From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market Update: Rising Activity & Global Demand Forecast Sparks Opportunities for Buyers

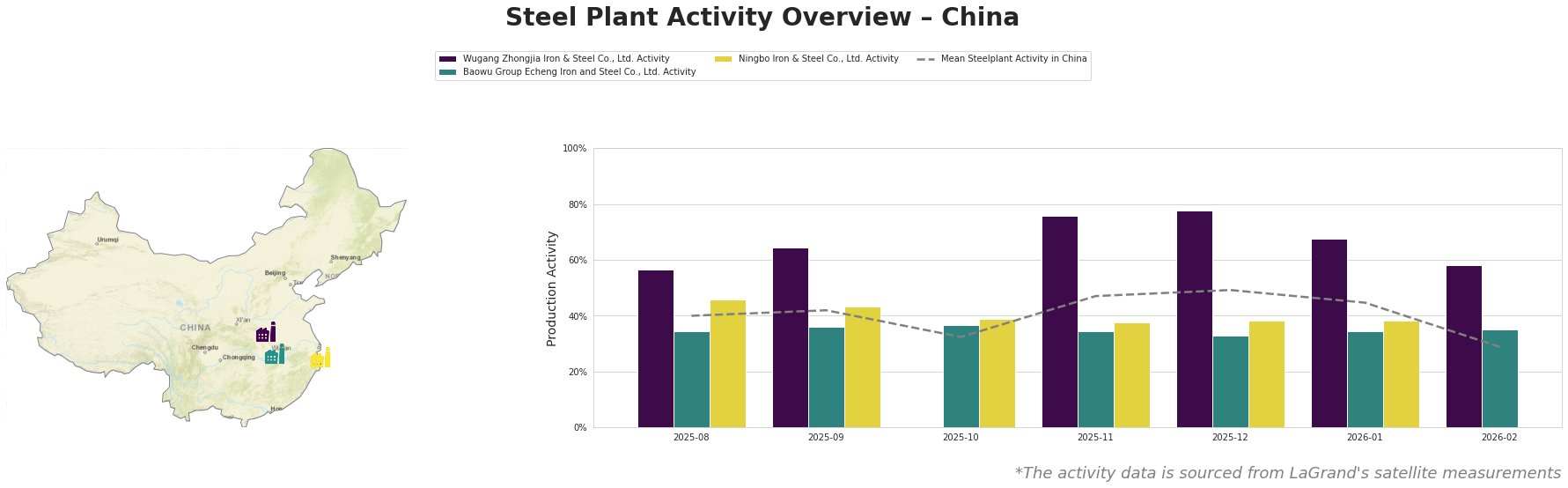

China’s steel market demonstrates a very positive outlook as satellite data reveals notable activity trends across several key plants, coinciding with recent forecasts from ArcelorMittal. The articles “ArcelorMittal forecasts rebounding demand, eyes higher sales globally” and “ArcelorMittal expects tariffs, CBAM to restore production levels and profit in 2026” highlight increased operational expectations driven by demand recovery, global supply shifts, and new trade measures, which collectively correlate with heightened activity in Chinese steel plants.

Wugang Zhongjia Iron & Steel Co., Ltd. in Henan exhibited a robust peak of 78.0% in December 2025, significantly contributing to its overall performance amid the global positive sentiment articulated in “ArcelorMittal anticipates a recovery in demand and expects sales growth worldwide“. This increase indicates strong output capabilities, likely influenced by regional demand. In contrast, Baowu Group Echeng Iron and Steel Co. displayed a low of 34.0% in both November and December, potentially illustrating operational challenges, though no direct linkage to the news articles can be established.

Ningbo Iron & Steel Co. maintained a stable range but peaked at 46.0% in August and decreased to 38.0% in December. The mean activity level shows fluctuations but suggests resilient operations. The collective rise in activity levels, particularly at Wugang, aligns with ArcelorMittal’s forecast of increasing demand, suggesting that procurement trends may favor higher output capacities in the coming months.

Evaluated Market Implications:

The marked variations in plant activity signal potential supply disruptions, particularly with Baowu Group’s lagging output, which could affect availability in the Hubei region. Steel buyers should closely monitor these activity trends and consider diversifying procurement sources towards Wugang, which exhibits higher productivity and resilience in operations. The anticipated tariff impacts discussed in the cited articles may further reshape import dynamics, urging buyers to plan ahead for potential price adjustments tied to international market shifts.