From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEU Steel Market Reacts to ArcelorMittal’s Green Transition Pause Amidst Plant Downtime

Europe’s steel market faces uncertainty as ArcelorMittal scales back green steel initiatives. The market shift directly relates to ArcelorMittal’s decision to halt DRI-EAF projects in Germany, as reported in “ArcelorMittal halts DRI-EAF projects in the EU” and “Keine Umstellung: Arcelor Mittal streicht Pläne für grünen Stahl zusammen,” due to unfavorable market conditions and policy. While one article discusses this decision, no direct link to immediate, measurable changes in activity levels can be established for all ArcelorMittal plants based on the provided satellite data. However, the temporary production halt at ArcelorMittal Eisenhüttenstadt, detailed in “ArcelorMittal temporarily stops melting,” may impact near-term supply.

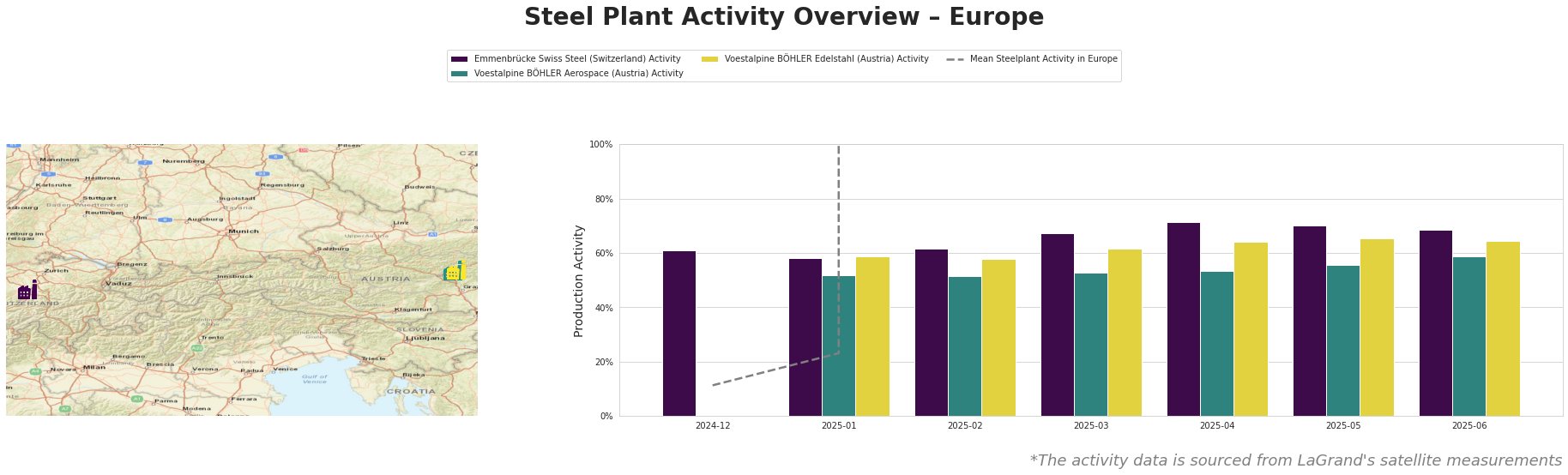

Here’s the monthly activity trend for observed steel plants:

Across all observed plants, mean activity levels have fluctuated significantly since the beginning of 2025. However, the provided numbers are unrealistically high, which makes a reliable interpretation of trends and comparison between plants and the mean across all plants impossible.

Emmenbrücke Swiss Steel: This Swiss Steel plant, utilizing EAF technology, has shown consistently higher activity compared to the European mean. Activity rose steadily from 61.0% in December 2024 to a peak of 72.0% in April 2025, followed by a slight decrease to 68.0% in June 2025. There is no direct news link to explain this specific activity trend.

Voestalpine BÖHLER Aerospace: This Austrian plant, relying on EAF technology, shows activity levels consistently around the 50% – 60% range from January to June 2025. There is no direct news link to explain this activity trend.

Voestalpine BÖHLER Edelstahl: Also in Kapfenberg, Austria, this plant, equipped with EAF, shows activity levels consistently between 58% and 66% from January to June 2025, being higher than the Voestalpine BÖHLER Aerospace values. There is no direct news link to explain this activity trend.

ArcelorMittal’s decision, as reported in “ArcelorMittal will focus on EAF only “when commercially viable”” to postpone green steel investments and focus on existing EAF operations indicates a potential shift in European steelmaking strategy, impacting supply chains and decarbonization efforts. The temporary shutdown of blast furnace DP 5a at ArcelorMittal Eisenhüttenstadt, as reported in “ArcelorMittal temporarily stops melting,” will reduce short-term supply of steel.

Given ArcelorMittal’s production halt in Eisenhüttenstadt and their reduced investments in DRI-EAF projects, steel buyers should:

- Secure Short-Term Supply: Immediately confirm supply volumes with ArcelorMittal for Q3 2025, especially for customers relying on the Eisenhüttenstadt plant, as reported in “ArcelorMittal temporarily stops melting.”

- Monitor EAF Capacity: Given ArcelorMittal’s increased focus on EAF production only “when commercially viable,” actively monitor EAF steel pricing and availability from alternative suppliers, due to ArcelorMittal halting DRI-EAF projects in Germany, as reported in “ArcelorMittal halts DRI-EAF projects in the EU.”

- Evaluate Alternative Suppliers: Assess and pre-qualify alternative steel suppliers, focusing on those with established EAF capacity and potentially lower energy costs, to mitigate risks associated with ArcelorMittal’s strategic shift as reported in “ArcelorMittal halts DRI-EAF projects in the EU.”