From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market: Ukraine War Talks, Dillingen Downturn, Procurement Strategies

Europe’s steel market faces uncertainty amid ongoing Ukraine war negotiations and fluctuating plant activity. “Ukraine-Gipfel in Washington: Die dritte Demütigung für Europa” highlights perceived European weakness in these negotiations, while satellite data reveals activity shifts at key steel plants, potentially impacting supply. Plant-specific analysis connects activity with geopolitical events where possible.

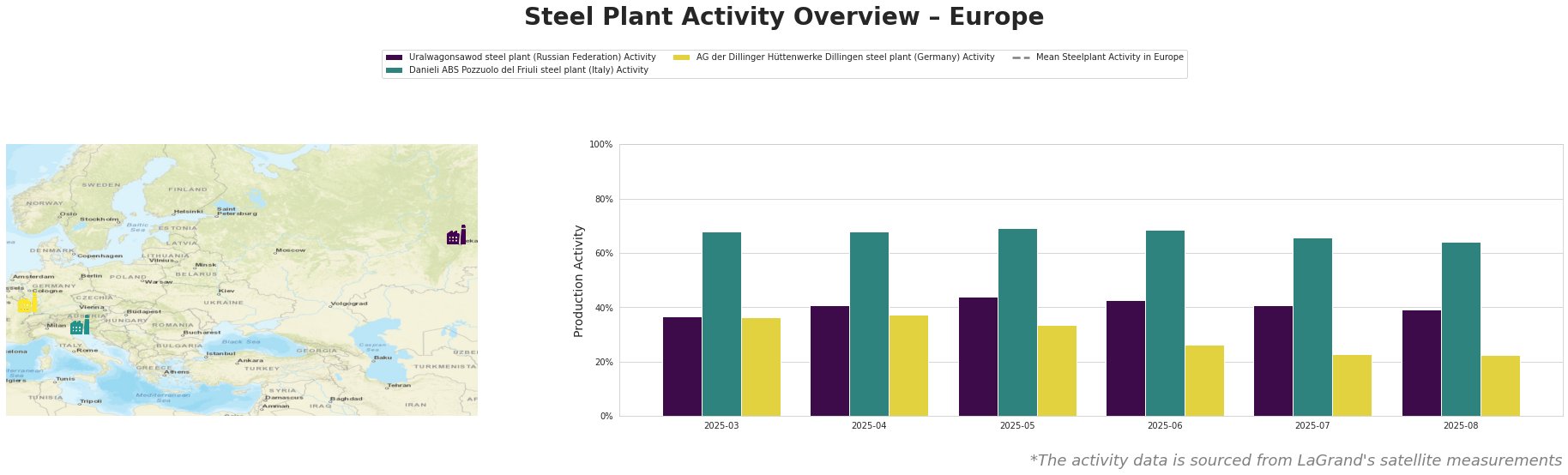

The mean steel plant activity in Europe fluctuated considerably over the observed period. The Uralwagonsawod steel plant’s activity, with a focus on the defense sector, saw a peak in May at 44%, declining to 39% by August. Danieli ABS Pozzuolo del Friuli, a ResponsibleSteel-certified plant in Italy, showed relatively stable activity, starting at 68% and gradually decreasing to 64% by August. AG der Dillinger Hüttenwerke in Germany experienced a more significant decline, dropping from 36% in March to 22% in August.

Uralwagonsawod steel plant: Located in the Rostov region, this plant’s main products and processes are unknown, however its end-user sector is defense. While the plant saw a peak in activity in May 2025, activity decreased to 39% by August. Considering the plant’s focus on the defense sector, this decrease might correlate with the ongoing negotiations reported in “Back from Alaska, Trump starts week with crucial foreign policy talks over Ukraine war,” “Zelenskyy agrees to Trump-Putin meeting without cease-fire, but will Kremlin dictator go along?,” “‘President of peace’: Trump tapped for Nobel Prize amid talks to end Russia-Ukraine war,” and “‘We’ll see what happens’: Trump ends week of Ukraine-Russia talks on a more tentative note,” suggesting potential de-escalation.

Danieli ABS Pozzuolo del Friuli steel plant: This Italian EAF-based plant, producing crude, semi-finished, and finished rolled products for various sectors, maintained relatively stable activity around 68% from March to June, before decreasing slightly to 64% in August. This decline cannot be directly linked to specific news articles provided. The plant holds a ResponsibleSteel certification.

AG der Dillinger Hüttenwerke Dillingen steel plant: An integrated BF-BOF plant in Germany producing semi-finished and finished rolled products for several industries. The plant’s activity dropped significantly from 36% in March to 22% in August. This substantial decrease, coupled with the sentiment expressed in “Ukraine-Gipfel in Washington: Die dritte Demütigung für Europa”, suggests possible concerns about Europe’s economic and political influence, potentially impacting investment or production decisions.

The observed activity decline at AG der Dillinger Hüttenwerke warrants immediate attention. The significant drop from 36% to 22% coupled with the sentiment in “Ukraine-Gipfel in Washington: Die dritte Demütigung für Europa”, signals a possible shift in market sentiment and reduced production output. For steel buyers, this plant’s downturn, producing specialized steels for critical sectors such as energy and infrastructure, may translate into future supply bottlenecks, especially if the political landscape remains uncertain. Given the uncertainty surrounding the war and Europe’s role, consider diversifying suppliers and securing long-term contracts with producers outside the directly affected regions to mitigate potential disruptions.