From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel: HRC Prices Stable Amid CBAM Uncertainty; Long Products Flat; Select Plant Activity Shifts

Europe’s steel market presents a mixed picture. Hot-rolled coil (HRC) prices are stable but buyers are wary, while the long products market remains flat. As reported in “European steel HRC prices steady; buyers doubt durability of rebound“ and “European steel HRC market still quiet amid push for higher offers,” weak demand and the upcoming EU Carbon Border Adjustment Mechanism (CBAM) are key influencing factors. While these news reports describe the overall price environment, no direct link to activity changes at the observed plants could be established.

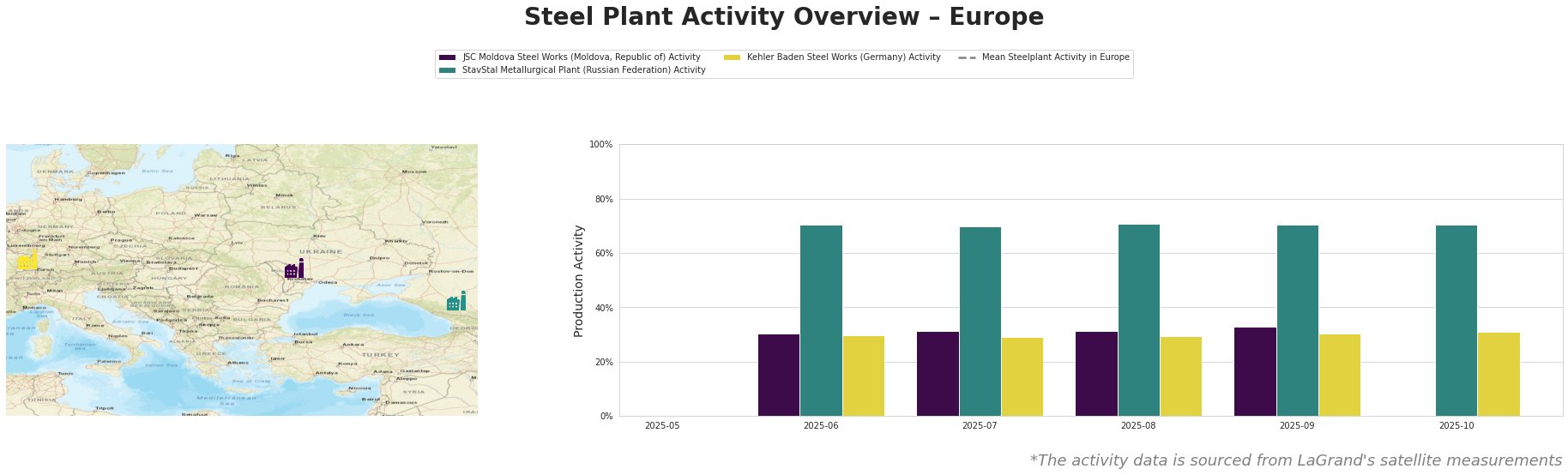

The following table shows the monthly activity trends for select steel plants:

The mean activity level across all observed European plants shows fluctuations, peaking in July and August, with a significant drop in October.

JSC Moldova Steel Works, an electric arc furnace (EAF) plant with a 1 million tonne crude steel capacity producing wire rod, rebar, and billet, shows relatively stable activity levels between June and September, ranging from 30% to 33%. These levels are significantly below the European mean steel plant activity. No direct link between these activity levels and the provided news articles could be established.

StavStal Metallurgical Plant, a 500,000-tonne capacity EAF-based producer of square billet, rebar, and wire rod, shows consistent activity levels around 70-71% from June to October. The levels are higher than the European mean steel plant activity. The stability of activity does not directly correlate with the price volatility described in the news articles.

Kehler Baden Steel Works, operating two EAFs with a combined 2.5 million tonne capacity and producing wire rod, bar, rebar and billet, demonstrates relatively stable activity, fluctuating between 29% and 31% from June to October, significantly below the European mean steel plant activity. There is no apparent direct connection between these activity levels and the market trends outlined in the provided news.

Evaluated Market Implications

Given the stable long steel prices reported in “The European long position market is generally stable“ and “European longs market stable overall“, coupled with consistent activity at StavStal Metallurgical Plant, buyers seeking long products may find relatively stable supply from this region.

However, the news reports “European steel HRC prices steady; buyers doubt durability of rebound” and “European steel HRC market still quiet amid push for higher offers” highlight uncertainty in the HRC market due to weak demand and CBAM. Buyers should closely monitor import offers, especially from India and Indonesia as noted in the articles, and factor potential CBAM charges into their procurement decisions, but without any additional indication in the supplied articles or satellite data, no further plant-specific mitigation actions can be explicitly recommended.