From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineDeclining Steel Production in Europe: A 2026 Forecast with Immediate Impacts on Buyers

Germany’s steel industry is facing a severe downturn, marked by a significant drop in production levels as reported in the articles “German steel production falls to its lowest level since 2009“ and “Germany sees another year of declining steel production“. The decline in activity is corroborated by satellite observations showing sharp decreases in plant operations, notably with a troubling persistence of low capacity utilization below 70%.

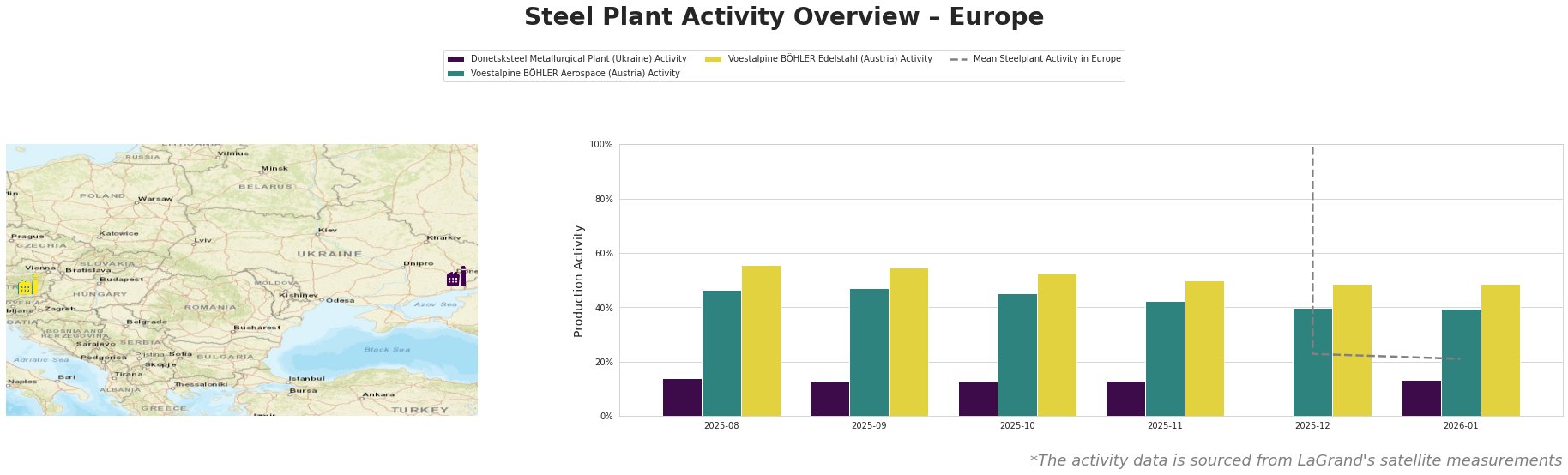

Across the observed European plants, a notable deterioration in activity is alarming. The mean steel plant activity has plummeted, particularly in December 2025 where it reached a mere 23%. The Donetsksteel Metallurgical Plant has also stagnated at 13% through the latter months without significant improvement. In contrast, Voestalpine BÖHLER Aerospace and Voestalpine BÖHLER Edelstahl show only mild declines but still operate far below optimal capacity, reinforcing the notion of market weakness.

The Donetsksteel Metallurgical Plant, observed at a stark 13% activity level in the last months of 2025, has been deeply affected by ongoing geopolitical tensions and lack of operational clarity. No direct connection can be established between its activity and the cited news articles, indicating external factors influencing its downturn.

Voestalpine BÖHLER Aerospace has maintained activity levels around 40-47%, suggesting some relative stability compared to its peers despite underlying market pressures. The plant’s operations have been partly if not directly influenced by the broader German production statistics reflecting weakened demand in the region. Although there’s no specific article correlating these numbers, the general industry atmosphere of negative sentiment affects prospective orders.

Similarly, Voestalpine BÖHLER Edelstahl has also seen a decline to about 49%, paralleling the broader narrative in Germany. The production cuts across the sector—especially the oxygen-route steel production decrease reported in “Germany reduced steel production by 8.6% y/y in 2025“—are suggestive of a supply-demand imbalance that affects procurement decisions.

Market Implications:

– Immediate supply disruptions are likely as Germany’s steel output continues to fall, with the latest 2025 figures falling below levels of past economic crises. Steel buyers should prepare for potential shortages and increased prices in 2026.

– Buyers should initiate procurement strategies promptly, focusing on securing steel from stable suppliers like Voestalpine BÖHLER, while considering the current demand slumps within Germany that could lead to sudden market shift and unexpected price hikes. Adopting a proactive replenishment approach might mitigate risks associated with forthcoming elevated import pressures from outside the EU, as emphasized in “Germany sees another year of declining steel production”.

In conclusion, an action-oriented approach based on thoroughly analyzing market trends and satellite data can help navigate this very negative sentiment environment, addressing immediate steel supply challenges in Europe.