From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market Booming: New Plants Fuel Optimism Despite Minor Activity Dips

China’s steel market shows strong signs of expansion, driven by new plant construction and upgrades geared towards high-value-added and green steel production. This positive outlook is supported by announcements such as “ANDRITZ to Supply Silicon Steel Processing Plant to ArcelorMittal/China Oriental Group,” indicating significant investment in advanced steel manufacturing. Similarly, the news “Shandong Zhongxin Taps Primetals Technologies for Coupled Pickling Line, Tandem Cold Mill” signals a drive towards high-quality steel for the automotive and appliance sectors, as reinforced by “China’s Shandong Zhongxin orders new pickling line from Primetals“. While satellite data shows some recent activity fluctuations at individual plants, these appear unrelated to the aforementioned expansion plans.

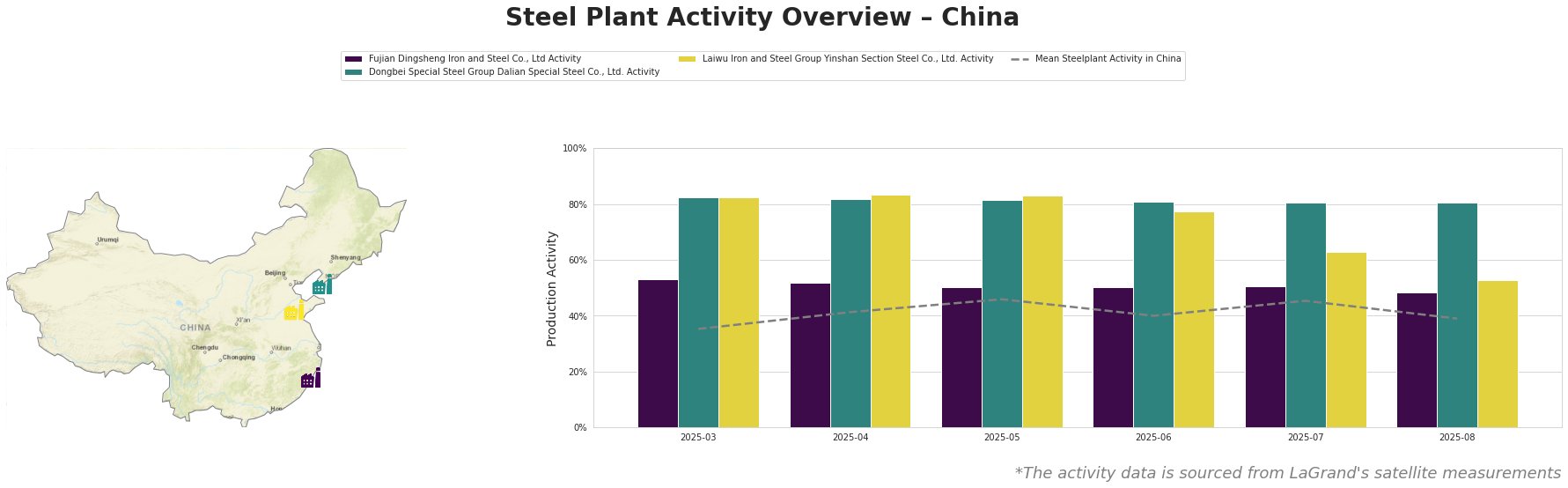

The mean steel plant activity in China fluctuated between 35% and 46% over the reporting period, ending at 39% in August. Fujian Dingsheng Iron and Steel Co., Ltd, a BOF-based plant producing finished rolled products for the automotive and tool & machinery sectors, saw a gradual decrease in activity from 53% in March to 48% in August. There is no immediately apparent link between this observed activity trend and the news regarding silicon steel or pickling line investments. Dongbei Special Steel Group Dalian Special Steel Co., Ltd, an integrated BF-BOF-EAF plant producing stainless steel and automotive steel, maintained a consistently high activity level around 81-83% throughout the period, significantly above the national average. Laiwu Iron and Steel Group Yinshan Section Steel Co., Ltd., another integrated BF-BOF plant producing section and strip steel, experienced a notable decline from 83% in March to 53% in August, well below its prior levels and national averages. This drop cannot be directly linked to any of the provided news articles.

The announcements of new plant construction and upgrades, particularly those detailed in “ANDRITZ to Supply Silicon Steel Processing Plant to ArcelorMittal/China Oriental Group” and “Shandong Zhongxin Taps Primetals Technologies for Coupled Pickling Line, Tandem Cold Mill“, signal future supply increases in high-end silicon steel and high-quality cold-rolled steel, respectively.

Based on the observed activity drops at Fujian Dingsheng and Laiwu Iron and Steel, and in the absence of supporting news, no immediate supply disruptions can be explicitly predicted. However, steel buyers should monitor these plants’ output closely and diversify their sources for section steel due to the significant activity decrease at Laiwu Iron and Steel Group Yinshan Section Steel Co., Ltd, mitigating against potential short-term availability issues. Procurement professionals focusing on automotive and appliance-grade steel should track the progress of Shandong Zhongxin’s new PLTCM line, detailed in the news articles, to anticipate future availability of high-quality steel from this source.