From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market Optimistic: Marcegaglia’s Green Investments Drive Positive Sentiment Amidst Stable Plant Activity

Europe’s steel market shows a very positive outlook, driven by strategic investments in green steel production. The news articles “Marcegaglia will supply its plant in Fos-sur-Mer with nuclear energy from EDF for 10 years,” “Marcegaglia secures low-carbon power from EDF for Fos-Sur-Mer green steel plant,” “Marcegaglia secures low-carbon energy for future Fos-sur-Mer site,” and “Marcegaglia provides low-carbon energy for the future plant in Fos-sur-Mer” all underscore a significant push toward sustainable steelmaking. While these articles highlight strategic shifts, no direct correlation to immediate satellite-observed activity changes at other steel plants could be established based on the provided data.

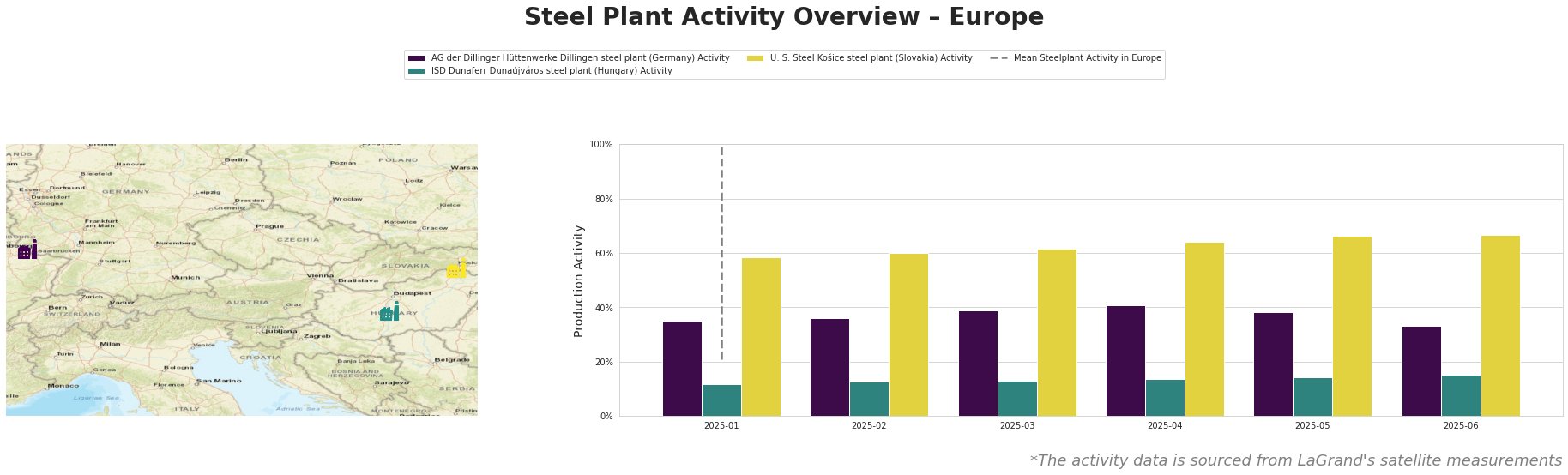

The data indicates relative stability across the observed steel plants. The “Mean Steelplant Activity in Europe” figures fluctuate significantly due to large numbers, but the individual plants show consistent activity. AG der Dillinger Hüttenwerke shows a slight decrease to 33% in June, from a peak of 41% in April. ISD Dunaferr shows a gradual, modest increase, reaching 15% in June. U. S. Steel Košice exhibits a steady climb, reaching 67% activity in June, the highest among the observed plants.

AG der Dillinger Hüttenwerke Dillingen steel plant, located in Saarland, Germany, is an integrated BF-BOF plant with a crude steel capacity of 2.76 million tonnes and a pig iron capacity of 4.79 million tonnes. It focuses on high-quality heavy-plate products, including various structural, high-strength, and specialty steels, catering to the automotive, building, energy, and machinery sectors. Activity at the Dillinger plant peaked at 41% in April before declining to 33% in June. While the decline could indicate a temporary adjustment in production, there is no direct link to the Marcegaglia news articles or other identified factors, so this link cannot be established.

ISD Dunaferr Dunaújváros steel plant in Hungary, with a crude steel capacity of 1.6 million tonnes and a pig iron capacity of 1.3 million tonnes, operates as an integrated BF-BOF plant. Its product range includes hot-rolled, cold-rolled, and coated steel products. The plant has shown a consistent, but modest, increase in activity, reaching 15% in June. This gradual increase does not directly correlate to the news regarding Marcegaglia’s investments, so no explicit connection can be established.

U. S. Steel Košice steel plant in Slovakia, a major integrated BF-BOF producer with a crude steel capacity of 4.5 million tonnes and a pig iron capacity of 5 million tonnes, produces a wide range of flat-rolled products, including hot-rolled, cold-rolled, galvanized, and coated steels, serving diverse sectors such as automotive, construction, and packaging. The plant demonstrated steady growth, achieving 67% activity in June. This upward trend appears independent of the Marcegaglia developments, so no explicit connection can be established.

The news of Marcegaglia’s significant investment in its Fos-sur-Mer plant and its commitment to low-carbon energy sources signals a long-term shift towards green steel production in Europe. However, the observed activity levels at other major plants do not show immediate disruption or correlation with this announcement.

Evaluated Market Implications:

Marcegaglia’s strategic shift towards green steel production, as highlighted in the news articles “Marcegaglia will supply its plant in Fos-sur-Mer with nuclear energy from EDF for 10 years,” “Marcegaglia secures low-carbon power from EDF for Fos-Sur-Mer green steel plant,” “Marcegaglia secures low-carbon energy for future Fos-sur-Mer site,” and “Marcegaglia provides low-carbon energy for the future plant in Fos-sur-Mer,” will add substantial green steel production capacity (2.1 million tonnes annually by 2028).

Recommended Procurement Actions:

- Focus on Long-Term Contracts: Steel buyers should consider securing long-term supply contracts with Marcegaglia for green steel products from the Fos-sur-Mer plant, particularly if sustainability is a key procurement criterion. This aligns with the company’s commitment to expanding production capacity and utilizing low-carbon energy sources, as indicated by the news articles.

- Monitor Dillinger’s Heavy Plate Production: Given Dillinger’s recent activity dip and its specialization in heavy plate, buyers who need this type of steel product should proactively engage with Dillinger to understand its production outlook and adjust procurement strategies accordingly.

- Track Energy Market Developments: Steel buyers should actively follow energy market trends and policy changes related to green energy sources, particularly nuclear power, to anticipate potential impacts on steel production costs and sustainability initiatives across Europe, in light of the EDF agreement.