From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market Reacts to Potential Ukraine War Resolution: Polish Steel Production Resilient

Europe’s steel market is showing signs of cautious optimism amid ongoing diplomatic efforts to resolve the Ukraine war. “Could Trump’s meeting with Putin be the next Reagan-Gorbachev moment?” and “Back from Alaska, Trump starts week with crucial foreign policy talks over Ukraine war” suggest a potential shift in geopolitical dynamics. While no direct relationship between these news articles and plant activity can be definitively established, the improved sentiment may be indirectly supporting stable to slightly improved production.

Monthly Activity Trends:

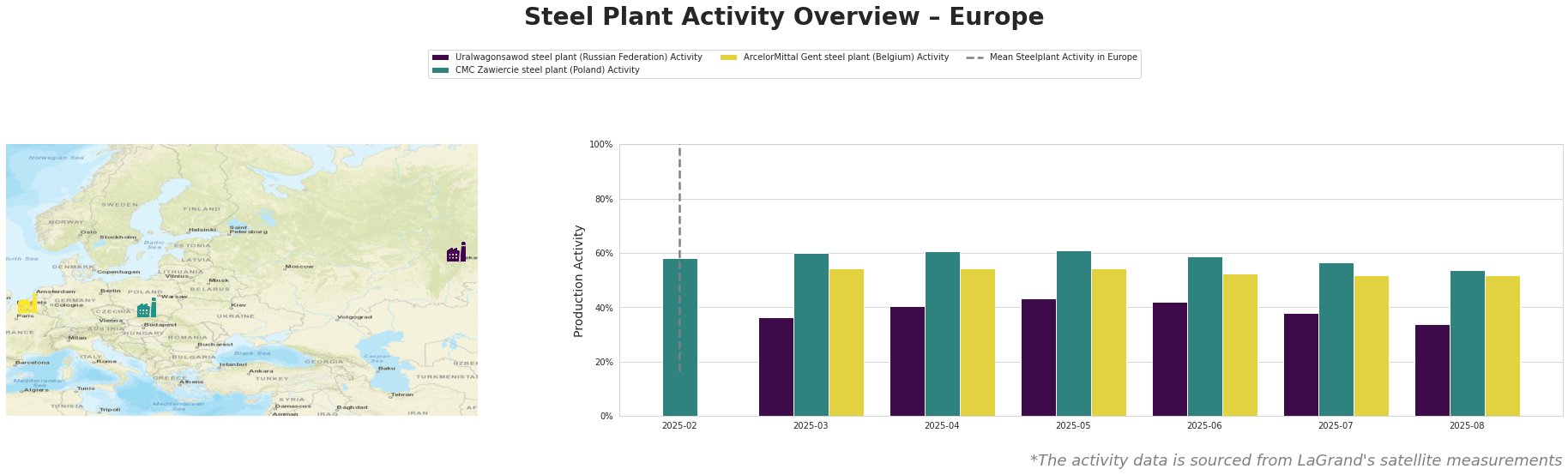

The mean steel plant activity in Europe has fluctuated significantly, with no clear trend visible.

Uralwagonsawod steel plant: This Russian plant, potentially serving the defense sector, has seen a steady decline in activity from 43% in May to 34% in August. While “Could Trump’s meeting with Putin be the next Reagan-Gorbachev moment?” and “Zelenskyy agrees to Trump-Putin meeting without cease-fire, but will Kremlin dictator go along?” suggest a potential shift in Russian war strategy, it is difficult to directly link these events to the observed production decrease.

CMC Zawiercie steel plant: This Polish EAF steel plant, serving diverse sectors, has shown relative resilience. Although activity decreased from 61% in May to 54% in August, it is a smaller decrease, especially when comparing to the Uralwagonsawod Steelplant activity. No immediate connection to the provided news can be established, suggesting factors internal to the plant or market dynamics within Poland may be responsible for the change.

ArcelorMittal Gent steel plant: This integrated BF/BOF plant in Belgium has shown a slight decrease in activity, stabilizing at 52% since June. No direct connection to the provided news could be established.

Evaluated Market Implications:

The observed decline in activity at Uralwagonsawod, coupled with news of potential peace negotiations (“‘President of peace’: Trump tapped for Nobel Prize amid talks to end Russia-Ukraine war“), may indicate a potential decrease in demand within the Russian defense sector, indirectly supporting the potential for peace in Ukraine.

Procurement Actions:

- Steel Buyers: Given the stable activity at CMC Zawiercie and potential shift in geopolitical dynamics, consider diversifying steel sourcing, focusing on Central European suppliers. This could help to buffer supply chain risks associated with the Russian plant’s reduced output.

- Market Analysts: Monitor Russian steel export data closely, as a continued decline in Uralwagonsawod’s activity may lead to increased export pressure on other markets.