From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Navigates Price Fluctuations Amid Stable Activity

The European steel market is experiencing mixed price trends, particularly in the longs segment, while overall plant activity remains relatively stable. “European longs market follows diverse price trends but moves towards stability” and “Thick-sheet metal prices in Italy are declining; the Northern European market has not changed” highlight the regional disparities and price pressures. While the provided news does not directly address changes in production levels, we examine activity trends at key plants for potential implications.

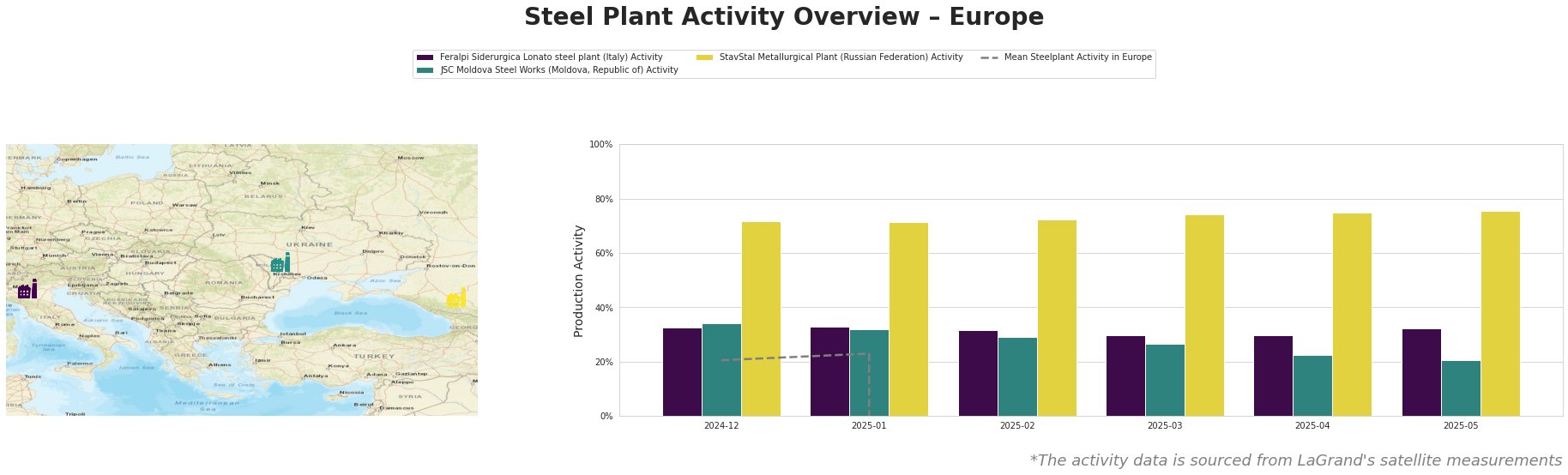

Measured Activity Overview

Note: The mean activity levels for February 2025 onwards are not useful and should be ignored.

Observed activity levels at Feralpi Siderurgica Lonato steel plant in Italy show relative stability, fluctuating between 30% and 33% from December 2024 to May 2025. Activity at JSC Moldova Steel Works in Moldova has declined from 34% in December 2024 to 21% in May 2025. Conversely, StavStal Metallurgical Plant in Russia has seen a gradual increase in activity, rising from 72% in December 2024 to 76% in May 2025. Given the issues with mean activity values, we can only reliably compare activity changes within individual plants, but not between plants, relative to a common European mean.

Plant Information

Feralpi Siderurgica Lonato steel plant, located in the Province of Brescia, Italy, operates an EAF-based steelmaking process with a crude steel capacity of 1.1 million tonnes per annum. Its product range includes rebar, billets, mesh, and wire rod. Activity at the plant remained relatively stable between December 2024 and May 2025. There appears to be no direct connection between this stable activity and the price fluctuations in the Italian rebar market reported in “European longs market follows diverse price trends but moves towards stability” and “European longs markets continue to follow diverse trends.”

JSC Moldova Steel Works, located in Transnistria, has a crude steel capacity of 1 million tonnes per annum, utilizing EAF technology to produce wire rod, rebar, and billets. The plant’s activity has steadily decreased from 34% in December 2024 to 21% in May 2025. The news articles provide no explanation for this decline.

StavStal Metallurgical Plant, situated in Stavropol Krai, Russia, produces square billets, rebar, and wire rod using EAF technology, with a crude steel capacity of 500,000 tonnes per annum. The plant’s activity has seen a consistent increase, rising from 72% in December 2024 to 76% in May 2025. The provided news articles do not cover the Russian steel market, and therefore, no direct relationship can be established.

Evaluated Market Implications

The observed price declines in Italian rebar and thick-sheet metal, as reported in “European longs market follows diverse price trends but moves towards stability”, “European longs markets continue to follow diverse trends” and “Thick-sheet metal prices in Italy are declining; the Northern European market has not changed”, coupled with the relatively stable activity at Feralpi Siderurgica Lonato, suggest that demand-side factors, rather than supply constraints, are currently driving price dynamics in Italy. The decline in activity at JSC Moldova Steel Works is not clearly explained by the provided news.

Procurement Actions for Steel Buyers and Analysts:

- Focus on Italian Rebar Purchases: Given the reported price declines in Italian rebar, buyers should actively negotiate for lower prices, leveraging the weak market sentiment and stable electricity costs reported in “European longs market follows diverse price trends but moves towards stability.”

- Monitor Scrap Prices: “European longs market follows diverse price trends but moves towards stability” and “European longs markets continue to follow diverse trends” suggest that potential increases in scrap prices could reverse the downward trend in rebar prices. Buyers should closely monitor scrap price movements to anticipate potential price increases and adjust procurement strategies accordingly.

- Consider Spanish Rebar Imports: With Spanish rebar prices to UK ports around €580/t FOB, buyers in the UK and surrounding regions should evaluate the cost-effectiveness of importing from Spain as an alternative to domestic sourcing, considering transportation costs and lead times.