal’s investments signals a positive outlook for future steel supply, particularly in specialized steel grades and steel powders. While current plant activity levels do not yet reflect these expansions, the impending completion of the SteelUp project and the construction of the steel powder plant in Spain suggest potential shifts in the supply landscape.

Evaluated Market Implications:

The ArcelorMittal developments, especially the steel powder plant as described in “ArcelorMittal receives environmental permit for steel powder production in Spain,” present a potential opportunity for buyers in the aerospace, defense, and automotive sectors seeking advanced materials for 3D printing and other high-tech applications.

- Procurement Action: Steel buyers should proactively engage with ArcelorMittal to secure supply agreements for the steel powder produced in Avilés, Spain, to benefit from its low-carbon, circular production chain. Given the initial capacity of 1,800 tons per year, securing early access is crucial.

- Monitoring: Market analysts should closely monitor the progress of the ArcelorMittal SteelUp project and the construction of the steel powder plant. Delays in these projects could impact the availability of new steel grades and steel powders.