From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market Faces Output Dip Amid Falling Coking Coal Costs: An Analysis

China’s steel sector is experiencing a complex interplay of factors, with output adjustments occurring against a backdrop of decreasing raw material costs. According to “CISA mills’ daily crude steel output down 0.5% in mid-June, stocks rise,” crude steel output experienced a slight decline in mid-June, while finished steel inventories increased. The satellite observed plant activity changes can only be linked indirectly, as the activity data covers a longer time span and the article only reports on a short-term trend.

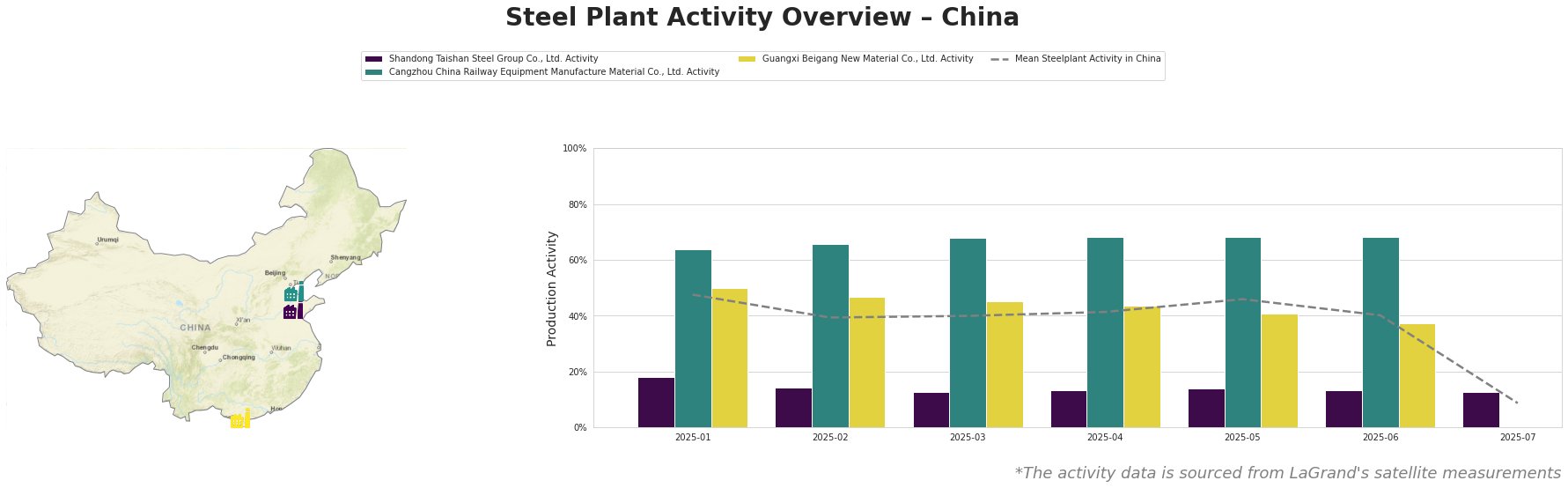

The mean steel plant activity in China shows a declining trend from January to July 2025, with a sharp drop to 9.0% in July. Shandong Taishan Steel Group Co., Ltd. consistently shows lower activity levels compared to the mean, remaining below 20% throughout the period. Cangzhou China Railway Equipment Manufacture Material Co., Ltd. maintained high activity levels, fluctuating around 66-68% until June. Guangxi Beigang New Material Co., Ltd. shows a gradual decline from 50% in January to 37% in June.

Shandong Taishan Steel Group Co., Ltd., an integrated BF steel plant with a crude steel capacity of 5,000 ttpa, has consistently operated at significantly lower activity levels than the national average. Activity remained around 13-14% for most of the observed period, indicating potential operational constraints or strategic production adjustments. No direct connection between these consistently low activity levels and the named news articles can be established.

Cangzhou China Railway Equipment Manufacture Material Co., Ltd., also an integrated BF steel plant, boasts a larger crude steel capacity of 7,500 ttpa. This plant, focused on high-quality carbon and low-alloy hot-rolled coils, maintained consistently high activity levels around 68% until June 2025. A sharp drop in activity is expected for July, though no observed data are available. No direct link to the cited news articles can be established.

Guangxi Beigang New Material Co., Ltd., with a crude steel capacity of 3,400 ttpa using both BF and EAF processes, exhibited a declining trend in activity from January (50%) to June (37%). This decline could reflect adjustments to market demand, particularly given their product diversification including nickel-chromium alloy slab. No direct connection between these declining activity levels and the named news articles can be established.

The decline in coking coal prices, as highlighted in “Asian coking coal prices fell in June amid weak demand” and “CISA: Coking coal purchase costs in China down 32.26% in Jan-May,” could lead to lower production costs for steelmakers. The lower operational tempo, indicated by the satellite imagery may indicate a possible contraction of the market segment in the longer term, while it is more likely that the observed plants are merely adjusting production because of the price developments.

Evaluated Market Implications:

- Potential Supply Disruptions: Given the reduced activity levels at Shandong Taishan Steel Group Co., Ltd. and the general trend of lowered crude steel output by Chinese mills named in the news article “CISA mills’ daily crude steel output down 0.5% in mid-June, stocks rise”, steel buyers should monitor their supply chains closely.

- Recommended Procurement Actions:

- Steel buyers reliant on hot-rolled coils or nickel-chromium alloy slab should diversify their supplier base to mitigate risks associated with reduced production at Guangxi Beigang New Material Co., Ltd..

- Analysts should closely monitor inventory levels and demand fluctuations, as the decline in coking coal prices could incentivize increased production in the long run, potentially impacting price dynamics.