From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market Faces Supply Concerns Amid Fires and Activity Fluctuations

Europe’s steel market is facing increased uncertainty driven by recent fires at steel plants and fluctuating production activity. The incidents, highlighted in news such as “Fire halts Marcegaglia CR line for ‘a few weeks’” and “Marcegaglia Ravenna fire causes no major production delays“, raise concerns about potential supply disruptions, particularly in the cold-rolled coil (CRC) sector. While “Marcegaglia Ravenna fire causes no major production delays” suggests minimal disruption from the Ravenna fire, other incidents like the ArcelorMittal Fos-sur-Mer fire are causing order redirection and slab sourcing. Satellite data provides insights into overall plant activity, though direct links between these observations and the named fire incidents cannot be definitively established.

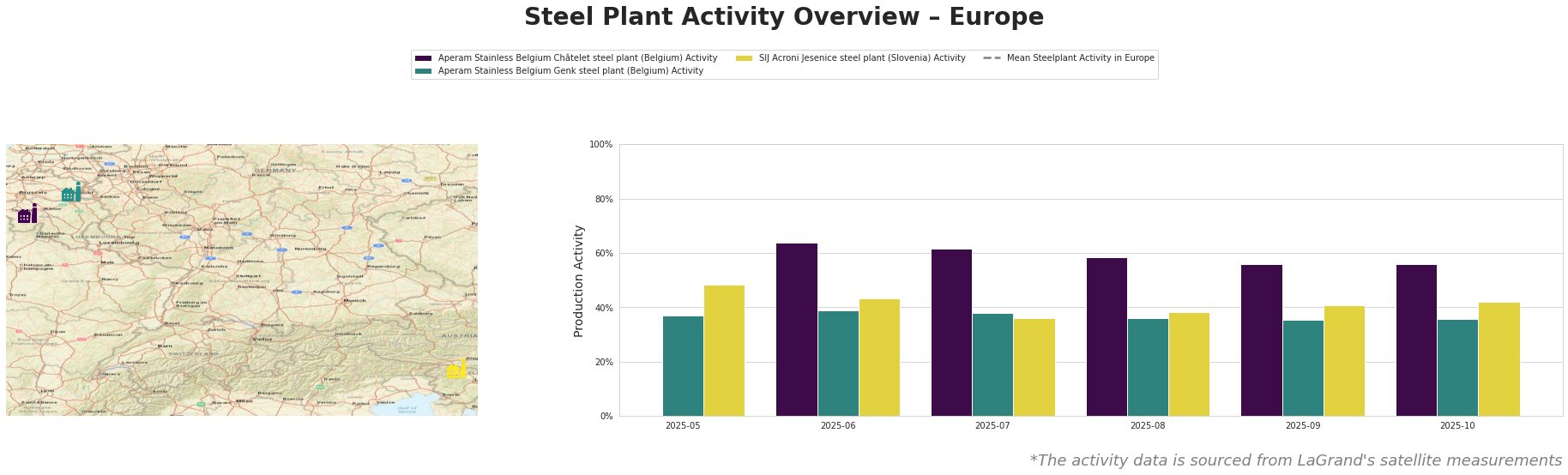

The satellite data reveals fluctuating activity levels across the observed plants. The Mean Steelplant Activity in Europe generally decreased from May to October. Aperam Stainless Belgium Châtelet steel plant shows a decreasing activity from 64% in June to 56% in October. Aperam Stainless Belgium Genk steel plant also shows a slow, consistent decrease from 37% in May to 36% in October. SIJ Acroni Jesenice steel plant showed a decrease from 48% to 42% in activity from May to October. No direct links between these observed activity trends and the named fire incidents can be established based on the provided information.

Aperam Stainless Belgium Châtelet, operating an EAF with a 1 million tonne capacity, produces stainless steel slabs and cold-rolled products. The observed decline in activity from 64% in June to 56% in October shows a period of reduced production. The news articles provided do not explain or provide insights for the observed production decrease.

Aperam Stainless Belgium Genk, another EAF-based stainless steel producer with a 1.2 million tonne capacity, also experienced decreased activity, gradually declining from 37% in May to 36% in October. Similar to Châtelet, the data on Genk does not correlate with information in any of the provided news articles

SIJ Acroni Jesenice, a 726,000-tonne EAF steel plant producing flat-rolled products, plates, and both hot and cold-rolled steel, saw activity fluctuate. Satellite data shows a drop from 48% activity in May to 42% in October. These fluctuations are not directly linked to any specific news events in the provided articles.

Given the recent fires at Marcegaglia and ArcelorMittal, as well as the described plant production outputs, steel buyers should prioritize the following:

* CRC Procurement Diversification: As highlighted in “Fire halts Marcegaglia CR line for ‘a few weeks’,” the fire at Marcegaglia’s Ravenna plant is expected to reduce CRC supply and increase prices. Buyers reliant on Marcegaglia should immediately explore alternative CRC suppliers to mitigate potential disruptions and price increases.

* Monitor ArcelorMittal’s Slab Sourcing: Given that ArcelorMittal Fos-sur-Mer is redirecting orders and sourcing slabs after a fire, buyers who usually source from them should stay informed about how this is resolved and potentially source from elsewhere.

* Increased Inventory: Buyers should consider increasing their inventory levels of CRC and other affected products to buffer against potential shortages and price volatility in the near term, as implied by the news related to Marcegaglia and general production data.