From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel: Exports Surge Amid Domestic Shifts, Plant Activity Shows Mixed Signals

China’s steel market is seeing rising exports amid changing domestic demand patterns, as stated in “IREPAS Meeting: 2025 set to be record year for China’s steel exports” where stagnant domestic demand is driving the increase, and “Producers at IREPAS: Chinese exports and protectionism squeeze global steel industry” points to challenges for the global industry. However, no direct relationship between these export forecasts and observed steel plant activity levels can be explicitly established based on the data.

The presented news articles indicate shifts in Chinese steel demand and export dynamics. “Baosteel at IREPAS: Long-term demand outlook solid despite short-term disruptions” highlights a transition from construction to manufacturing demand, with a decline in rebar production.

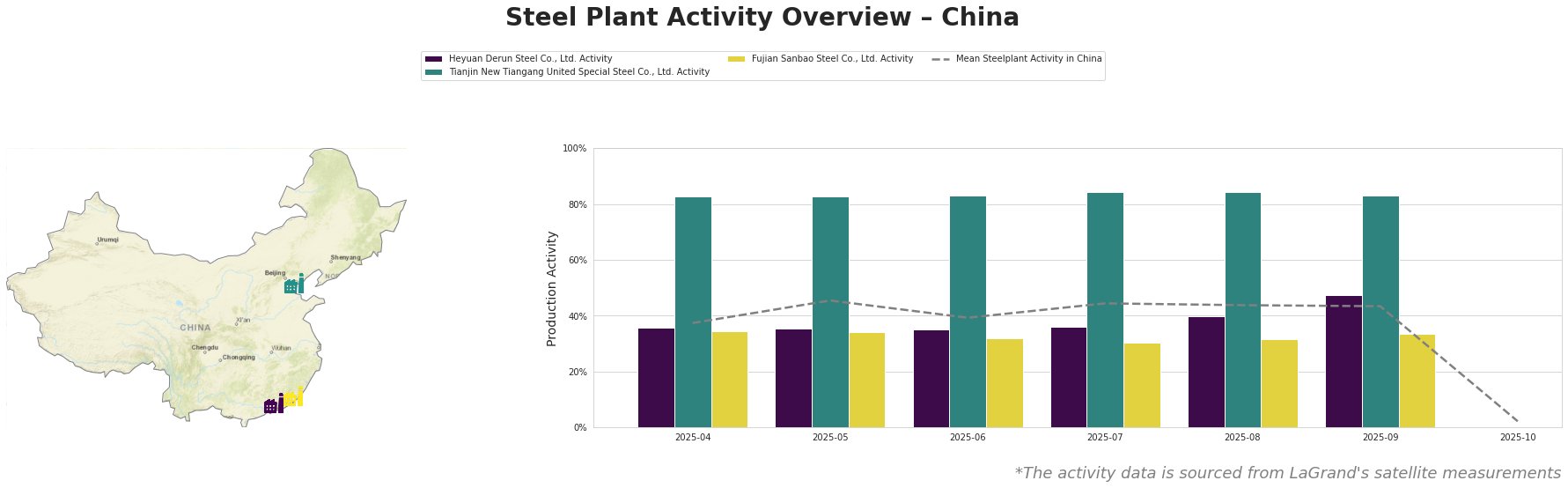

The mean steel plant activity in China fluctuated between 37% and 45% from April to September 2025, before dropping significantly to 2% in October. Tianjin New Tiangang United Special Steel Co., Ltd. consistently showed high activity, around 83-84%, throughout the observed period. Heyuan Derun Steel Co., Ltd.’s activity saw a slight increase, peaking at 48% in September. Fujian Sanbao Steel Co., Ltd. experienced a gradual decline, reaching 30% in July before a slight rebound. The sharp drop in mean activity in October cannot be directly linked to the provided news articles.

Heyuan Derun Steel Co., Ltd., located in Guangdong and operating with EAF technology, has a crude steel capacity of 1.2 million tonnes. The plant specializes in hot rolled rebar and billets. While its activity remained relatively stable between April and August, it peaked at 48% in September, before the average Chinese steel plant activity plummeted in October. No direct correlation between this plant’s activity and the provided news articles can be explicitly established.

Tianjin New Tiangang United Special Steel Co., Ltd., an integrated BF-BOF steel plant in Tianjin with a crude steel capacity of 4.5 million tonnes, maintained a consistently high activity level around 83-84% throughout the observed months, significantly above the national mean. Its product portfolio includes angle steel and continuous casting billet. This high activity level does not appear to be directly impacted in the short term by the trends outlined in the news articles.

Fujian Sanbao Steel Co., Ltd., based in Fujian, is an integrated BF-BOF steel plant with a crude steel capacity of 4.62 million tonnes, also operating EAF. It produces a diverse range of products, including corrosion-resistant hot-rolled coils, rebars, and steel strands. Activity at this plant saw a decline from 35% in April to 30% in July before rising slightly to 33% in September. The shift in the steel product mix, as mentioned in “Baosteel at IREPAS: Long-term demand outlook solid despite short-term disruptions,” might be a contributing factor due to changing demand for Fujian Sanbao’s product range.

The surge in exports predicted in “IREPAS Meeting: 2025 set to be record year for China’s steel exports” combined with protectionist measures mentioned in “Producers at IREPAS: Chinese exports and protectionism squeeze global steel industry” could disrupt supply chains and increase price volatility.

Procurement Action: Steel buyers should closely monitor Chinese export policies and trade regulations, particularly tariffs and quotas, and their impacts on specific steel products. Diversifying sources for products like hot-rolled coils and rebar, especially if sourcing from Fujian Sanbao Steel Co., Ltd., which exhibits signs of fluctuating production, may mitigate potential disruptions.

The recent data and market analysis does not offer a clear explanation of the drop in mean activity in China, this should be investigated further.