From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market Faces Supply Risks as ArcelorMittal Plant Fire Disrupts Production

In Europe, steel supply faces increased uncertainty due to a major disruption at ArcelorMittal’s Fos-sur-Mer plant. As reported in “ArcelorMittal Fos-sur-Mer shut down blast furnace No. 2 due to a fire,” “ArcelorMittal Shuts Down Fos-sur-Mer Blast Furnace After Major Fire,” “ArcelorMittal shuts down Fos-sur-Mer blast furnace after major fire incident,” and “ArcelorMittal shuts down Fos-sur-Mer blast furnace after major fire incident,” a fire has caused a shutdown of blast furnace No. 2, impacting steelmaking operations. No direct relationship between this event and the satellite observed plant activity data has been established.

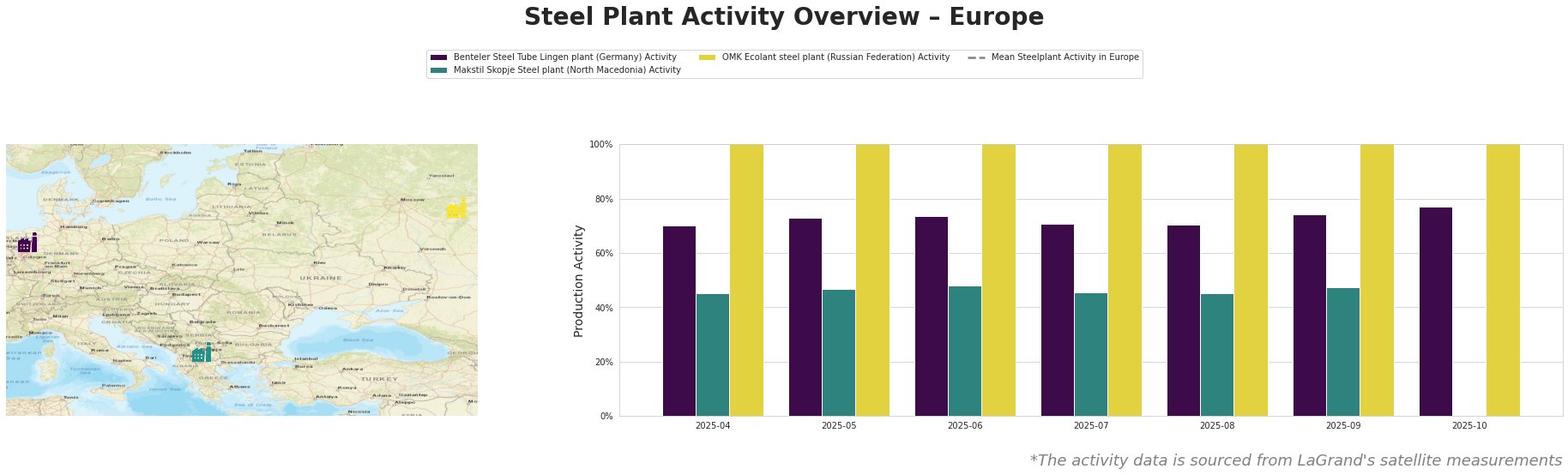

The Benteler Steel Tube Lingen plant, an EAF-based facility in Germany with a crude steel capacity of 650 ttpa, experienced relatively stable activity levels between April and August 2025, fluctuating between 70% and 74%. A slight increase to 77% was observed in October. This plant produces semi-finished and finished rolled products, including tubes, billets, and slabs, serving the automotive and building/infrastructure sectors. There is no direct connection between this activity and the Fos-sur-Mer incident.

Makstil Skopje, a 550 ttpa EAF-based steel plant in North Macedonia producing primarily slabs, shows consistent activity levels around 45%-48% between April and September 2025, with no reported activity for October. There is no direct connection between this activity and the Fos-sur-Mer incident.

The OMK Ecolant steel plant in Russia, an integrated DRI-EAF facility with a crude steel capacity of 1800 ttpa, shows consistently high activity levels in the provided data. As the mean steelplant activity in Europe is significantly lower, a reporting or scaling error in the plant’s measured activity cannot be excluded. There is no direct connection between this activity and the Fos-sur-Mer incident.

Given the fire at ArcelorMittal Fos-sur-Mer, which is expected to cause at least a two-day production halt and potentially longer, steel buyers should anticipate potential disruptions in the supply of slabs and related steel products. Based on the news article “ArcelorMittal shuts down Fos-sur-Mer blast furnace after major fire incident,” the Fos-sur-Mer plant relies on its steelmaking shop for slabs required in downstream processes. Procurement professionals focusing on sourcing steel from ArcelorMittal or those reliant on slab supply from the region should:

- Contact ArcelorMittal immediately to assess the impact on existing orders and delivery schedules.

- Explore alternative slab sourcing options within Europe or from reliable overseas suppliers to mitigate potential shortfalls. Given that the fire has damaged structures and the electrical substation, the incident is not just an ordinary disruption. Alternative suppliers and products should be explored.

- Prioritize orders from steel plants with consistent and stable activity, such as the Benteler Steel Tube Lingen plant, while acknowledging that its product range may not entirely substitute for Fos-sur-Mer’s output.

- Closely monitor market developments and official statements from ArcelorMittal for updates on the extent of the damage and expected timeline for resuming full production.