From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market: Chip Sector Woes Signal Potential Downturn Despite Stable Production

China’s steel market faces potential headwinds due to challenges in the semiconductor industry, impacting related demand. While some plants show stable or increasing activity, uncertainties surrounding key sectors raise concerns. The “Synopsys set to wipe out 2025 gains as shares tank on China business woes” article highlights reduced spending due to restrictions and scaled-back plans by Intel, potentially affecting steel demand for related construction or equipment upgrades. Despite this, there is no direct indication in the given news that the activity of China’s steel plants is affected.

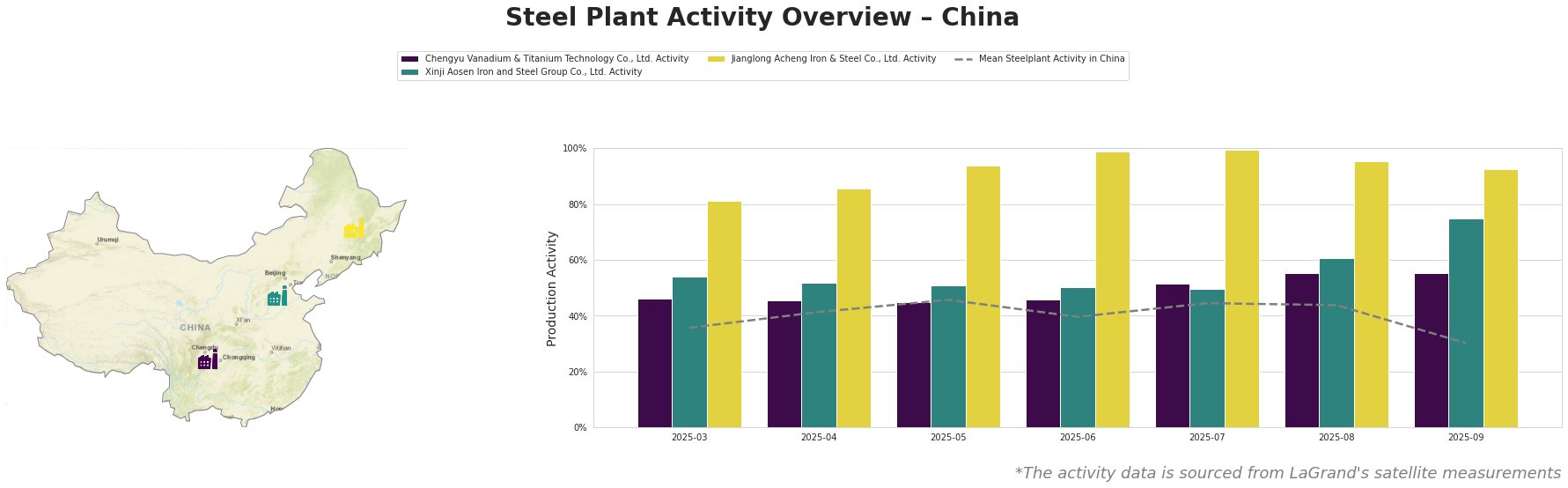

Recent monthly activity trends for selected steel plants in China are shown below:

The mean steel plant activity in China decreased significantly in September to 30% after being relatively stable around 40% to 46% during the previous months.

Chengyu Vanadium & Titanium Technology Co., Ltd., located in Sichuan, is an integrated steel plant with a 6000ktpa BOF crude steel capacity, specializing in vanadium-containing hot-rolled ribbed steel bars and steel wire rods. The plant’s activity has seen a steady increase, reaching 55% in August and September, a significant rise from 46% in March and April. There is no explicitly established connection between this increase and the provided news articles.

Xinji Aosen Iron and Steel Group Co., Ltd., situated in Hebei, is another integrated steel plant, producing billets, slabs, high-speed wire rods, and hot-rolled strip products with a 3600ktpa BOF crude steel capacity. Its activity has seen a steady increase over the months to 75% in September after being around 50% in the previous months. Again, no direct connection to the provided news can be established.

Jianglong Acheng Iron & Steel Co., Ltd., based in Heilongjiang, focuses on hot-rolled and coated steel products for automotive, energy, and tools & machinery. Its BOF-based production has a crude steel capacity of 1100ktpa. The plant has been operating at very high activity levels, consistently above 80% and reaching 100% in July. September’s activity remained high at 92%. No direct links between this activity and the provided news articles can be explicitly stated.

The “Analyst surprisingly cuts Nvidia stock target amid a growing threat” and “China schlägt zu: Schock‑Vorwurf gegen Nvidia” articles, indicating potential headwinds for Nvidia due to lowered stock targets and antitrust investigations in China, may indirectly impact steel demand, especially for plants like Jianglong Acheng Iron & Steel Co., Ltd. if the end-user sectors it serves are indirectly affected by the semiconductor industry slowdown.

Evaluated Market Implications:

The “Synopsys set to wipe out 2025 gains as shares tank on China business woes” article suggests potential disruptions in the semiconductor sector. While no immediate supply disruptions in the steel market are apparent, the decline in overall Chinese steel plant activity in September warrants close monitoring.

Recommended Procurement Actions:

Steel buyers and analysts should:

- Closely monitor demand from sectors related to the semiconductor industry. Given the news surrounding Synopsys and Nvidia, assess potential impacts on steel demand from related construction or equipment manufacturing projects, especially for plants like Jianglong Acheng Iron & Steel Co., Ltd.

- Diversify steel sourcing options. While current activity levels at individual plants seem stable or even increasing, the decrease in mean steel plant activity in China combined with the instability in the semiconductor industry suggest exploring alternative steel suppliers.

- Evaluate inventory levels strategically. Consider increasing steel inventory levels to mitigate potential supply chain disruptions stemming from the general decline of steel plant activity in China and from the uncertainties in the semiconductor sector.