From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEU Steel Market Alert: Political Uncertainty and Mixed Plant Activity Signal Potential Supply Instability

Europe’s steel market faces increased uncertainty amid shifting political landscapes and fluctuating plant activity. The steel industry, heavily reliant on stable economic conditions and infrastructure spending, is closely monitoring the implications of the new German government, as highlighted in “Liveticker zur Merz-Regierung: Merz: Müssen uns der neuen Wirklichkeit stellen | FAZ“, “Liveticker zur Merz-Regierung: Klingbeil distanziert sich von Merz’ „Drecksarbeit“-Zitat | FAZ“, and “Liveticker zur Merz-Regierung: CDU und SPD gegen repräsentative Ämter für AfD-Politiker | FAZ“. However, we cannot establish a direct connection between these political developments and the satellite-observed plant activity levels.

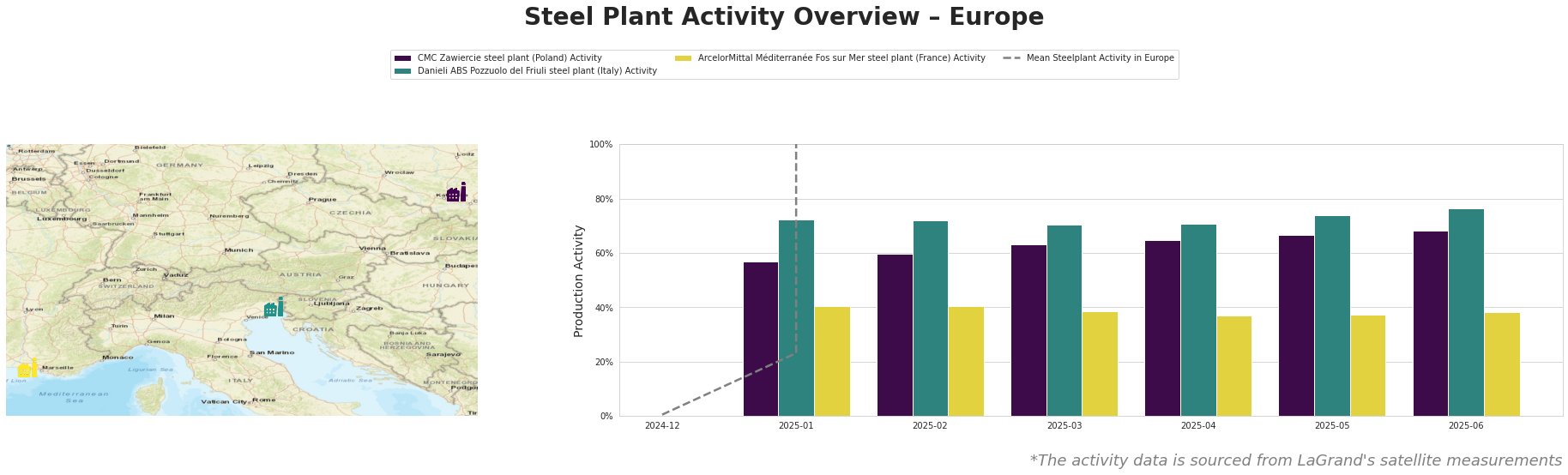

The provided data shows varying activity levels across the observed plants. The mean steel plant activity in Europe shows a high fluctuation, whereas the individual plants show a steady increase. It is important to note, that the numbers are not comparable due to the large difference in values. The CMC Zawiercie steel plant in Poland, an EAF-based producer with a capacity of 1.7 million tonnes, consistently operated above the initial mean activity level for Europe, reaching 68% in June 2025. Danieli ABS Pozzuolo del Friuli in Italy, also an EAF-based plant with a capacity of 1.1 million tonnes, similarly shows a steady increase up to 76% in June 2025. ArcelorMittal Méditerranée Fos sur Mer in France, an integrated BF-BOF plant with a 4 million tonne capacity, is operating at much lower activity levels compared to the EAF based plants, remaining below 41%. It is important to note, that no direct link can be established between the described political situation in Germany and the activity rates of any of the selected steel plants.

The CMC Zawiercie steel plant, relying on electric arc furnaces (EAF) for its 1.7 million tonnes of crude steel production, consistently operated at significantly higher activity levels than the European mean throughout the observed period. Activity steadily increased from 57% in January 2025 to 68% in June 2025. There is no observed connection to the German political developments reported in “Liveticker zur Merz-Regierung: Merz: Müssen uns der neuen Wirklichkeit stellen | FAZ”.

Danieli ABS Pozzuolo del Friuli, an EAF-based plant with a 1.1 million tonne capacity, demonstrates similar positive trends, with activity increasing from 72% in January to 76% in June 2025. The plant serves automotive, construction, and energy sectors. Similar to the CMC Zawiercie plant, no direct link to the cited political news can be established.

ArcelorMittal Méditerranée Fos sur Mer, a major integrated steel plant with a 4 million tonne capacity utilizing BF-BOF technology, shows relatively stable activity levels hovering around 37-41% throughout the period. This contrasts with the increasing trends observed at the EAF-based plants. It’s important to note the plant’s announced plans to shut down its two BOF furnaces by 2030. However, no direct relationship between this strategic decision and the German political developments reported in “Liveticker zur Merz-Regierung: Merz: Müssen uns der neuen Wirklichkeit stellen | FAZ” can be established based on the provided information.

Given the political uncertainties highlighted by the FAZ news articles and the disparity in activity trends between integrated (BF-BOF) and EAF-based plants, steel buyers should prioritize the following actions:

- Diversify Sourcing: Reduce reliance on single suppliers, particularly those dependent on specific production technologies. Favor EAF-based producers that show stable or increasing activity.

- Monitor Political Developments: Closely track policy changes and infrastructure spending plans in Germany, as outlined in the FAZ articles. Any shifts in economic policy could impact steel demand.

- Assess ArcelorMittal Méditerranée’s Strategy: Given the planned BOF shutdown at ArcelorMittal Méditerranée Fos sur Mer by 2030, evaluate potential long-term supply chain risks associated with this plant. Initiate discussions with alternative suppliers to mitigate these risks.

- Negotiate Flexible Contracts: Secure contracts with built-in flexibility to adjust order volumes and delivery schedules in response to potential supply disruptions.

- Focus on Short Term Contracts: Given the high uncertainty in the market, choose short-term over long-term contracts, where possible.