From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market: Construction Slowdown Impacts Production, Exports Remain Strong

China’s steel sector faces headwinds from a struggling real estate market, though exports remain robust. “China’s real estate investments in January-September decreased by 13.9% y/y” highlights a significant contraction in the construction sector, which directly impacts steel demand. The news article “Slight Decline in China’s Rebar Production in the First Nine Months of 2025” confirms that this decreased demand has resulted in lower rebar production, although the decline is only marginal at 0.1%. While these articles suggest a decrease in domestic demand impacting production, we cannot link them to specific plant-level activity changes.

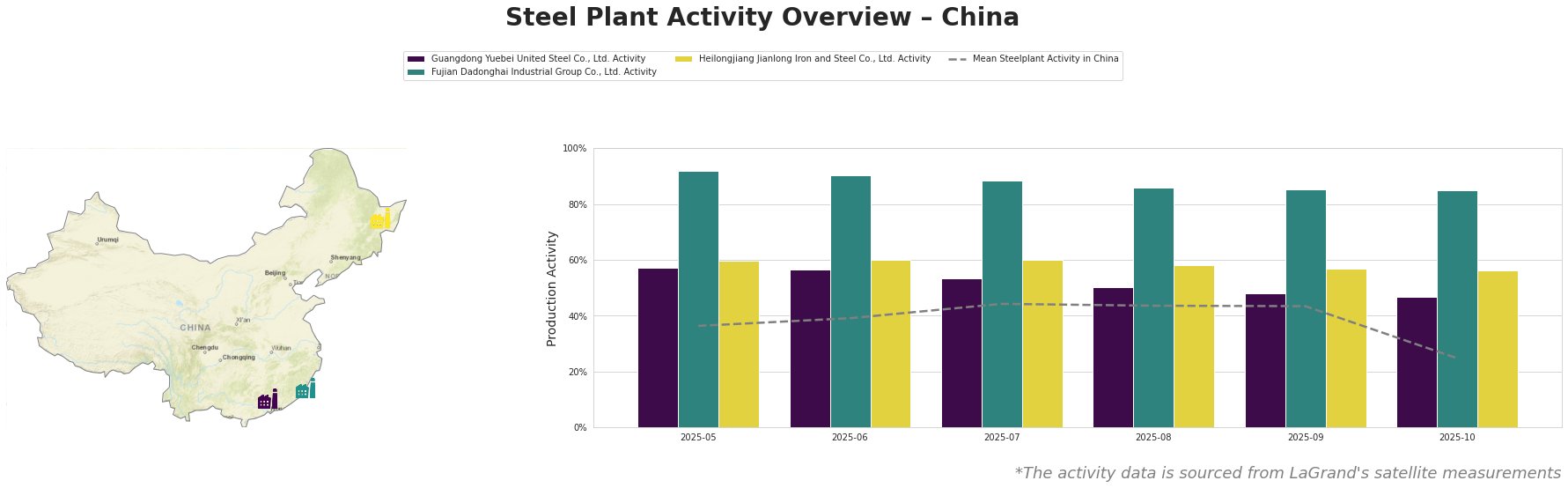

The mean steel plant activity in China shows a significant drop in October, from 43% to 25%, which could reflect broader production cuts. Individual plant activity levels present a mixed picture.

- Guangdong Yuebei United Steel Co., Ltd., an integrated steel plant producing finished rolled products like rebar for the building and infrastructure sectors, saw a gradual decline in activity from 57% in May to 47% in October. While “China’s real estate investments in January-September decreased by 13.9% y/y” indicates a construction slowdown, it is not possible to directly attribute Guangdong Yuebei United Steel Co., Ltd.’s activity decline to this article alone.

- Fujian Dadonghai Industrial Group Co., Ltd., another integrated rebar producer, maintained a high level of activity, hovering around 90% from May to September, with a slight decrease to 85% in October. The consistently high activity level, despite a dip in the mean and the drop in construction investment, may indicate strong export demand or regional factors not captured in the provided news articles.

- Heilongjiang Jianlong Iron and Steel Co., Ltd., an integrated steel plant producing hot-rolled ribbed steel bars, seamless steel tube products, and rebar, experienced a gradual decrease in activity from 60% in May to 56% in October. Similar to Guangdong Yuebei United Steel, a connection between “China’s real estate investments in January-September decreased by 13.9% y/y” and this plant’s activity cannot be directly established based on the given information.

The article “China reduced iron ore production by 3.8% y/y in January-September” indicates a government push to reduce reliance on heavy industry. While this suggests potential supply-side constraints, the high import levels reported in the same article mitigate immediate concerns. This trend is confirmed by the article “China’s iron ore output down 3.8% in January-September 2025“

Evaluated Market Implications:

While domestic demand is weakening, as demonstrated by “China’s real estate investments in January-September decreased by 13.9% y/y”, steel exports remain a significant factor. The stable activity at Fujian Dadonghai Industrial Group Co., Ltd. suggests that export demand may be offsetting domestic weakness. For steel buyers and analysts, these factors result in concrete actions:

- Procurement Recommendation: Given the gradual activity decline at Guangdong Yuebei United Steel Co., Ltd. and Heilongjiang Jianlong Iron and Steel Co., Ltd., procurement professionals sourcing rebar in those regions should diversify their suppliers to mitigate potential supply disruptions.

- Procurement Recommendation: The high and stable activity at Fujian Dadonghai Industrial Group Co., Ltd. suggests a reliable supply source. Buyers should assess pricing and availability from this supplier, bearing in mind that export demand may affect their ability to fulfill domestic orders.

- Procurement Recommendation: As pig iron production declines globally (Global pig iron production fell to a two-year low in September), but Chinese exports are holding due to lowered production. Securing long-term supply contracts, specifically for pig iron or rebar made from pig iron, should be seen as a reasonable approach.