From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineDeclining Production and Inventory Challenges: Germany’s Steel Market Outlook

Germany’s steel market is currently experiencing a negative sentiment driven by significant decreases in crude steel production and inventory levels. As detailed in German crude steel output down 12.5 percent in Q1, the crude steel output for the first quarter of 2023 fell 12.5% year-on-year, totaling 8.50 million metric tons. This aligns closely with the reported decline in activity observed at various steel plants, illustrating a pronounced downturn in production capabilities.

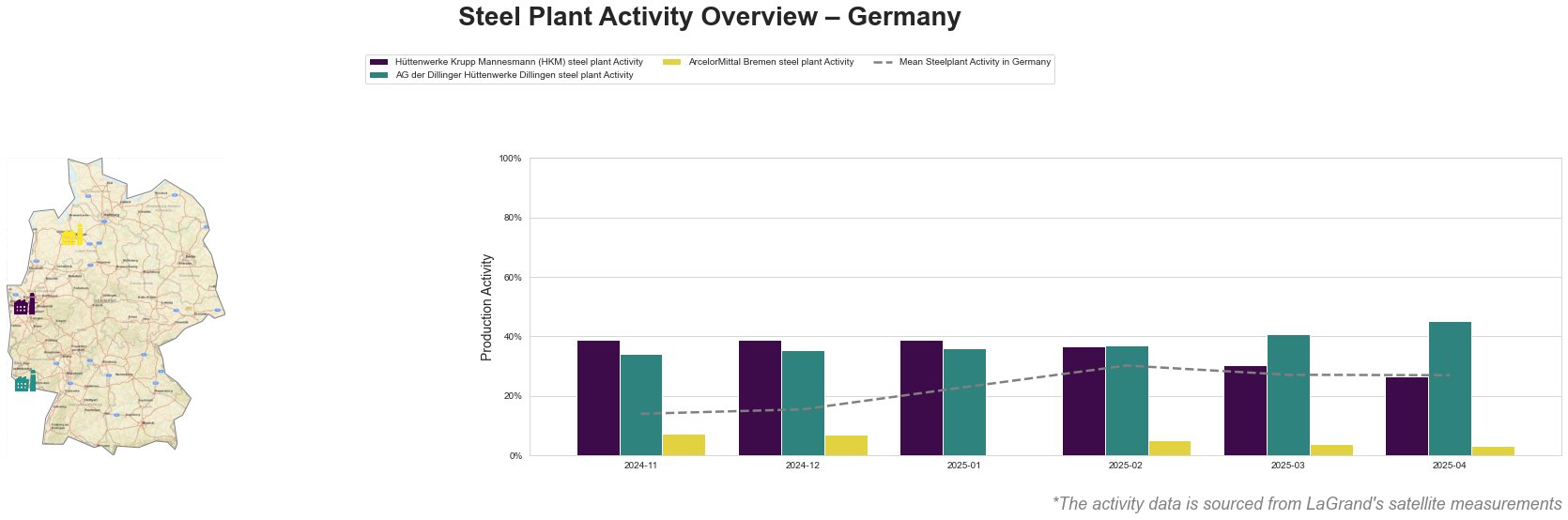

Measured Activity Overview

Activity levels have seen notable declines, particularly in April 2025, where the mean activity across steel plants remained stagnant at 27.0%. HKM showed a decrease from 39.0% to 27.0%, while the Dillinger plant improved slightly to 45%. In contrast, the Bremen facility plunged to a mere 3.0%. The drop in production aligns with trends from WV Stahl struggles to foresee German production stabilisation, highlighting a persistent inability to stabilize national production levels.

Plant Insights

Hüttenwerke Krupp Mannesmann (HKM) saw its activity decrease from 39.0% to 27.0% during this period, reflecting reduced production output coinciding with the decline of crude steel production noted in German crude steel output down 12.5 percent in Q1. This integrated steel plant mainly produces crude steel and semi-finished products, relying on conventional processes which are currently hampered by raw material shortages.

AG der Dillinger Hüttenwerke Dillingen experienced a modest increase to 45% from 41.0% activity levels, which does not strongly correlate with the broader negative trends emphasized in the latest news reports. The specialized outputs in heavy-plate production indicate resilience in specific market sectors, despite the overall downturn highlighted by WV Stahl struggles to foresee German production stabilisation.

The ArcelorMittal Bremen facility, however, showcases the sharpest decline from 4.0% to 3.0%, mirroring the broader downturn in crude steel production (down 12.5% as per German crude steel output down 12.5 percent in Q1). The reliance on hot-rolled coil production underscores the vulnerability of this plant amid fluctuating demand and price pressures.

Evaluated Market Implications

The continued declines in steel production across Germany, particularly affecting the Bremen and HKM plants, pose significant risks of supply disruptions. Buyers should prepare for potential shortages, especially in flat rolled products that Bremen specializes in. It is critical to re-evaluate dependency on these sources and consider diversifying procurement strategies.

Given the recent increase in steel prices for hot-rolled coils, now at EUR 655 per metric ton, as reported in Stockholding: German steel sales rise 5.6% in March as stocks fall, buyers are advised to lock in contracts at current pricing levels to mitigate future volatility. Immediate procurement actions should focus on securing sources from the Dillinger plant, which, despite industry-wide challenges, appears to have a relative stability and resilience compared to others.

In light of the substantial inventory drops indicated in March, companies should consider escalating their procurement efforts to build reserves while the market is still able to supply inventory at current rate levels. Conducting rapid assessments of supplier reliability amid these turbulent conditions will be essential for maintaining operational continuity.