From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineDeclining Activity Trends at Mannesmann Line Pipe GmbH: Implications for Steel Supply

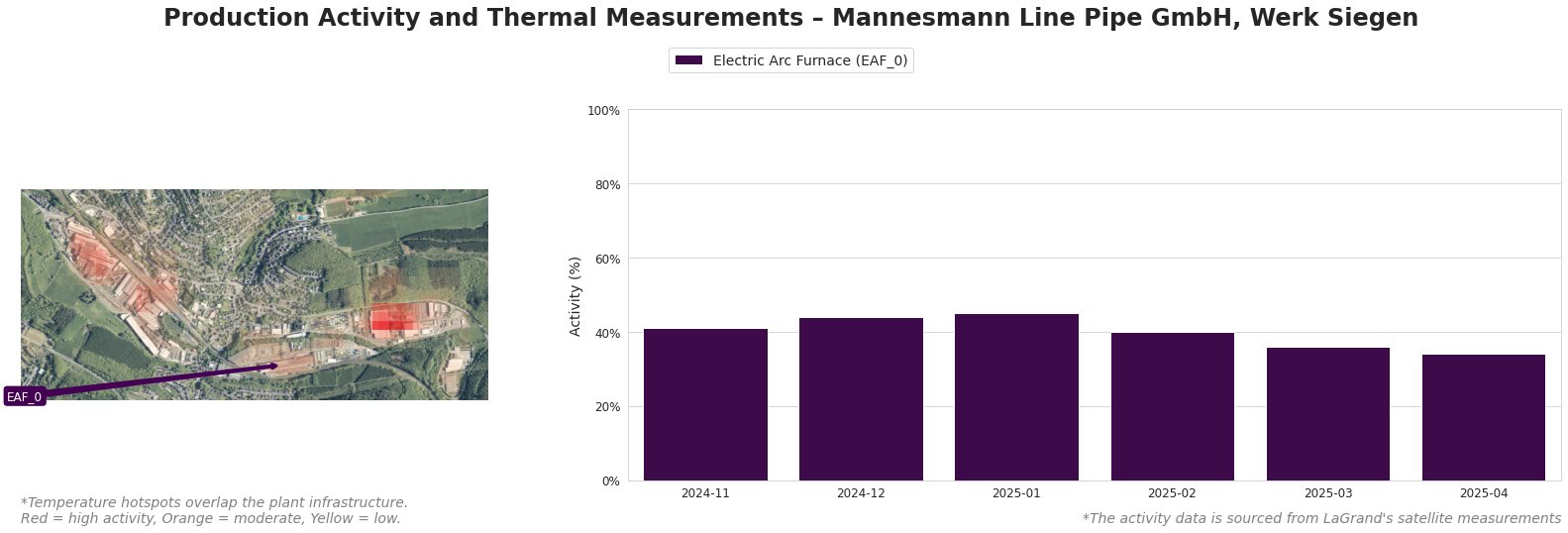

Introduction: Mannesmann Line Pipe GmbH, located in Nordrhein-Westfalen, Germany, specializes in the production of steel pipes primarily through Electric Arc Furnace (EAF) technology. The plant, part of the Mannesmann Group, faces significant operational challenges amid a broader trend of declining steel production in Germany.

Recent data show a notable decrease in thermal activity at the plant, with an overall activity change of -8.13%, indicating a contraction in production capabilities. Output levels are at risk as operational patterns reflect sustained drops, which could impact supply chains.

Thermal Activity Over Time

The plant experienced a peak operational level of 45% in January 2025, but has since seen a steady decline to 34% by April 2025. This trend corresponds with industry-wide challenges, including a 12.5% reduction in German crude steel production during the first quarter of 2025, as reported in German crude steel production decreased by 12.5% in the first quarter. Such a decline aligns with observed difficulties in stabilizing production, as discussed in WV Stahl struggles to foresee German production stabilisation.

Market Implications

The observed decline in thermal activity at Mannesmann Line Pipe GmbH suggests potential bottlenecks for steel buyers and market analysts, particularly amid existing challenges in the German steel sector. As steel sales reportedly increased by 5.6% in March 2025 despite falling inventories, according to Stockholding: German steel sales rise 5.6% in March as stocks fall, the current state of production may lead to further price increases due to tighter supply conditions.

In light of trade disruptions highlighted in ArcelorMittal: Trade disruptions threaten projected demand growth, the decrease in activity at Mannesmann adds to the complexities facing steel procurement, underscoring the need for strategic supply chain management. Overall, the trends observed indicate that buyers should prepare for potential supply constraints and price volatility in the near future.