From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market Optimistic Despite Activity Dip: Renewables Surge Drives Demand

China’s steel market shows continued positive sentiment driven by the renewable energy sector, although recent satellite data indicates a decrease in overall steel plant activity. The IEA report, “IEA-Bericht: Energiewende macht weltweit Fortschritte – reicht das für die Klimaziele?,” highlights China’s leading role in renewable energy growth, suggesting a strong demand for steel in infrastructure and manufacturing. A relationship between increased demand and steel-plant activity could not be explicitly established. The “Renewables overtook coal for powergen in 1H: Ember“ article indicates a surge in renewable energy outpacing coal, implying a growing need for steel in the renewable energy sector. A direct relationship between this renewable-energy steel demand and steel plant activity has not been explicitly established using the provided data.

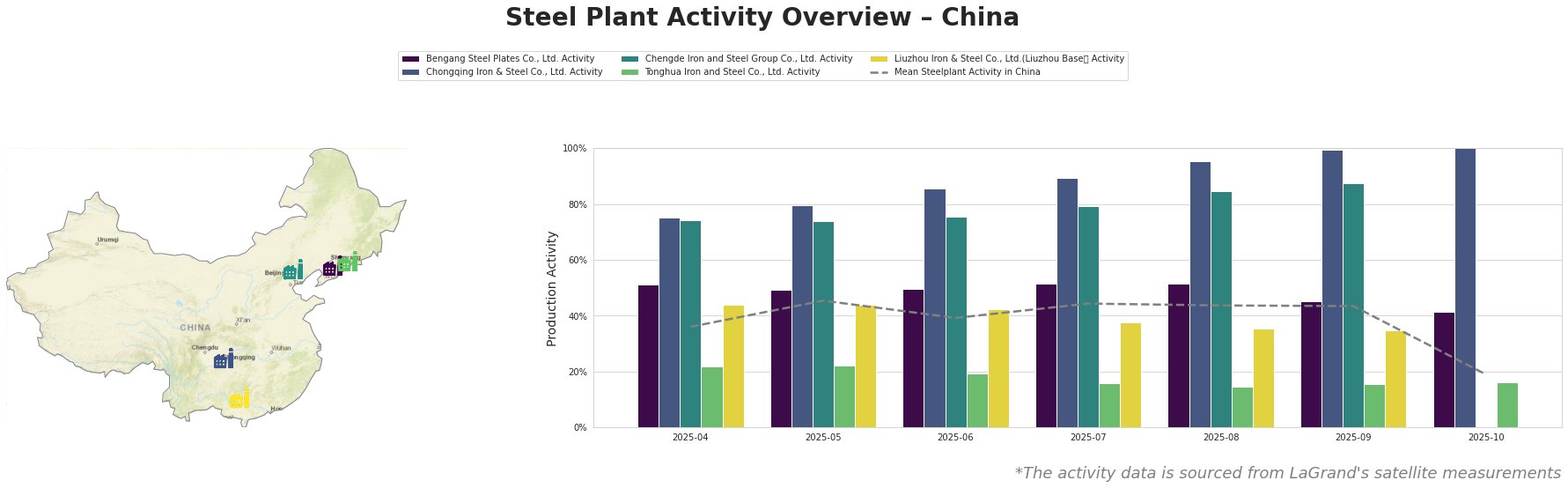

The mean steel plant activity in China fluctuated between 36% and 45% from April to September 2025, peaking in May, before dropping sharply to 19% in October. Chongqing Iron & Steel Co., Ltd. showed a consistent increase in activity, reaching its all-time high of 100% in September and October. Chengde Iron and Steel Group Co., Ltd. also showed high activity, peaking at 88% in September before data became unavailable. Tonghua Iron and Steel Co., Ltd. maintained low activity throughout the period. Bengang Steel Plates Co., Ltd. Activity remained near the overall Chinese mean, peaking at 52% in July and August before dropping to 41% in October. Liuzhou Iron & Steel Co., Ltd.(Liuzhou Base) Activity showed a continuous decline from 44% in April/May to 35% in August/September, before data became unavailable.

Bengang Steel Plates Co., Ltd., located in Liaoning, is an integrated steel plant with a crude steel capacity of 12.8 million tonnes. Its activity peaked in July/August 2025 at 52% before dropping to 41% in October, remaining above the national average. This plant focuses on finished rolled products, including automotive and home appliance plates, aligning with the increased manufacturing activity potentially driven by the renewable energy sector as stated in “Renewables overtook coal for powergen in 1H: Ember.” The decrease in activity in October cannot be explicitly linked to the news articles provided.

Chongqing Iron & Steel Co., Ltd., an integrated steel plant in Chongqing with an 8.4 million tonne capacity, demonstrated a consistent rise in activity, reaching 100% in September and October. The company produces semi-finished and finished rolled products like billets, plates, and steel bars, catering to various end-user sectors. This increase may be driven by infrastructure demands related to renewable energy projects mentioned in “IEA-Bericht: Energiewende macht weltweit Fortschritte – reicht das für die Klimaziele?.”

Chengde Iron and Steel Group Co., Ltd., based in Hebei, has an 8 million tonne capacity and produces finished rolled products. The company’s activity showed a peak in September at 88% before data became unavailable. This aligns with the broader growth in steel demand, though a direct link to specific projects or news events cannot be established.

Tonghua Iron and Steel Co., Ltd. in Jilin, an integrated plant with a 4.6 million tonne capacity, consistently showed low activity. It produces plates, building materials, and profiles. No explicit connection between its low activity and any specific event in the provided news could be established.

Liuzhou Iron & Steel Co., Ltd. (Liuzhou Base), located in Guangxi, has a 12.5 million tonne capacity and produces finished rolled products. The plant’s activity steadily declined from April to September. This decline may not be related to the growth in renewable energy demand.

The “Imports of green energy products to the EU exceed €14 billion per year” article highlights the EU’s reliance on green energy imports, particularly solar panels, and indicates solar power became the largest electricity source in the EU, surpassing nuclear and wind power for the first time, while coal use decreased. China was the primary solar panel supplier, while India and China supplied most wind turbines. A direct relationship between this renewable-energy steel demand and steel plant activity has not been explicitly established using the provided data.

Based on the observed activity drop in October and the continued rise in renewable energy demand, steel buyers should:

- Monitor price volatility: The recent sharp drop in mean steel plant activity in October 2025 could lead to price increases if demand remains strong due to the “IEA-Bericht: Energiewende macht weltweit Fortschritte – reicht das für die Klimaziele?”.

- Prioritize orders: Steel buyers should prioritize orders from Chongqing Iron & Steel, given its consistent high production activity, to ensure stable supply. The 100% activity level indicates full capacity utilization, but a single plant can be unreliable.

- Diversify suppliers: Given the potential for localized disruptions, consider diversifying steel suppliers beyond the observed plants to mitigate supply chain risks, explicitly justified by the observed activity drop in October 2025.