From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market Optimism: EFTA Impact and Stable Plant Activity Amidst Trade Dynamics

Europe’s steel market maintains a positive outlook, influenced by international trade agreements and generally stable plant activity, while navigating potential trade tensions related to carbon taxes. The “India-EFTA FTA to come into effect on October 1“ could indirectly influence European steel demand by shifting global trade flows, although no direct impact on European steel plant activity is currently observable. While the “UK FTA: India Has Right To Retaliate If Carbon Tax Hurts Industry, Say Sources“ does not appear to have a direct bearing on current production, it highlights a potential future risk for European steel exports to India if CBAM implementation triggers retaliatory measures.

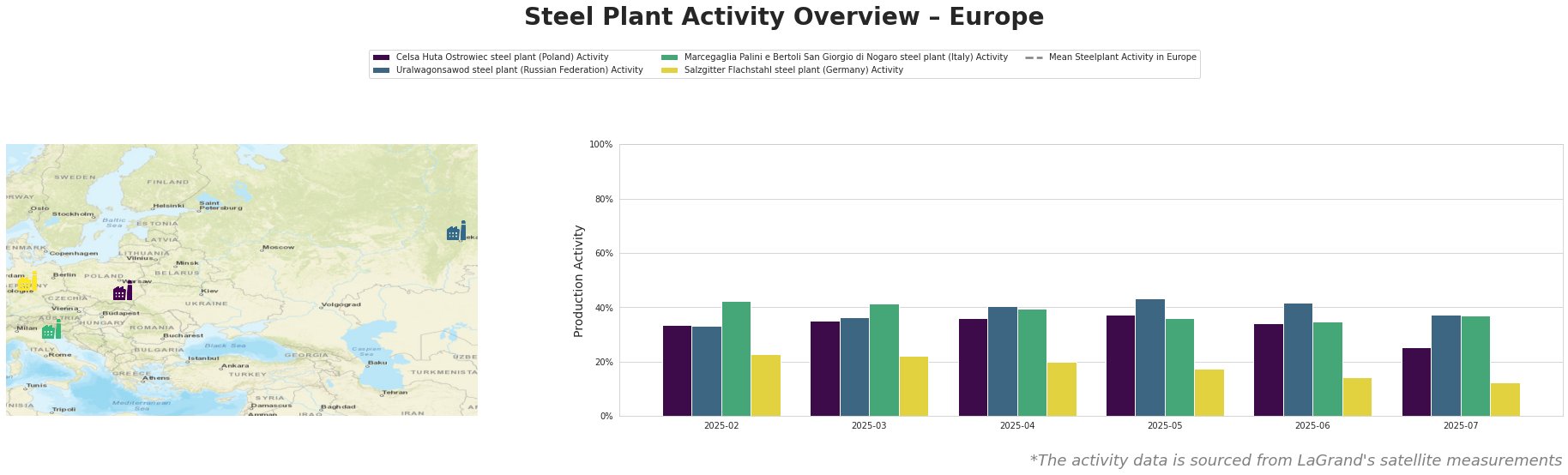

The Mean Steelplant Activity in Europe is consistently negative and provides limited informational value due to the large negative value, and so it is not suitable for comparison with individual plant activities.

Celsa Huta Ostrowiec (Poland), an EAF-based producer focused on finished rolled products like rebar, experienced relatively stable activity from February to May, peaking at 37% in May before dropping to 25% in July. This represents the largest single month activity drop of all plants observed and may warrant further investigation from procurement managers active in the construction sector.

Uralwagonsawod (Russian Federation) showed a steady increase in activity from February (33%) to May (43%), followed by a minor decrease to 37% in July. While the plant details suggest a focus on the defense sector, no direct link can be established between this activity and the provided news articles.

Marcegaglia Palini e Bertoli San Giorgio di Nogaro (Italy), a producer of hot rolled plate using EAF technology, saw a gradual decline in activity from February (42%) to June (35%), with a rebound to 37% in July. Given its end-user sectors, including building and infrastructure, energy, tools and machinery, and transport, this rebound is a sign of resilience in demand in these sectors.

Salzgitter Flachstahl (Germany), an integrated BF/BOF producer of flat steel products for the automotive and construction sectors, experienced a continuous decline in activity from February (23%) to July (12%). Salzgitter’s efforts to transition to hydrogen-based steel production are long-term and would not explain short-term activity fluctuations.

Evaluated Market Implications:

The activity drop at Celsa Huta Ostrowiec in July may signal a potential localized supply issue for rebar in the building and infrastructure sector, suggesting buyers in this sector should consider diversifying their sourcing or securing inventory in advance. While no immediate impact is evident, procurement professionals should closely monitor policy developments related to the UK’s CBAM and any potential retaliatory measures from India, as outlined in the article “UK FTA: India Has Right To Retaliate If Carbon Tax Hurts Industry, Say Sources”. Any trade disputes impacting steel flows could create volatility in the European market. The “India-EFTA FTA to come into effect on October 1” could impact long-term global trade flows but does not currently translate into actionable insights for European buyers.