From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market: SSAB’s Fossil-Free Push Drives Optimism Despite Price Pressures

Europe’s steel market demonstrates a very positive sentiment, driven by sustainability initiatives despite some price headwinds. “Sweden’s SSAB posts lower revenues for H1 2025 amid weak prices” highlights revenue decline due to pricing pressure, which contrasts with increased production output. “Germany’s EMW, SSAB enter partnership for fossil-free steel” directly relates to observed activity, as such partnerships often precede capacity adjustments or dedicated production lines, although the satellite data does not yet explicitly reflect any specific activity uptick related to this announcement. “ArcelorMittal Increases Low Emission Steel Standard Support” signals a broader industry commitment to decarbonization, potentially influencing long-term investment and production strategies.

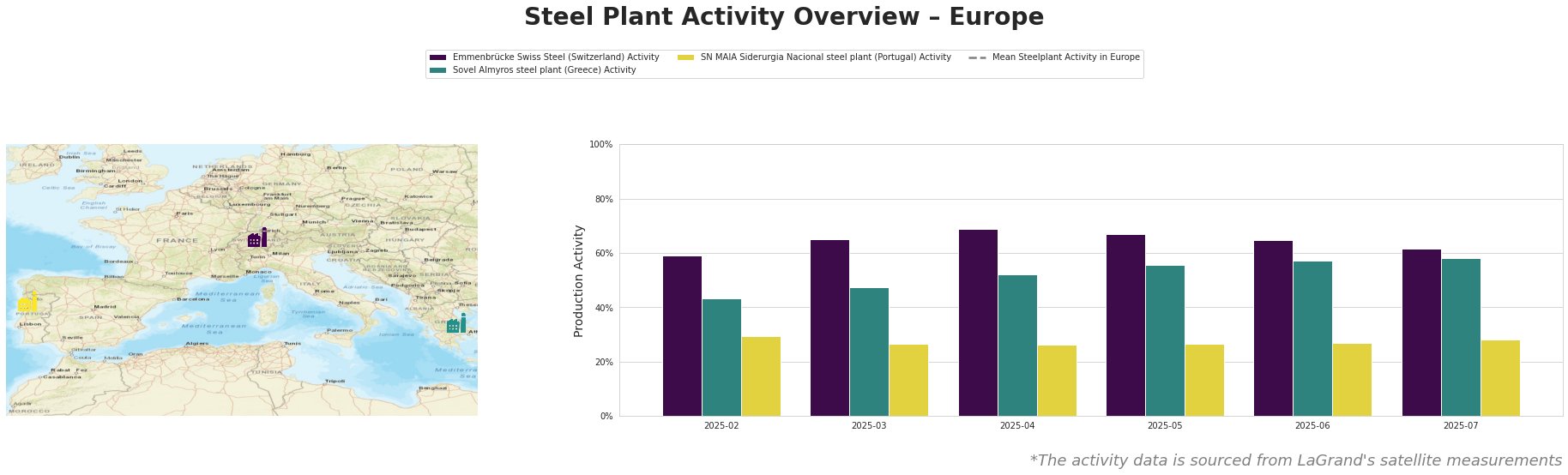

Across the observed plants, activity levels fluctuated, but without significant overall decline. Emmenbrücke Swiss Steel in Switzerland shows consistent activity, peaking in April 2025 at 69% and ending July at 62%. Sovel Almyros steel plant in Greece demonstrates a steady increase from 43% in February to 58% in July. SN MAIA Siderurgia Nacional steel plant in Portugal remains relatively stable, hovering around 27-29%. It is important to note, however, that the data quality of “Mean Steelplant Activity in Europe” is poor and inconsistent, thereby disqualifying it as an appropriate reference value.

Emmenbrücke Swiss Steel

Emmenbrücke Swiss Steel, an EAF-based producer in Switzerland with ResponsibleSteelCertification, saw its activity peaking at 69% in April 2025, followed by a slight decrease to 62% in July. While no direct connection can be established, the plant’s commitment to responsible steel production could align with the broader trend highlighted in “ArcelorMittal Increases Low Emission Steel Standard Support,” potentially leading to further operational adjustments in the future.

Sovel Almyros steel plant

The Sovel Almyros steel plant in Greece, a 1350 ttpa EAF producer of rebar and finished rolled products, exhibited a consistent upward trend in activity, reaching 58% in July 2025. This increase might be indicative of growing demand in the construction sector, but without further news or details, a specific link is difficult to establish. The company’s ResponsibleSteelCertification mirrors industry trends towards sustainable production, but again, no direct connection with any specific named article can be explicitly confirmed.

SN MAIA Siderurgia Nacional steel plant

SN MAIA Siderurgia Nacional, a 600 ttpa EAF-based rebar producer in Portugal, maintained stable activity levels around 27-29%. The lack of significant variation suggests a consistent production schedule, potentially catering to stable regional demand for rebar. As with the other plants, no explicit connections can be made between its activity and the provided news articles.

Given SSAB’s partnership with EMW (“Germany’s EMW, SSAB enter partnership for fossil-free steel”) steel buyers focused on automotive applications should prioritize securing contracts with EMW to guarantee access to fossil-free steel, managing potential supply constraints related to the ramp-up of new production processes. Furthermore, monitor ArcelorMittal’s XCarb offerings (“ArcelorMittal Increases Low Emission Steel Standard Support”) and the development of the Low Emission Steel Standard (LESS) to anticipate shifts in market preferences and potential regulatory impacts on steel procurement. Buyers should also be aware of the revenue decline reported by SSAB (“Sweden’s SSAB posts lower revenues for H1 2025 amid weak prices”), as this could influence their pricing strategies and negotiating power, despite their sustainable steel focus.