From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market: Production Declines in Germany, France, and Ukraine Offset by Polish Growth

Steel production trends across Europe are mixed, with significant declines in Germany, France, and Ukraine, offset by increases in Poland. Declines in production in major steel producing countries such as Germany and France could lead to supply concerns in the coming months. The developments do not show obvious links to satellite-observed activity at the steel plants tracked.

Recent reports paint a complex picture of the European steel market. According to the article titled “Germany reduced steel production by 6.4% y/y in May,” German steel production has been declining for five consecutive months. Similarly, “France reduced steel production by 20.6% y/y in May” highlights a substantial drop in French output. “Steel production in Ukraine fell by 14% in May – Worldsteel” reports on significant decreases in Ukrainian steel production, impacted by the ongoing war in the region. Offsetting these declines, the article “Poland increased steel production by 3.7% y/y in January-May” indicates growth in Poland, spurred by the full capacity restart of Huta Częstochowa.

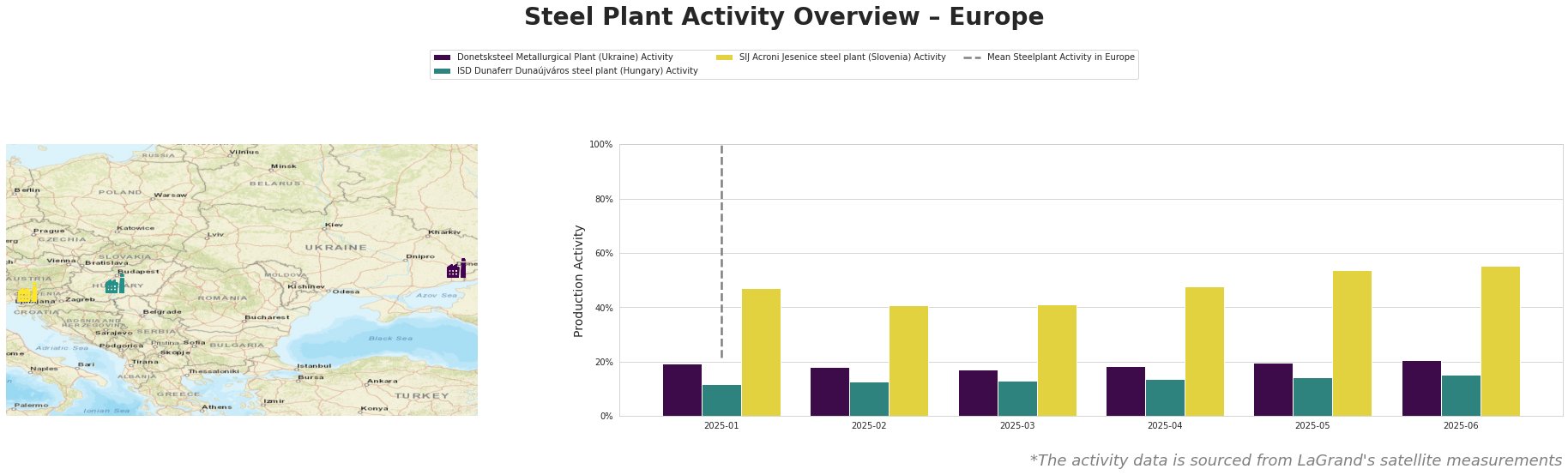

Measured Activity Overview

The “Mean Steelplant Activity in Europe” shows extreme values due to data anomalies, rendering it uninformative. Activity at the Donetsksteel Metallurgical Plant (Ukraine) gradually increased from 17% in March 2025 to 21% in June 2025. The ISD Dunaferr Dunaújváros steel plant (Hungary) has shown a slight upward trend, increasing from 12% in January 2025 to 15% in June 2025. SIJ Acroni Jesenice steel plant (Slovenia) recorded the highest activity levels among the observed plants, increasing from 47% in January 2025 to 55% in June 2025. These activity levels have not dropped markedly, and thus the satellite data do not confirm the regional news articles about production drops.

Steel Plant Insights

Donetsksteel Metallurgical Plant: This Ukrainian plant, with a crude steel capacity of 0 and iron capacity of 1.5 million tons, primarily produces pig iron using integrated (BF) processes. Despite the article “Steel production in Ukraine fell by 14% in May – Worldsteel” indicating a broad decline in Ukrainian steel production, satellite data shows a slight increase in activity at Donetsksteel, rising from 17% in March 2025 to 21% in June 2025. No direct connection between the broader Ukrainian production decline and the plant’s activity can be established based on the available information.

ISD Dunaferr Dunaújváros steel plant: Located in Hungary, this plant has a crude steel capacity of 1.6 million tons and relies on integrated (BF) processes, producing semi-finished and finished rolled products. Activity levels show a gradual increase from 12% in January 2025 to 15% in June 2025. There are no news articles directly referencing ISD Dunaferr Dunaújváros, therefore it is not possible to assess the causes of the observed activity changes.

SIJ Acroni Jesenice steel plant: This Slovenian plant, with a crude steel capacity of 726,000 tons, utilizes electric arc furnaces (EAF) to produce flat rolled steel products. The plant’s activity increased from 47% in January 2025 to 55% in June 2025. There are no news articles directly referencing SIJ Acroni Jesenice, therefore it is not possible to assess the causes of the observed activity changes.

Evaluated Market Implications

The reports of declining steel production in Germany, France, and Ukraine, as per “Germany reduced steel production by 6.4% y/y in May“, “France reduced steel production by 20.6% y/y in May,” and “Steel production in Ukraine fell by 14% in May – Worldsteel“, alongside the increase in Poland (“Poland increased steel production by 3.7% y/y in January-May“), suggest a potential shift in the European steel supply landscape. While satellite data of Donetsksteel shows increasing activity levels, it is not enough to offset broader declines in the Ukraine. Similarly, satellite data shows constant if slightly increasing levels in Hungary and Slovenia.

Procurement Actions:

- Diversify Sourcing: Steel buyers should consider diversifying their sourcing strategies to include Polish suppliers to mitigate risks associated with production declines in Germany, France, and Ukraine.

- Monitor Polish Production: Closely monitor the production trends in Poland, particularly the output of Huta Częstochowa, to assess the stability of this alternative supply source.

- Negotiate Contract Terms: When negotiating contracts with German and French suppliers, ensure flexible delivery schedules and consider price escalation clauses to account for potential supply disruptions.

- Evaluate Alternative Grades: Explore the possibility of substituting steel grades from Poland for those traditionally sourced from Germany or France, based on technical specifications and cost considerations.

- Monitor logistical challenges in Ukraine The article “Ukraine reduced iron ore exports by 13% y/y in January-May” highlights production and export challenges that may disrupt downstream steel production.