From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel: Output Dips Signal Shift Amid Export Surge – Procurement Strategies

China’s steel sector is showing mixed signals as production cuts coincide with rising semi-finished steel exports, requiring careful navigation for buyers. The analysis is driven by reports of declining steel production as highlighted in “China cuts steel production to 73 million tons in September” and increased exports as mentioned in “China’s semi-finished steel exports rise 215.43% in January – September 2025“. While the former points to weakening demand and supply adjustments, the latter suggests a strategic shift in the market. Satellite data, however, does not show an immediate and direct correlation with production cuts at the selected steel plants in September.

Measured Activity Overview

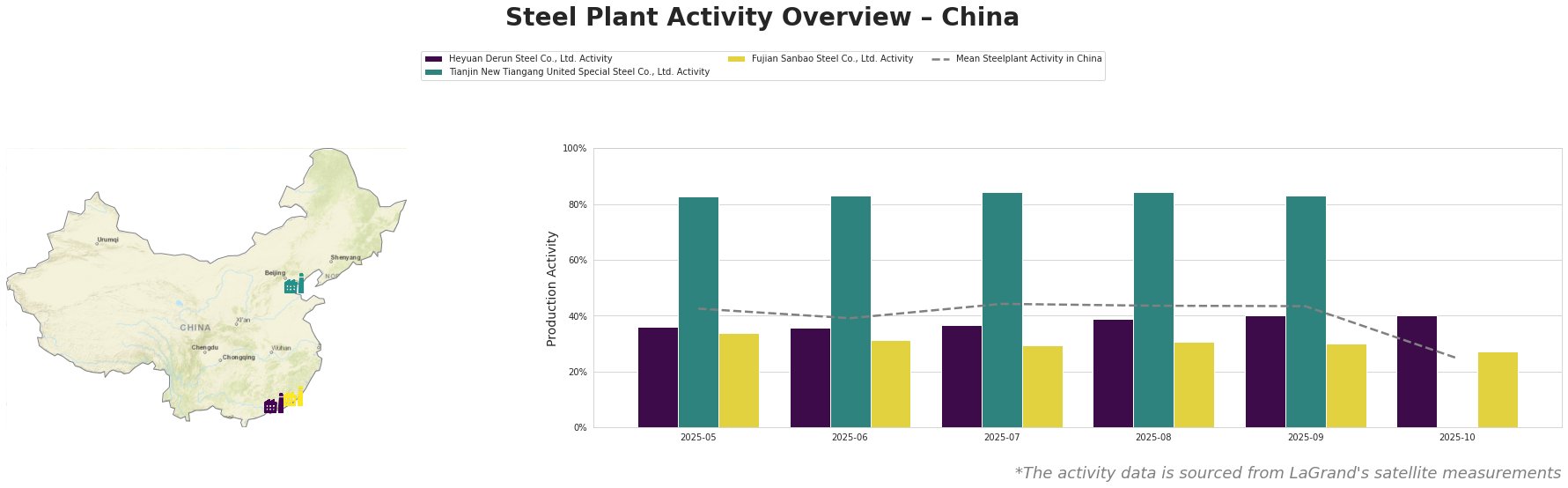

The mean steel plant activity in China fluctuated between 39% and 44% from May to September 2025, then dropped significantly to 25% in October. Tianjin New Tiangang United Special Steel Co., Ltd. consistently operated at high activity levels (83-84%) during May-September, significantly above the mean. Heyuan Derun Steel Co., Ltd. Activity and Fujian Sanbao Steel Co., Ltd. Activity remained below the mean. There are no measured activity levels for Tianjin New Tiangang United Special Steel Co., Ltd. for October.

Heyuan Derun Steel Co., Ltd.

Heyuan Derun Steel, located in Guangdong, operates exclusively with EAF technology, possessing a crude steel capacity of 1.2 million tons, focusing on hot-rolled rebar and billets. Its activity levels have shown a slight upward trend from 36% in May to 40% in September and remained at 40% in October, in contrast to the general downturn described in “China cuts steel production to 73 million tons in September“. No direct connection can be established between observed activity and national trends based on the provided news.

Tianjin New Tiangang United Special Steel Co., Ltd.

Tianjin New Tiangang United Special Steel, based in Tianjin, utilizes integrated BF-BOF processes with a crude steel capacity of 4.5 million tons, specializing in angle steel and continuous casting billets. The plant operated at a consistently high level (83-84%) from May to September, significantly exceeding the national average. As an integrated steel plant, it is less flexible to respond to short-term market fluctuations than EAF plants. No direct connection can be established between observed activity and national trends based on the provided news as there is no October data available.

Fujian Sanbao Steel Co., Ltd.

Fujian Sanbao Steel, situated in Fujian, has a crude steel capacity of 4.62 million tons, using both BF-BOF and EAF processes. The plant’s activity was consistently below the mean from May to September, showing a small fluctuation. In October, there was a slight decrease. The plant produces a diverse range of products, including corrosion-resistant hot-rolled coils and rebars. The overall decrease in activity is consistent with the reported output reduction as mentioned in “China’s crude steel output totals 73.49 million mt in Sept, down 2.9% in Jan-Sept 2025“, which attributes output decreases to seasonal holiday patterns and reduced demand.

Evaluated Market Implications

The data suggests a divergence in the Chinese steel market: While overall production is down (according to “China’s Crude Steel Output Falls by 2.9% in January–September 2025“), exports are surging (according to “China’s semi-finished steel exports rise 215.43% in January – September 2025“). The satellite observations reveal distinct activity patterns among steel plants, with some operating above average and others below.

-

Potential Supply Disruptions: The observed drop in national average activity in October suggests tightening domestic supply. Fujian Sanbao Steel Co., Ltd.’s reduced activity aligns with this trend.

-

Recommended Procurement Actions:

- For buyers sourcing semi-finished steel: Given the surge in exports reported in “China’s semi-finished steel exports rise 215.43% in January – September 2025,” be prepared for potential price increases and longer lead times. Consider diversifying suppliers to mitigate risks.

- For buyers relying on domestic supply in China: Closely monitor the output of plants like Fujian Sanbao Steel.

- For all buyers: Consider the potential impact of reduced iron ore production, as reported in “China reduced iron ore production by 3.8% y/y in January-September“. This could impact steel prices in the medium term.