From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market Poised for Growth Amid Collaboration and Decarbonization Efforts

Europe’s steel market exhibits a very positive sentiment, driven by collaborative efforts towards decarbonization and addressing industry challenges. Eurometal’s initiatives, as highlighted in “75 Jahre EUROMETAL: Zukunft gestalten durch systemischen Wandel,” “75 anni di Eurometal: dialogo con la filiera, Cbam e decarbonizzazione,” and “EUROMETAL: Future of European steel depends on collaboration,” emphasize the need for unified strategies. The satellite data, however, does not currently show a direct and immediate link between these collaborative initiatives and any significant, consistent changes in the overall mean steel plant activity in Europe.

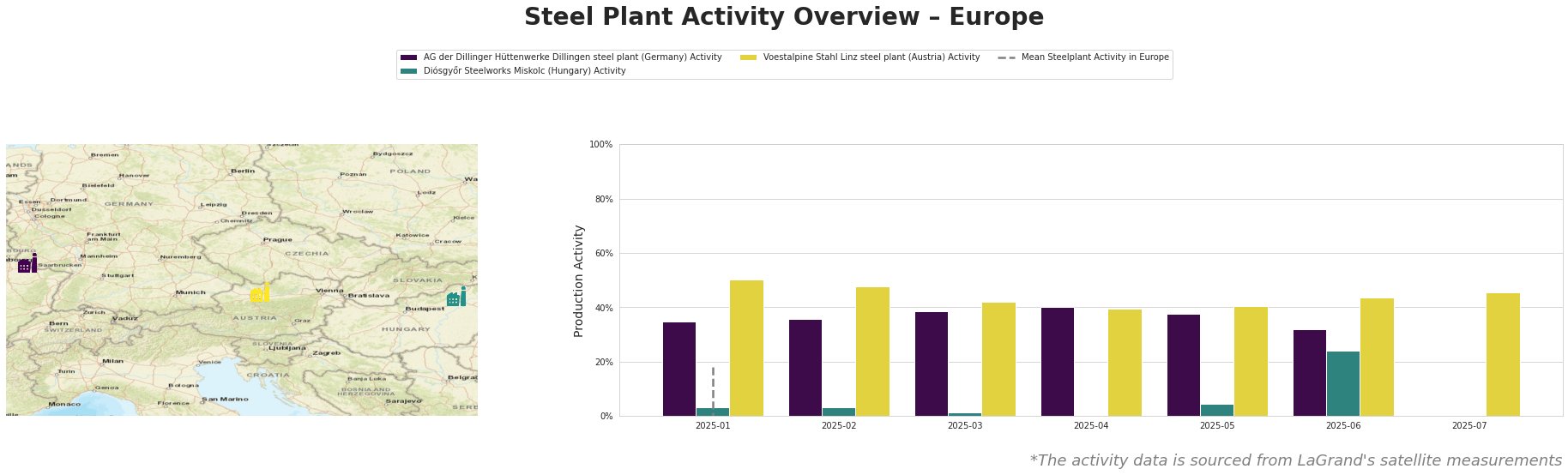

The mean steel plant activity data is inconsistent. From January 2025 onwards, the values drastically drop each month into negative numbers. We can conclude that the provided Mean Steelplant Activity in Europe data is inaccurate. We can however observe the evolution of the steel plants themselves based on satellite data.

AG der Dillinger Hüttenwerke Dillingen steel plant (Germany): This integrated steel plant, relying on BF/BOF technology with a crude steel capacity of 2.76 million tonnes and a significant iron production of 4.79 million tonnes, shows a gradual activity increase from January (35%) to April (40%), followed by a decrease to 32% in June. The plant focuses on high-quality heavy-plate products for demanding sectors. No direct connection can be established between the observed activity and the issues raised in “75 anni di Eurometal: dialogo con la filiera, Cbam e decarbonizzazione,” although the plant’s ResponsibleSteel certification aligns with the conference’s decarbonization focus.

Diósgyőr Steelworks Miskolc (Hungary): This EAF-based steel plant, with a smaller crude steel capacity of 550,000 tonnes, shows very low activity levels in the initial months (3% in January and February, decreasing to 0% in April) with a significant increase to 24% in June. The plant primarily produces semi-finished and finished rolled products. No explicit link can be established between this recent activity increase and the collaborative themes discussed in “EUROMETAL: Future of European steel depends on collaboration.” However, the ResponsibleSteel certification aligns to the themes raised in that article.

Voestalpine Stahl Linz steel plant (Austria): As an integrated steel plant with a large 6 million tonne crude steel capacity and 5 million tonne iron capacity, Voestalpine Stahl Linz displays the highest activity levels, starting at 50% in January and stabilizing around 40% during February-May, with a slight increase to 44% in June and 45% in July. This plant produces a wide range of flat steel products. Like Dillinger, its operations, based on BF/BOF, are directly affected by Carbon Border Adjustment Mechanism (CBAM) discussions raised in “75 anni di Eurometal: dialogo con la filiera, Cbam e decarbonizzazione.” A stable production activity could mean mitigation strategies have been implemented.

Given the emphasis on decarbonization and CBAM in the steel market, and considering the differing activity levels at the observed steel plants, steel buyers should prioritize suppliers with ResponsibleSteel certification and transparent carbon footprint data. This is especially important given the discussions in “EUROMETAL: Future of European steel depends on collaboration” regarding client demands for verified emissions data. Buyers relying on heavy plate from AG der Dillinger Hüttenwerke should monitor activity for a potential short-term supply constraint. The increase in activity at the Diósgyőr Steelworks Miskolc presents a potential alternative source for specific steel grades, although further investigation into their production capacity and capabilities is warranted. Overall, steel procurement should focus on long-term partnerships that promote decarbonization and supply chain transparency, aligning with the collaborative spirit emphasized by EUROMETAL.