From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market: Green Transition Challenges & Regional Activity Variances

Europe’s steel market faces headwinds as decarbonization efforts encounter economic realities. The news articles “ArcelorMittal Europe halts progress on DRI-EAF plans in Germany” and “ArcelorMittal will focus on EAF only “when commercially viable”” directly relate to observable potential shifts in production strategies. However, satellite data does not explicitly reflect these decisions at this time and cannot confirm a direct impact. In contrast, “Thyssenkrupp will continue construction of a green steel plant” signals a continued commitment to decarbonization despite economic challenges.

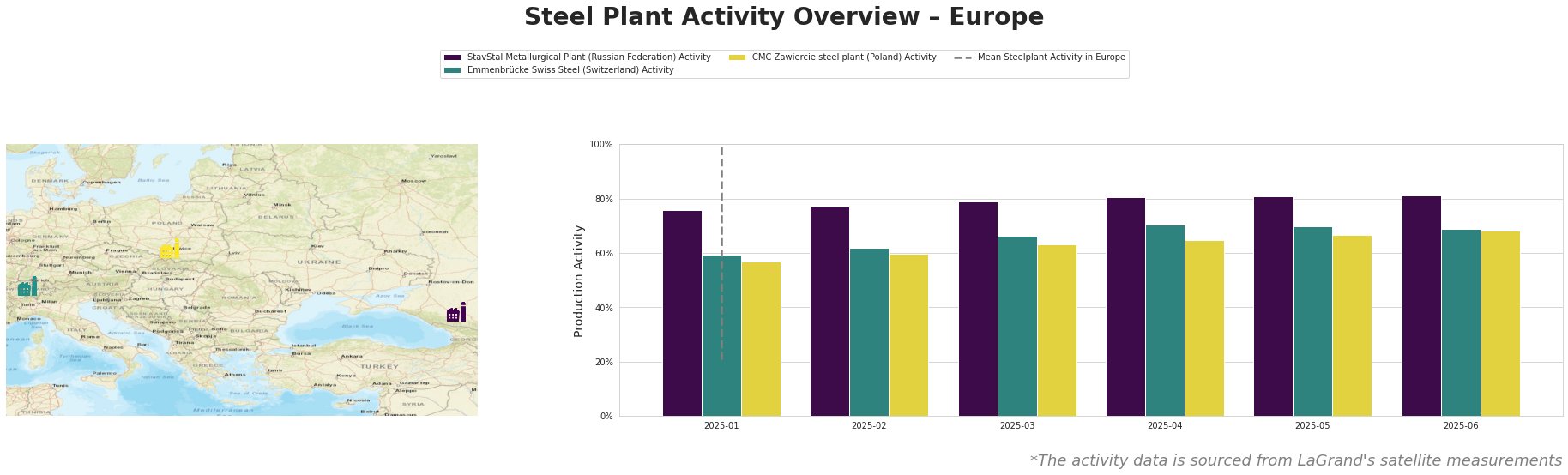

Monthly Aggregated Activities

The average steel plant activity levels in Europe fluctuate significantly across months. Individual plants show greater stability. StavStal Metallurgical Plant (Russian Federation) consistently operates at high activity levels, peaking at 81% in May and June. Emmenbrücke Swiss Steel (Switzerland) shows a gradual increase from 59% in January to 71% in April, followed by a slight decrease to 69% in June. CMC Zawiercie steel plant (Poland) also demonstrates increasing activity, reaching 68% in June. The average European steel plant activity varies greatly month-to-month, with no evident correlation to the named news articles regarding decarbonization plans.

StavStal Metallurgical Plant, located in Stavropol Krai, Russian Federation, is a relatively small EAF-based steel plant with a crude steel capacity of 500 thousand tonnes per annum. It focuses on producing semi-finished and finished rolled products like square billets, rebar, and wire rod. The plant’s activity has steadily increased from 76% in January to 81% in May and June. There is no explicitly established connection between this plant’s activity and the provided news articles concerning European decarbonization efforts.

Emmenbrücke Swiss Steel, located in Luzern, Switzerland, utilizes EAF technology. Its activity increased from 59% in January to a peak of 71% in April, then decreased to 69% in June. There is no explicitly established connection between this plant’s activity and the provided news articles.

CMC Zawiercie steel plant, situated in Silesia, Poland, has a crude steel capacity of 1.7 million tonnes per annum using EAF technology. Its products serve sectors including automotive, construction, and energy. Activity at the plant shows a consistent increase from 57% in January to 68% in June. Considering the news that “Thyssenkrupp will continue construction of a green steel plant” this increase could reflect broader positive trends in European steel production and is generally consistent with the positive market sentiment, though no direct link can be explicitly established.

Given ArcelorMittal’s announced delays in DRI-EAF projects due to economic concerns (“ArcelorMittal Europe halts progress on DRI-EAF plans in Germany” and “ArcelorMittal will focus on EAF only “when commercially viable”“), steel buyers should prioritize securing medium-term supply contracts from producers committed to existing EAF capacity. Focus on suppliers with established EAF operations, such as CMC Zawiercie, as they are less likely to be impacted by the uncertainties surrounding green steel investments. Closely monitor energy prices and policy developments in Germany, as highlighted in “Thyssenkrupp will continue construction of a green steel plant“, as these factors will significantly influence the competitiveness and availability of green steel in the long term.