From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market Resilient Amidst AI Chip Demand & Nvidia’s China Strategy Shifts

China’s steel market exhibits resilience despite US export restrictions impacting Nvidia, as AI infrastructure demand buoys activity. Recent satellite data indicates stable to increasing steel plant activity. Nvidia’s strategies in China, as reported in “Nvidia-Umsatz wächst weiter rasant — trotz Exportbeschränkungen nach China” and “The 3 biggest takeaways from Nvidia’s Q1 earnings call: China, China, China“, highlight the interplay between technology sector developments and the broader industrial landscape. However, no direct correlation between these news events and specific steel plant activity shifts could be established based on the available information.

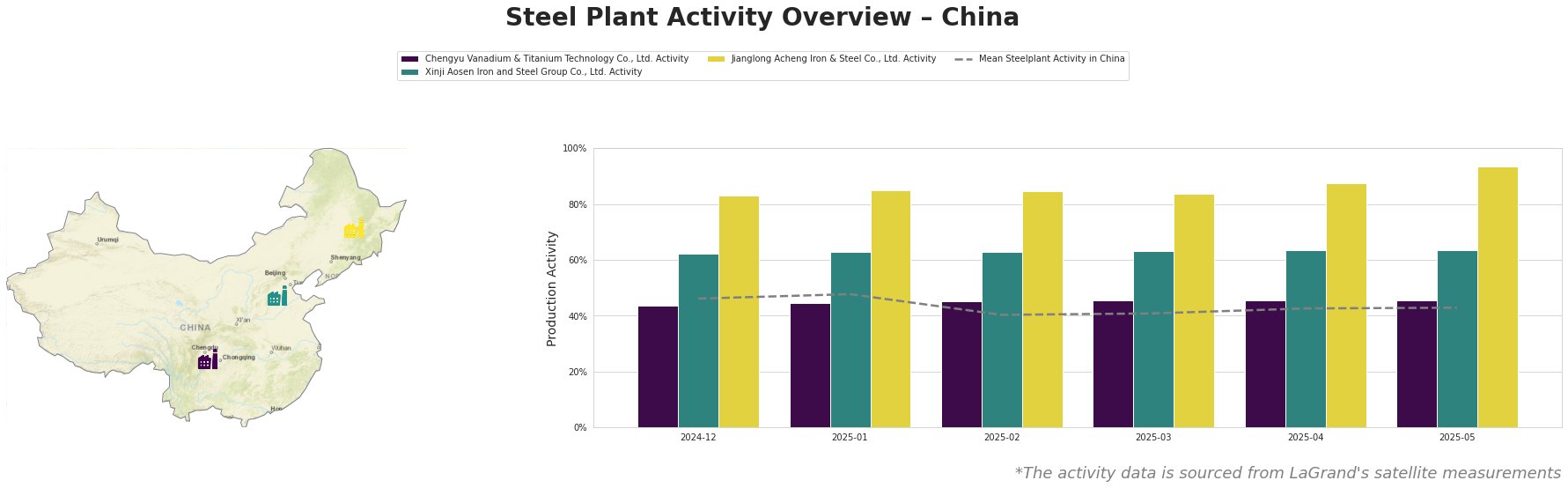

Here’s an overview of recent monthly activity trends:

Activity across all plants averaged between 40% and 48% during the observed period, with May showing 43%.

Chengyu Vanadium & Titanium Technology Co., Ltd., based in Sichuan, operates an integrated BF-BOF production route with a crude steel capacity of 6 million tonnes. The plant’s activity remained relatively stable between 44% and 46% during the observed period. While “Nvidia: Neuer China‑Chip kommt – Insider verraten Details” and other news articles discuss technology developments, no direct connection to Chengyu’s activity level could be established.

Xinji Aosen Iron and Steel Group Co., Ltd., located in Hebei, also utilizes an integrated BF-BOF route, with a crude steel capacity of 3.6 million tonnes. Its activity has been consistently above the mean, hovering around 62-64%, indicating robust output of semi-finished and finished rolled products. No specific link between the Nvidia-related news and Xinji Aosen’s operations could be determined from the provided data.

Jianglong Acheng Iron & Steel Co., Ltd., in Heilongjiang, shows the highest activity level among the selected plants, consistently above the mean, increasing from 83% in December 2024 to 94% in May 2025. This plant produces hot-rolled and coated steel products for automotive and energy sectors. The surge in activity, although significant, shows no clear link with the provided news articles on Nvidia’s activities.

Despite Nvidia facing challenges due to US export restrictions as described in “Nvidia: Umsatz steigt um 69%” and analysts remaining bullish as per “‘Full hit from China’: Analysts are staying bullish on Nvidia ahead of earnings, but tariffs loom large“, no immediate supply disruptions are directly observable in the provided steel plant activity data. Given the strong activity at Jianglong Acheng Iron & Steel Co., Ltd. and its focus on automotive and energy sectors, steel buyers should secure contracts early to avoid potential price increases stemming from high demand. No steel supply disruptions are expected in the regions of Chengyu Vanadium & Titanium Technology Co., Ltd. and Xinji Aosen Iron and Steel Group Co., Ltd.