From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market Signals Strong Growth: Rebar Prices Surge Amid Rising Exports & Plant Activity

China’s steel market exhibits a very positive outlook driven by rising prices and increased export activity. The “NBS: Local Chinese rebar prices up 4.5 percent in late July 2025” article directly correlates with observed increases in activity at several steel plants. While “Stocks of main finished steel products in China up 1.3 percent in late July 2025” indicates rising inventory levels, this rise is concentrated in specific products and overall may reflect a shift towards higher export demand. These trends occur concurrently with “China increased steel exports by 1.6% m/m in July,” suggesting a robust export market is supporting domestic steel production.

Observed plant activity levels:

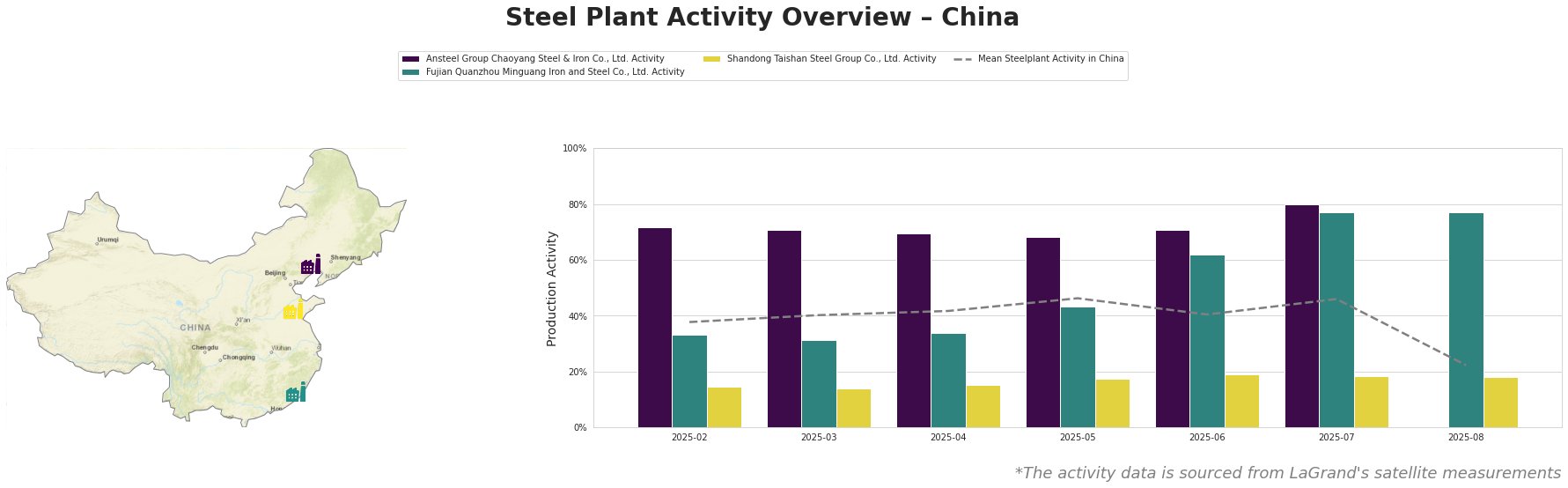

The mean steel plant activity in China saw consistent growth from February to May, peaking at 46% in May and July, before dropping significantly to 22% in August. Ansteel Group Chaoyang Steel & Iron Co., Ltd. consistently operated well above the national average until August, exhibiting peak activity in July at 80%, but data is missing for August. Fujian Quanzhou Minguang Iron and Steel Co., Ltd. also shows a strong upward trend, reaching 77% in July and maintaining that level in August, far exceeding the national average in August, contrasting the drop. Shandong Taishan Steel Group Co., Ltd. remained consistently below the national average, fluctuating narrowly between 14% and 19% throughout the observed period. The sharp decrease in the mean activity level in August appears not to correlate with explicit information in the provided news articles.

Ansteel Group Chaoyang Steel & Iron Co., Ltd., located in Liaoning, has a crude steel capacity of 2.1 million tonnes utilizing basic oxygen furnaces (BOF) within an integrated BF production process. The plant is ResponsibleSteel certified and produces finished rolled steel products like steel plate and steel pipe. Observed activity levels consistently exceeded the national average, peaking at 80% in July. This increased activity could be linked to the rising rebar prices reported in “NBS: Local Chinese rebar prices up 4.5 percent in late July 2025” as they produce steel plate and pipe, though a direct link is speculative. No data exists for August, so no further conclusions can be drawn.

Fujian Quanzhou Minguang Iron and Steel Co., Ltd., based in Fujian, boasts a crude steel capacity of 2.55 million tonnes, also utilizing BOF within an integrated BF process. This ResponsibleSteel certified plant produces finished rolled products, including round bar, high-speed bar, coiled rebar, and wire rod. The plant displayed a marked increase in activity, reaching 77% in both July and August, significantly above the national average in August. Considering the product mix and the “NBS: Local Chinese rebar prices up 4.5 percent in late July 2025” article, the activity increase can be plausibly linked to higher rebar production to capitalize on rising prices.

Shandong Taishan Steel Group Co., Ltd., situated in Shandong, has a crude steel capacity of 5 million tonnes, employing both BOF and EAF within an integrated BF production route. The plant, ResponsibleSteel certified, manufactures hot-rolled coil, cold-rolled coil, and stainless steel. Activity at Shandong Taishan Steel Group Co., Ltd. remained consistently low throughout the observed period, showing no significant changes or direct correlation with the named news articles.

Given the rising rebar prices, increased steel exports, and the elevated activity at Fujian Quanzhou Minguang Iron and Steel Co., Ltd. (producing rebar), steel buyers should anticipate potential upward pressure on rebar prices, especially in regions supplied by this plant. Recommendation: For buyers needing rebar, secure contracts promptly to mitigate price increases. The drop in the national average is not explained by the data. Buyers should closely monitor regional production changes and consider diversifying supply sources.