From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market: Industrial Output Surge Offsets Construction Slump; German Steel Faces Competitiveness Challenges

Europe’s steel market presents a mixed picture, with rising industrial output potentially boosting demand while specific challenges in Germany impact production. “Euro area industrial output up 2.6 percent in March from February” indicates a positive trend for steel consumption, while activity levels at the ArcelorMittal Duisburg steel plant remain comparatively robust. This contrasts with the stagnation highlighted in “Zwischen Hoffen und Bangen – wie viel Aufschwung ist möglich?“, revealing competitiveness issues for German steel producers. This article does not provide any clear connection to observed activity changes, but it indicates potential challenges that may arise in the mid-term.

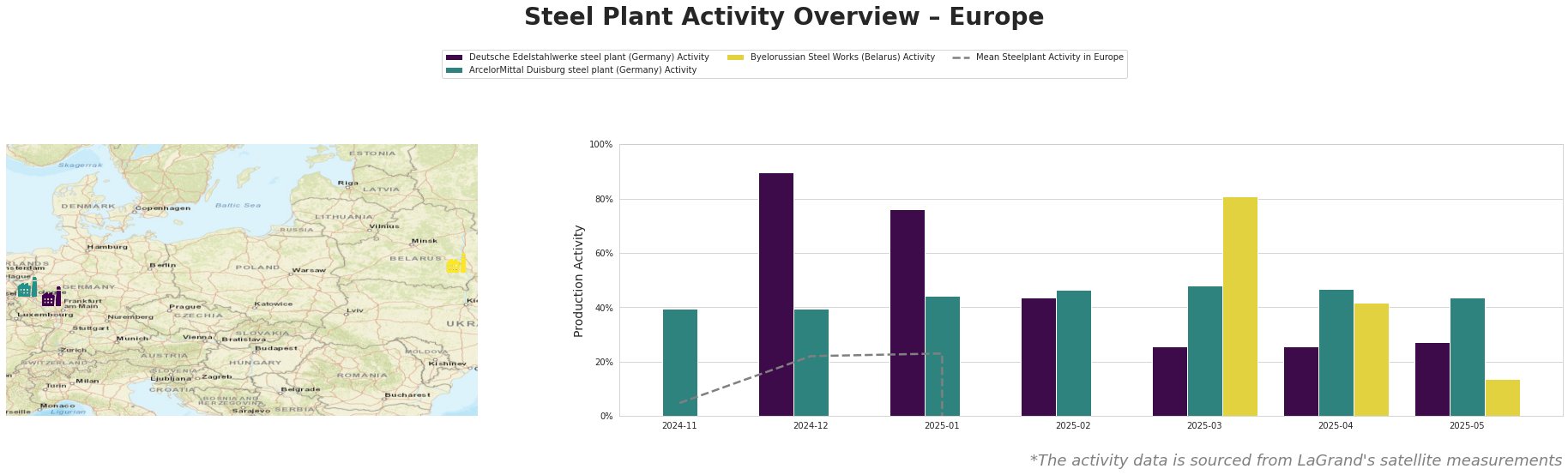

The following table summarizes recent activity trends across key European steel plants:

The mean steel plant activity cannot be used due to calculation errors.

Deutsche Edelstahlwerke steel plant: This German plant, relying on EAF technology with a 600ktpa crude steel capacity, saw a significant drop in activity from 90% in December 2024 to around 26% by April 2025. The most recent data for May 2025 shows a slight recovery to 27%. Given the challenges highlighted in “Zwischen Hoffen und Bangen – wie viel Aufschwung ist möglich?”, specifically high energy costs and regulatory burdens impacting German manufacturers, it is plausible, though not directly verifiable, that these factors contribute to the observed decline.

ArcelorMittal Duisburg steel plant: In contrast to Deutsche Edelstahlwerke, the ArcelorMittal Duisburg plant, a BOF-based facility with a 1300ktpa capacity, demonstrates relatively stable activity levels. Starting at 40% in November 2024, it peaked at 48% in March 2025, and has since settled around 43% in May 2025. This stability, occurring concurrently with the industrial output growth reported in “Euro area industrial output up 2.6 percent in March from February”, suggests this plant is well-positioned to capitalize on increased demand.

Byelorussian Steel Works: This EAF-based plant with a 3000ktpa capacity shows a volatile activity pattern, peaking at 81% in March 2025, and then sharply declining to 14% in May 2025. There is no directly linking news to explain this drop.

The construction sector’s stagnation, as indicated by “Construction in the European Union increased by 0.1% m/m in March,” is not expected to pose significant constraints, since “Eurofer forecasts a 2% y/y growth in 2025”, but careful attention must be paid to actual economic trends in the upcoming months.

Evaluated Market Implications:

The observed divergence in activity between Deutsche Edelstahlwerke and ArcelorMittal Duisburg, considered against the backdrop of broader economic trends, has key implications:

-

Potential Supply Disruptions (Specific Plants or Regions): The significant activity decline at Deutsche Edelstahlwerke signals potential supply constraints, especially for specialized steel products catered to the automotive, energy, and machinery sectors. “Zwischen Hoffen und Bangen – wie viel Aufschwung ist möglich?” highlights Germany’s competitiveness challenges, suggesting this disruption may be more prolonged if policy changes are not implemented. The situation in Belarus is even more uncertain, with Byelorussian Steel Works reducing it’s output to a minimum after a short peak.

-

Specific Recommended Procurement Actions:

- For steel buyers reliant on Deutsche Edelstahlwerke: Immediately explore alternative suppliers, particularly those within the EU. Prioritize securing long-term contracts with ArcelorMittal or other robust producers to mitigate supply chain vulnerabilities.

- For steel buyers with exposure to the construction sector: Closely monitor construction output data in Austria, Romania, and the Czech Republic where growth is more robust, and prepare for localized price increases due to demand. Balance this with developments in Portugal, Slovenia and Poland, where activity levels are expected to decline.

- For steel buyers: Due to the uncertainty of supplies coming from Byelorussian Steel Works, avoid short-term contracts, and increase stocks as appropriate.

- For market analysts: Track policy changes in Germany aimed at reducing energy costs and bureaucratic burdens. Success in these areas could revitalize German steel production and alleviate potential supply constraints.