From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market: Ukrainian Export Shifts Impact Regional Supply Amidst Rising Flat Steel Demand

Europe’s steel market is experiencing notable shifts due to changes in Ukrainian steel exports, as highlighted by the news articles “Ukraine reduced semi-finished products’ exports by 34% y/y in January-May,” “Ukraine’s flat steel exports up 6.1 percent in Jan-May 2025,” “Ukraine increased flat rolled products’ exports by 6.1% y/y in January-May,” “Imports of flat rolled products to Ukraine have increased, with Turkey, Poland and Slovakia as supply leaders.” and “Ukraine increased imports of flat rolled steel by 17.2% y/y in January-May“. These changes appear to be driven by a combination of reduced semi-finished product exports and increased flat steel exports, coupled with rising domestic demand and imports into Ukraine. However, a direct link to steel plant activity levels based on provided satellite data is not explicitly evident in these articles.

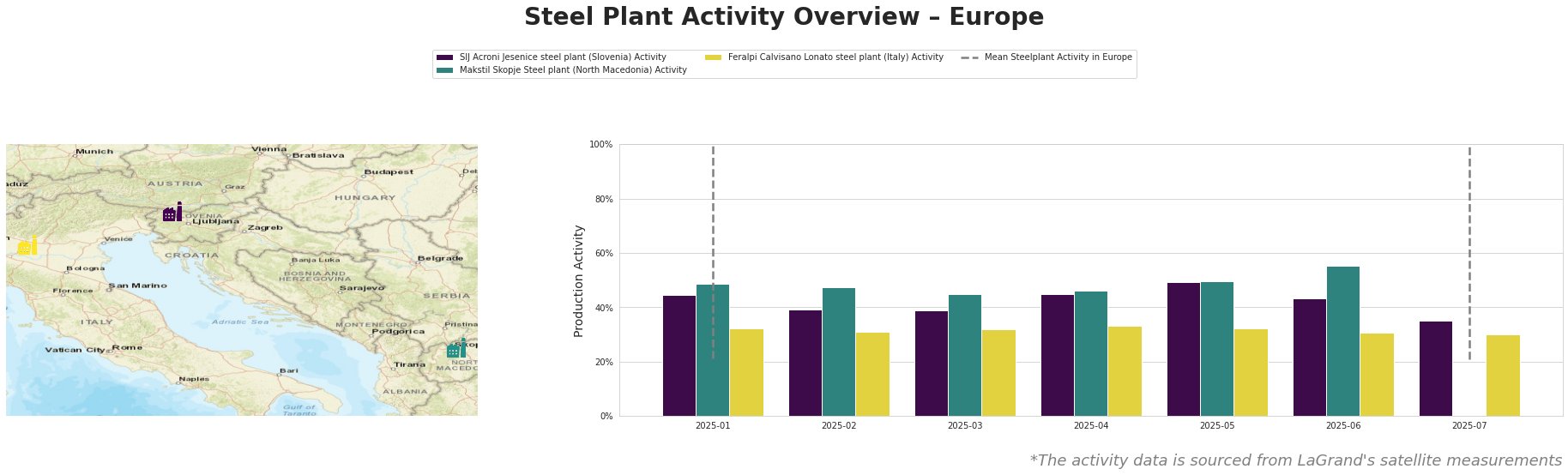

Observed mean activity levels across all observed European steel plants show extreme volatility throughout the observed period, skewing analysis. The highest values are registered in the period between February and June, dropping back to a minimal activity level in July.

SIJ Acroni Jesenice, an EAF-based steel plant in Slovenia producing 726 ttpa of crude steel, specializing in flat rolled steel products, exhibited activity levels between 39% and 49% from February to May 2025. There was a noticeable drop to 35% in July 2025. Without further information, no direct connection can be established between the reported Ukrainian export shifts and this plant’s activity.

Makstil Skopje, a 550 ttpa EAF steel plant in North Macedonia producing slabs, showed relatively stable activity between 45% and 50% from January to May 2025, with a peak at 55% in June 2025. There is no explicitly evident direct connection between the shifts in Ukrainian exports and Makstil Skopje’s activity based on the provided information.

Feralpi Calvisano Lonato, an EAF-based steel plant in Italy producing 600 ttpa of crude steel and specializing in billets, maintained a consistent activity level between 30% and 33% during the observed period. No direct connection can be established between Ukrainian export shifts and this plant’s activity levels based on the available news articles.

The reduced exports of Ukrainian semi-finished products, coupled with increased flat steel exports and domestic demand, suggest potential supply constraints in the European market, especially for semi-finished products. Given that “Ukraine increased imports of flat rolled steel by 17.2% y/y in January-May” the increase in flat steel exports may be less sustainable or come at the expense of overall steel availability in the region. Furthermore, if Ukraine is importing more flat rolled products, as suggested by “Imports of flat rolled products to Ukraine have increased, with Turkey, Poland and Slovakia as supply leaders“, buyers should monitor price trends and availability in Turkey, Poland, and Slovakia as increased demand from Ukraine could affect supply dynamics in those markets. Steel buyers should diversify their sources for semi-finished steel products and closely monitor flat steel prices and availability, particularly from Turkey, Poland, and Slovakia, considering Ukraine’s increased import activity. Consider forward purchasing or securing long-term contracts to mitigate potential price increases and supply disruptions.