From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean HRC Prices Rise Amid Anticipated Import Restrictions: ArcelorMittal Hikes Prices as Plant Activity Varies

The European steel market is seeing rising HRC prices, driven by expectations of import restrictions, as highlighted in “ArcelorMittal raises hot-rolled steel prices to €610/t” and “ArcelorMittal raises prices for hot-rolled steel for the second time this summer“. These price increases occur despite a seasonally subdued market, as noted in “Seasonal lull keeps European HRC market subdued, despite ArcelorMittal price hike plans“. Satellite data shows fluctuating activity levels across European steel plants, though a direct link between these specific price announcements and observed plant activity cannot be conclusively established based on the provided data.

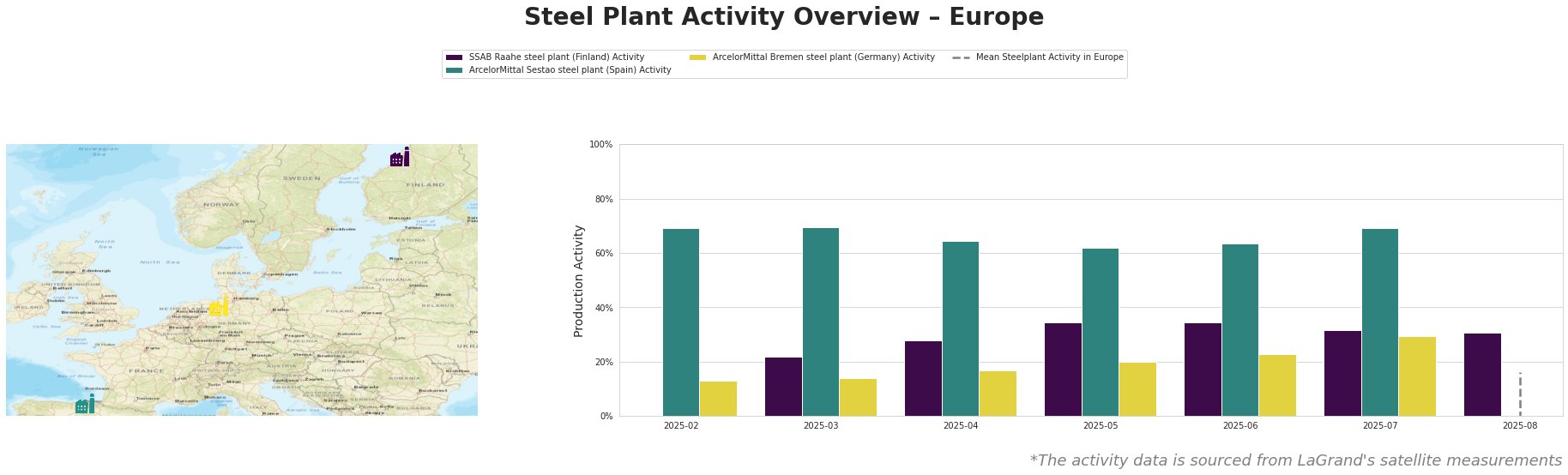

The mean steel plant activity in Europe shows strong variations over time, with the latest available data point for August 2025 showing a level of 16%. SSAB Raahe in Finland, an integrated BF/BOF plant with a 2.6 million tonne crude steel capacity, shows a fluctuating activity level, starting at 22% in March, peaking at 34% in May and June, and then declining to 31% in August. ArcelorMittal Sestao, an EAF-based plant in Spain with a 2 million tonne crude steel capacity, maintained a relatively high activity level, fluctuating between 62% and 69% from February to July. The activity at ArcelorMittal Bremen, an integrated BF/BOF plant in Germany with a 3.8 million tonne capacity, shows a steady increase from 13% in February to 29% in July. While ArcelorMittal is raising prices, there is no clear, immediate correlation between these price hikes and the satellite-observed activity levels at its Sestao and Bremen plants based solely on this data.

Evaluated Market Implications:

Given ArcelorMittal’s price increases driven by anticipated import restrictions (“ArcelorMittal raises hot-rolled steel prices to €610/t“), coupled with the relatively stable and high activity observed at ArcelorMittal Sestao (62-69% from February to July), a key producer of hot-rolled coil for automotive and infrastructure sectors, steel buyers should consider:

- Securing Q4 supply contracts now, particularly for HRC. The news articles suggest prices are expected to rise, making immediate action prudent.

- Exploring alternative supply sources carefully. “Seasonal lull keeps European HRC market subdued, despite ArcelorMittal price hike plans” mentions rising import offers. However, buyers should thoroughly evaluate the impact of CBAM on import costs to determine the true cost-effectiveness of imported steel. Offers from Indonesia and India are mentioned in the article.

- Monitoring activity at ArcelorMittal Bremen. Its increasing activity (13% to 29% from February to July) might indicate its strategic importance in fulfilling anticipated demand, making it a critical plant to watch for potential supply contributions.