From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEU Steel Market Braces for “Buy European” Policy Amid Rising Plant Activity

The European steel market is anticipating significant changes following Germany’s SPD call for a “Buy European” policy, aiming to counter cheap imports as reported in “Germany’s SPD calls on EU to adopt “Buy European” steel policy to counter cheap imports“. While plant activity shows some fluctuation, no direct links between these policy proposals and immediate production shifts could be established based on provided data.

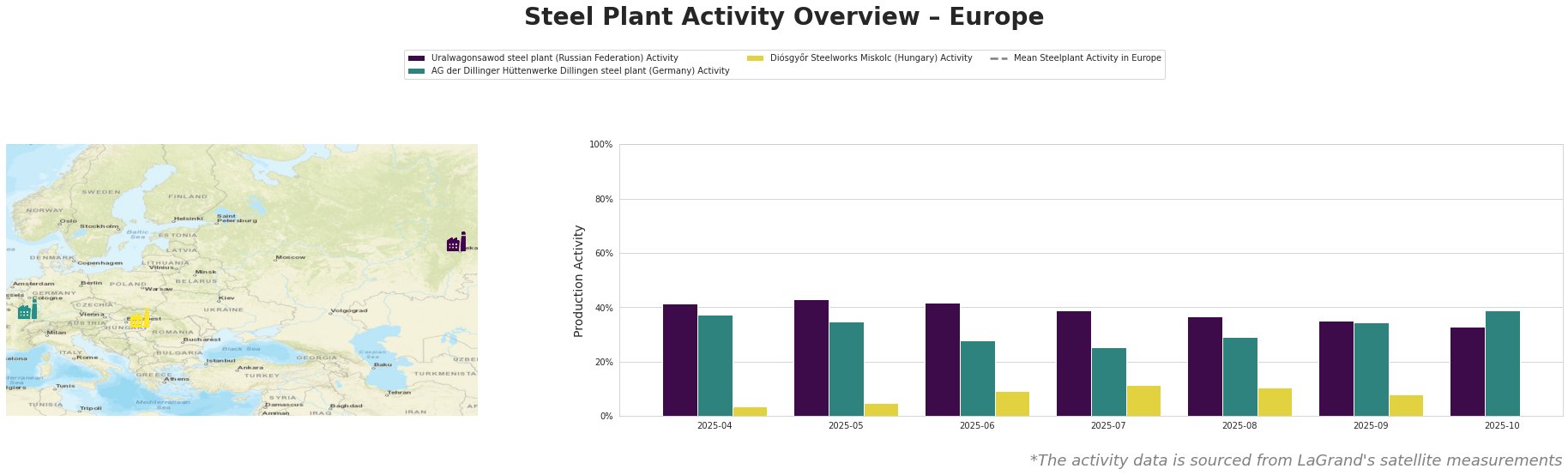

The activity levels of the observed steel plants show the following evolution:

The Mean Steelplant Activity in Europe shows a fluctuating trend, peaking in May, July, August, and October.

Uralwagonsawod steel plant activity, located in the Russian Federation and primarily serving the defense sector, has generally decreased from April (41%) to October (33%). No explicit connection to the news articles regarding the “Buy European” policy can be established based on the provided information, given its location and focus.

AG der Dillinger Hüttenwerke Dillingen steel plant, a German integrated steel plant with a 2.76 million tonne BOF capacity, experienced a notable drop in activity from April (37%) to July (25%), followed by a rise to 39% in October. This rise might reflect anticipation of increased domestic demand following the “Germany’s SPD calls on EU to adopt “Buy European” steel policy to counter cheap imports“, but a direct causal link cannot be conclusively proven with the data provided.

Diósgyőr Steelworks Miskolc, a Hungarian EAF steel plant with a 550,000-tonne capacity, demonstrates a steady increase from April (3%) to July (12%), followed by a slight decrease to 7% in October. While the activity shows an overall rise, no clear link to the “Buy European” initiative or other protectionist measures can be established from the provided information.

Evaluated Market Implications:

The proposed “Buy European” policy, as detailed in “Germany’s SPD calls on EU to adopt “Buy European” steel policy to counter cheap imports“, could lead to supply disruptions if import restrictions are implemented without a corresponding increase in domestic production capacity. While Dillinger’s recent activity increase could be a preparation for higher domestic demand, buyers should:

- Monitor Policy Implementation: Closely track the development and implementation of the “Buy European” policy. This includes understanding the specific tariff-quota levels and any exemptions.

- Secure Domestic Supply Agreements: Proactively engage with European steel producers like AG der Dillinger Hüttenwerke Dillingen to secure supply agreements and mitigate potential import restrictions. Verify sustainability certifications to comply with emerging EU regulations and customer demands.

- Diversify Sourcing (Cautiously): While the policy aims to restrict imports, explore sourcing options from countries less likely to be affected by the policy, keeping a close watch for rising domestic production capacity. However, this strategy must be weighed against the risk of future policy changes and potential trade disputes. Buyers also need to comply with sanctions on Russian steel.