From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market Faces Uncertainty Amid Trump’s Criticism and Plant Activity Slowdown

Europe’s steel market faces increasing uncertainty due to geopolitical factors and fluctuating plant activity. Donald Trump’s criticism of European policies, as reported in “Trump attackiert UNO und warnt Europa vor Ruin,” adds to the overall negative sentiment. While no direct relationship can be established between Trump’s statements and the observed steel plant activity levels, his rhetoric introduces further instability into the market. The article “UN-Generaldebatte: ++ Trump nennt Russland einen „Papiertiger“ – Selenskyj ist überrascht von „großer Kehrtwende“ ++ Liveticker” further highlights the unpredictable nature of the geopolitical landscape influencing the steel sector.

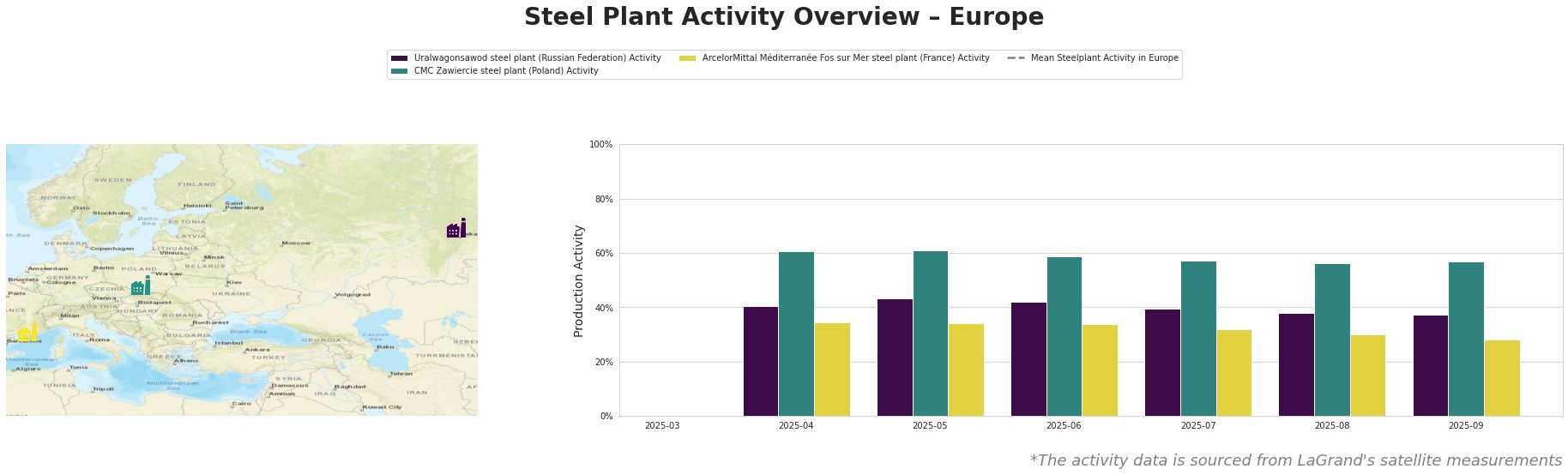

The mean steel plant activity in Europe has fluctuated significantly, peaking in May and July before dropping sharply in September. Uralwagonsawod steel plant shows a gradual decline in activity from April (40%) to September (37%). CMC Zawiercie steel plant in Poland shows a slight decline from April (61%) to August (56%), followed by a slight increase in September (57%). ArcelorMittal Méditerranée Fos sur Mer steel plant in France has experienced a steady decrease in activity, from 35% in April to 28% in September.

The Uralwagonsawod steel plant, located in the Rostov region of Russia, primarily serves the defense sector. Its activity has steadily declined from 40% in April to 37% in September. Given its Russian location and end-user sector, this decline, while not directly linked to any specific news article provided, may be indirectly influenced by the geopolitical instability and Trump’s rhetoric, particularly as highlighted in “UN-Generaldebatte: ++ Russland ist weder „Papiertiger“ noch „Papierbär“, spottet der Kreml über Trump ++ Liveticker“.

CMC Zawiercie, a Polish EAF steel plant with a crude steel capacity of 1.7 million tonnes per annum, serves various sectors, including automotive and construction. Activity at this plant saw a minor decrease from 61% in April/May to 57% in September. This relative stability compared to other plants may reflect Poland’s continued economic strength and its distance from the most acute geopolitical tensions discussed in the news articles. No explicit connection can be established to the provided news.

ArcelorMittal Méditerranée Fos sur Mer, an integrated BF-BOF steel plant in France with a 4 million tonne crude steel capacity, produces semi-finished and finished rolled products. The plant’s activity has consistently decreased, reaching 28% in September. While no direct causal link can be established with the provided news articles, the general negative sentiment expressed in “Trump attackiert UNO und warnt Europa vor Ruin” regarding European policies might contribute to the pessimistic outlook affecting the steel sector, including ArcelorMittal. The plant is planned to be shut down by 2030 due to its two BOFs.

Given the overall negative market sentiment, Trump’s criticisms of Europe, the observed fluctuating mean steel plant activity, and the specific declines in plant activity, steel buyers should:

- Carefully monitor supply chains: Given the decline in activity at the ArcelorMittal Méditerranée Fos sur Mer steel plant and the general market volatility, buyers relying on slabs, hot rolled products, and coil from this plant should consider diversifying their supply base to mitigate potential disruptions.

- Negotiate flexible contracts: Considering the geopolitical uncertainty highlighted in “Trump attackiert UNO und warnt Europa vor Ruin“, buyers should negotiate contracts with clauses that allow for adjustments based on unforeseen political or economic events.

- Evaluate inventory levels: Due to the unpredictable geopolitical environment, steel buyers should carefully evaluate their inventory levels. While overstocking can be costly, maintaining a buffer can protect against potential supply disruptions stemming from the general uncertainty.