From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Faces Production Cuts Amidst Falling Sales: A Buyer’s Guide

Europe’s steel market is facing headwinds as production declines coincide with falling sales, particularly in Germany. The “Germany reduced steel production by 10.1% y/y in April” article directly reflects a downturn in the region’s steelmaking activity. This is further corroborated by “German crude steel output down 11.9 percent in Jan-Apr” which highlights consistent production decreases. While “Global steel production fell by 6.3% m/m in April” puts the regional data in a global context, no explicit links between activity observations outside Germany and those articles could be established. “Steel sales in Germany decreased by 5% in April, inventories decreased” further signals weakening demand within the region.

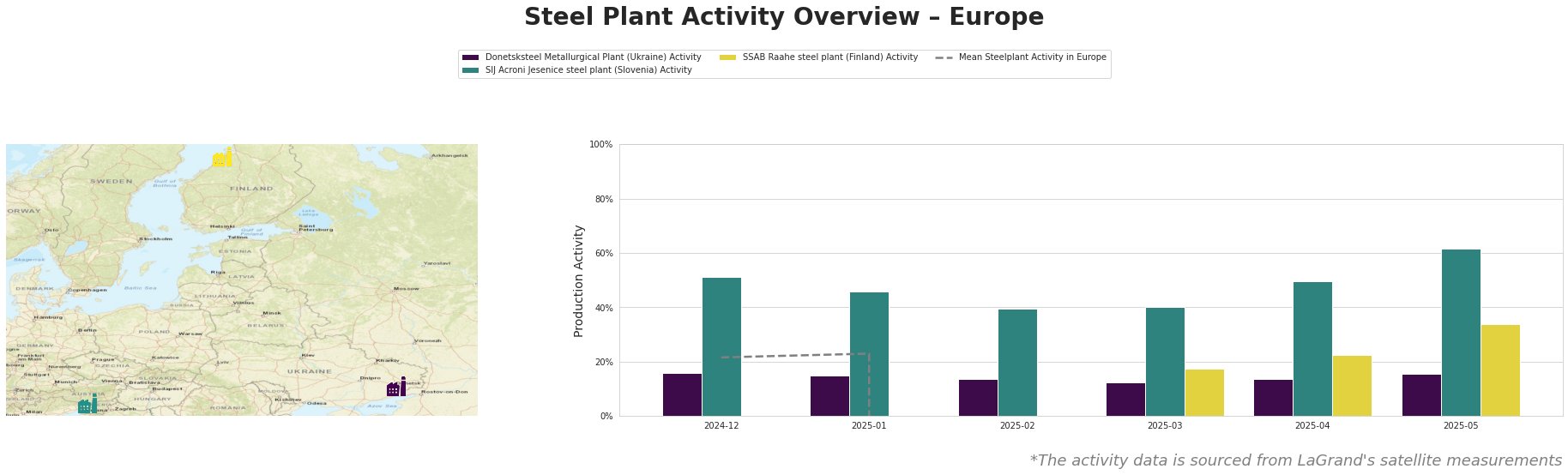

Note: Negative mean activity data is assumed to be erroneous and should be disregarded for analytical purposes. It does not impact individual plant activity observations.

Donetsksteel Metallurgical Plant, an integrated BF-based producer focused on pig iron, shows a slight upward trend in observed activity, rising from 12% in March to 16% in May. While global production decreases are documented, no direct connection to Donetsksteel’s output can be established from the provided articles, and its EAF is reportedly mothballed. SIJ Acroni Jesenice steel plant, a smaller EAF-based producer specializing in flat-rolled products, has shown increasing activity, reaching 62% in May, a significant jump from 39% in February. This positive trend contrasts sharply with the general negative sentiment in Germany, and its underlying causes cannot be directly related to the provided news articles. The SSAB Raahe steel plant, an integrated BF/BOF producer in Finland, is showing a distinct upwards trend over the period from 17% in March to 34% in May, its activity increase may be driven by factors beyond regional market trends, as no clear connection to the German news can be established. Mean European steel plant activity appears to be erratic, but individual plants can still show production gains.

The German steel market is facing a downturn, as highlighted by “Germany reduced steel production by 10.1% y/y in April” and “Steel sales in Germany decreased by 5% in April, inventories decreased.” Considering this negative trend, potential supply disruptions are higher for flat rolled steel products, given the “Steel sales in Germany decreased by 5% in April, inventories decreased” article highlighting a 9% month-on-month sales decline for flat rolled steel, linked to automotive sector weakness.

Recommended Procurement Actions:

Given the observed decline in German steel production and sales, steel buyers should:

1. Diversify Flat Rolled Steel Suppliers: Given the specific weakness in German flat rolled steel sales (“Steel sales in Germany decreased by 5% in April, inventories decreased”), prioritize establishing or reinforcing relationships with alternative suppliers, especially those outside of Germany or in regions less affected by automotive downturns, to mitigate potential supply chain disruptions.

2. Monitor SIJ Acroni Jesenice steel plant: Given the increased activity at this plant despite of an overall market slowdown, investigate opportunities to leverage this production uptick for potential supply benefits, keeping in mind its specialization in flat-rolled products.