From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Exports Surge Despite Import Dip; Activity Suggests Regional Shifts

China’s steel market presents a complex picture of robust exports alongside fluctuating regional production. Recent data from “China’s steel exports strong in July and up 11.4% in Jan-July as sellers change geography“ indicates a significant year-on-year increase in steel exports, driven by diversification into new markets. Simultaneously, “China’s iron ore imports decrease by 2.3 percent in January-July 2025“ reveals a slight decline in overall iron ore imports despite a recent increase in July, potentially signaling changing feedstock strategies or inventory management. We do not have the data to link these articles to direct observations of plant activity.

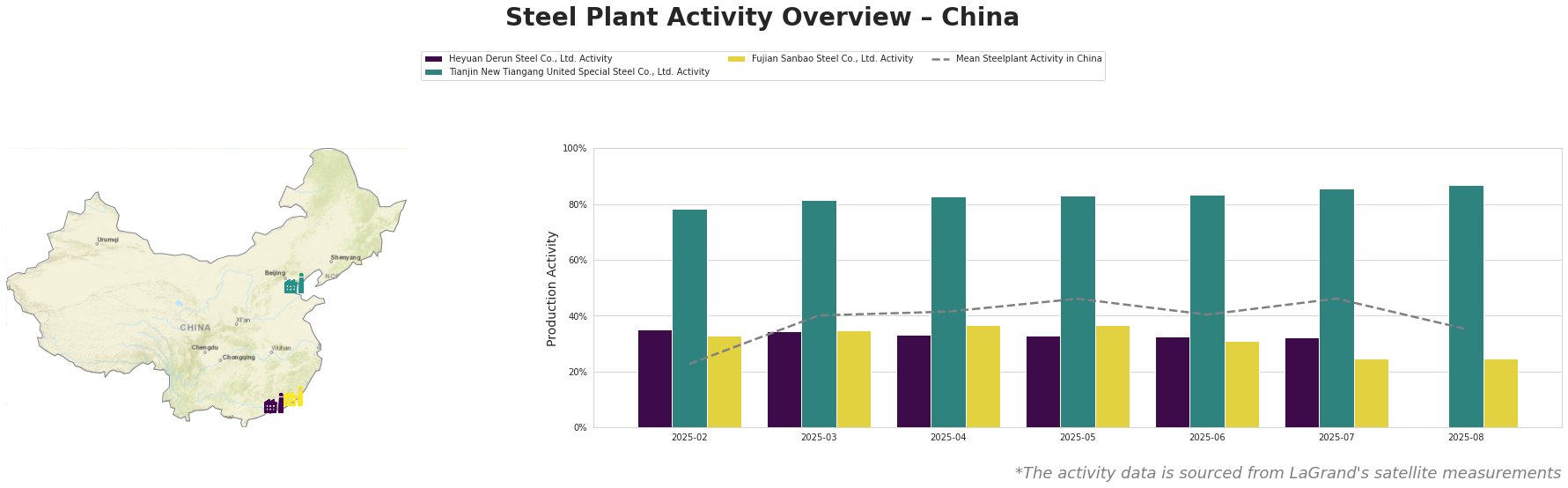

Overall steel plant activity in China reached a peak in May 2025 at 46%, subsequently dropping to 35% by August 2025. Tianjin New Tiangang United Special Steel Co., Ltd. consistently operated well above the mean, achieving 87% activity in August. Heyuan Derun Steel Co., Ltd. operated below the mean, experiencing a slight decline from 35% in February to 32% in July. Fujian Sanbao Steel Co., Ltd. also operated below the mean, exhibiting a decline from 37% in May to 25% by August. We do not have the data to link these observations to the cited news articles.

Heyuan Derun Steel Co., Ltd., located in Guangdong, operates exclusively with EAF technology, boasting a crude steel capacity of 1.2 million tons annually, specializing in hot-rolled rebar and billet. Its activity levels have remained consistently below the national average and have shown a slight decline throughout the observed period, reaching 32% in July. There is no directly correlating news to explain this behavior.

Tianjin New Tiangang United Special Steel Co., Ltd., a major integrated steel plant in Tianjin with a 4.5 million ton crude steel capacity and a 3.32 million ton iron capacity, utilizes BF and BOF technology to produce angle steel and continuous casting billet. Its activity consistently remains significantly above the mean. The plant reached an activity level of 87% in August, and no direct connection can be established to the export activity described in “China’s steel exports strong in July and up 11.4% in Jan-July as sellers change geography”.

Fujian Sanbao Steel Co., Ltd., based in Fujian, has a crude steel capacity of 4.62 million tons with a mix of BF, BOF, and EAF production. Their product range is diverse, including corrosion-resistant hot-rolled coils, billets, and various steel bars, catering to sectors like energy and construction. Its activity levels have declined notably in the last observed month. The most recent activity in July 2025 dropped to 25%. No direct link can be established to the cited news articles.

The geographical diversification of China’s steel exports, as highlighted in “China’s steel exports strong in July and up 11.4% in Jan-July as sellers change geography”, doesn’t have an immediate and obvious reflection in the three observed activity profiles, but may lead to different market dynamics in different regions.

Evaluated Market Implications:

The observed decline in activity at Fujian Sanbao Steel Co., Ltd. coupled with robust export figures may indicate a shift in regional production priorities. Given the high activity levels at Tianjin New Tiangang United Special Steel Co., Ltd. and the overall export trends, steel buyers should:

- Monitor Regional Supply Dynamics: Actively track the supply and pricing trends in Fujian and Guangdong to assess the impact of localized production changes on availability and lead times.

- Diversify Sourcing Geographies: Expand procurement efforts to include suppliers in regions with higher production activity, like Tianjin, to mitigate potential supply disruptions from regions experiencing declines.

- Assess Export-Driven Price Impacts: Factor in the impact of strong Chinese exports on global steel prices when negotiating contracts, anticipating potential upward pressure due to increased international demand.

- Evaluate semi-finished product sourcing Given the overall increase in Chinese steel exports mentioned in “China’s steel exports strong in July and up 11.4% in Jan-July as sellers change geography”, steel buyers that have semi-finished products in their portfolio should re-evaluate their reliance on Chinese semi-finished product sourcing given the increased international and domestic demand that is likely driving up prices and lead times.