From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market: Mixed Signals as Exports Persist Amidst Production Declines

China’s steel market presents a complex picture, with “Pressure on steel supplies to China remains despite falling production” and “China’s stainless steel exports up 0.04 percent in January-October 2025” highlighting the ongoing interplay between production cuts and export volumes. While the news articles indicate downward price pressure persists despite production cuts, direct links to specific observed changes in plant activity levels are not immediately apparent, requiring careful analysis of individual plant data. “Stocks of main finished steel products in China down 2.5 percent in mid-Nov 2025” indicates some tightening of domestic supply, though its direct relationship to observed plant activity levels needs further scrutiny.

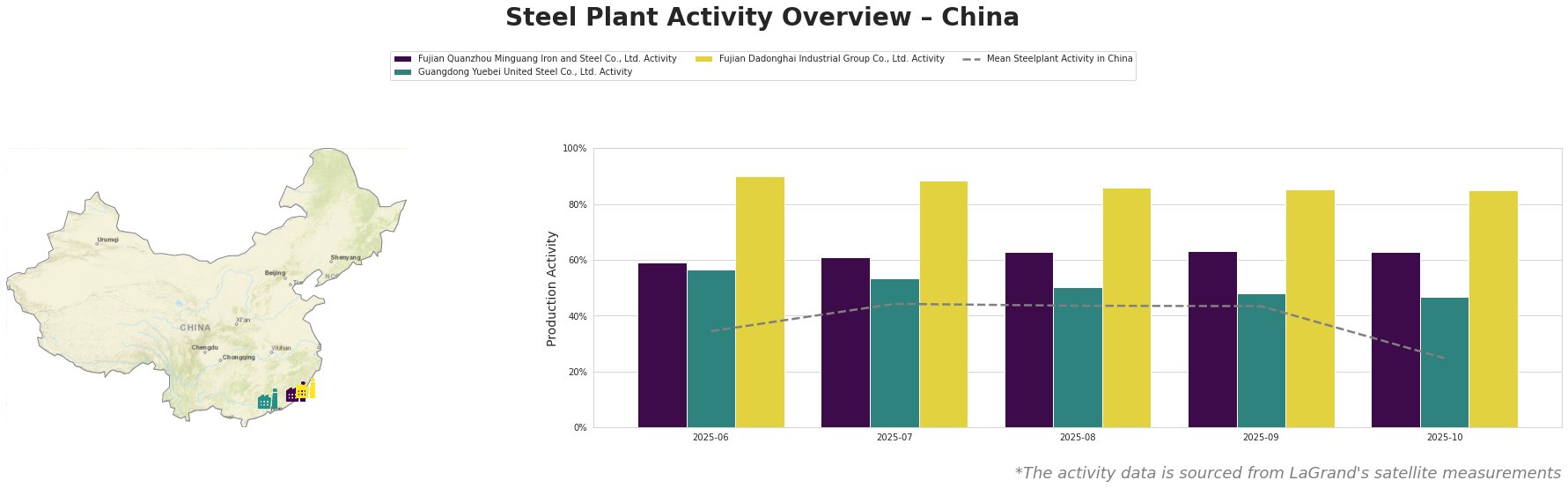

Overall, the mean steel plant activity in China experienced a significant drop in October 2025, falling to 25.0% from 43.0% in September, indicating a potentially substantial production decrease. In contrast, Fujian Quanzhou Minguang Iron and Steel Co., Ltd. maintained a stable activity level of around 60% throughout the observed period. Guangdong Yuebei United Steel Co., Ltd. saw a gradual decline from 57.0% in June to 47.0% in October. Fujian Dadonghai Industrial Group Co., Ltd. exhibited the highest activity levels, consistently above 85%, with a slight decrease from 90.0% in June to 85.0% in October.

Fujian Quanzhou Minguang Iron and Steel Co., Ltd., an integrated BF-based steel plant with a crude steel capacity of 2.55 million tonnes producing round bar, high-speed bar, coiled rebar, and wire rod, showed consistently high activity, peaking at 63% from August-October. This stable performance occurs despite the “Pressure on steel supplies to China remains despite falling production”. There is no clear link between this observation and the news, but its sustained activity compared to the overall market decline is notable.

Guangdong Yuebei United Steel Co., Ltd., an integrated BF/EAF steel plant with a crude steel capacity of 2.0 million tonnes, producing rebar for building and infrastructure, experienced a gradual decline in activity from 57% in June to 47% in October. This trend aligns with the broader production cuts reported in “Pressure on steel supplies to China remains despite falling production,” particularly given the focus on construction-related products, which aligns with mentioned weak domestic demand.

Fujian Dadonghai Industrial Group Co., Ltd., an integrated BF-based steel plant with a crude steel capacity of 2.2 million tonnes producing rebar, maintained a high activity level around 85% throughout the period, despite the general downward trend in Chinese steel production. No direct connection to the provided news articles can be established for its sustained high activity.

The article “China’s medium and heavy steel plate exports up 3.46% in January-October 2025” alongside the “Pressure on steel supplies to China remains despite falling production,” which highlights increased exports even with lower production, suggests the price pressure is not abating. Based on the observed decrease in the average plant activity and the news articles, here are the evaluated market implications:

Potential Supply Disruptions: The substantial drop in average steel plant activity in China, coupled with decreasing inventories (“Stocks of main finished steel products in China down 2.5 percent in mid-Nov 2025”) suggests potential localized supply shortages, especially for products from regions and plants exhibiting the largest activity drops. Guangdong Yuebei United Steel Co., Ltd.’s decreased activity could lead to regional rebar supply constraints.

Recommended Procurement Actions:

* Monitor Guangdong Rebar Prices: Due to the observed activity decline at Guangdong Yuebei United Steel Co., Ltd., closely monitor rebar prices in the Guangdong region. Consider securing supply contracts or exploring alternative suppliers to mitigate potential price increases if supply tightens.

* Assess Fujian Supply Stability: Given the stable activity at Fujian Quanzhou Minguang Iron and Steel Co., Ltd. and Fujian Dadonghai Industrial Group Co., Ltd., assess the availability and pricing of their products (round bar, high-speed bar, coiled rebar, wire rod, and rebar) as potential alternatives to products from regions experiencing greater production cuts.

* Evaluate Export Trends Impact: Analyze the specific impact of “China’s stainless steel exports up 0.04 percent in January-October 2025” and “China’s medium and heavy steel plate exports up 3.46% in January-October 2025” on domestic availability and pricing. Understand how these exports might offset domestic production cuts and influence your procurement strategy.

* Scrutinize inventory reports: Closely monitor the weekly inventory reports to estimate if the plants in production are capable of supplying the domestic demand, or if the need to import from other regions of china is increasing.