From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel: Export Surge Amid Rising Inventories Signals Potential Price Weakness

In China’s steel market, rising exports contrast with increased inventories, suggesting downward price pressure despite some production increases. According to the news article, “China increased steel exports by 13.4% y/y in April,” exports have surged to their highest level since 2015. Meanwhile, “CISA mills’ daily crude steel output up 0.2% in early May, stocks also up” indicates a slight production increase alongside growing inventories, a trend that doesn’t directly explain the export rise, but highlights growing stocks inside of China.

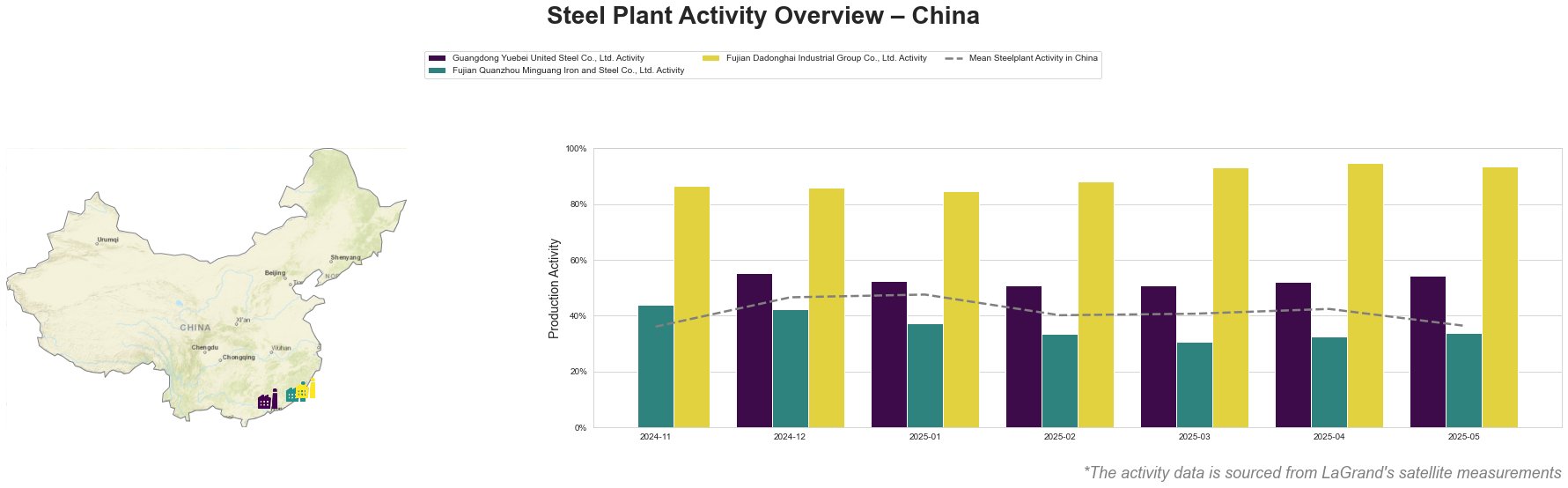

Observed activity levels across the monitored plants show varied trends. The mean activity level in China fluctuated, peaking at 48% in January 2025 before dropping to 36% by May 2025. Guangdong Yuebei United Steel Co., Ltd. maintained a relatively stable activity level, ranging from 51% to 55%, consistently above the national average. Fujian Quanzhou Minguang Iron and Steel Co., Ltd. exhibited a declining trend, starting at 44% in November 2024 and decreasing to 34% by May 2025, consistently below the national average. Fujian Dadonghai Industrial Group Co., Ltd. showed high activity levels, peaking at 95% in April 2025, significantly above the national average, before receding slightly to 93% in May 2025. The slight increase in activity at Guangdong Yuebei United Steel, relative to the national downtrend, could suggest they are focusing on export production, aligning with the “China increased steel exports by 13.4% y/y in April” news, however, no direct link can be established.

Guangdong Yuebei United Steel Co., Ltd., an integrated steel plant with a 2,000 thousand tonnes per annum (ttpa) crude steel capacity, predominantly produces rebar for the building and infrastructure sectors. The plant uses BF and EAF processes. Satellite-observed activity showed a relatively stable production level above the national average, ranging between 51% and 55%. The stabilization of production may indicate this plant is operating closer to full capacity in comparison to the national downtrend. While the plant holds a ResponsibleSteel Certification, observed activity trends do not directly reflect the news article about CISA mill’s output and inventories.

Fujian Quanzhou Minguang Iron and Steel Co., Ltd., another integrated steel plant with a 2,550 ttpa crude steel capacity, focuses on producing round bar, high-speed bar, coiled rebar, and wire rod. The plant’s satellite-observed activity has shown a downward trend, decreasing from 44% in November 2024 to 34% in May 2025, remaining below the national average. This decline doesn’t directly align with the news of increased exports, but may indicate reduced domestic demand, or production adjustments based on internal factors. The plant holds a ResponsibleSteel Certification.

Fujian Dadonghai Industrial Group Co., Ltd., an integrated steel plant with a 2,200 ttpa crude steel capacity, specializes in rebar production. Observed activity levels have remained consistently high, ranging from 87% to 95%. This high level of activity may contribute to the increased finished steel stocks reported in “CISA mills’ daily crude steel output up 0.2% in early May, stocks also up”. The plant also holds a ResponsibleSteel Certification.

The increase in exports reported in “China increased steel exports by 13.4% y/y in April”, alongside the rise in inventories reported in “CISA mills’ daily crude steel output up 0.2% in early May, stocks also up” suggests a potential oversupply situation in the domestic market. With some plants like Fujian Quanzhou Minguang Iron and Steel Co., Ltd. showing decreased activity, this dynamic may lead to further export increases and price competition. Considering the likelihood of increased export volumes and the potential for price reductions, steel buyers should:

* Negotiate for lower prices: Leverage the oversupply situation and rising export trend to negotiate more favorable pricing terms with Chinese steel suppliers, especially for rebar.

* Carefully monitor inventory levels: Track domestic inventory levels and production data in China to anticipate further price fluctuations. The drop of inventories according to the news article “Stocks of main finished steel products in China down 4.0% in early May” needs further analysis.

* Diversify sourcing: While the oversupply in China presents opportunities, consider diversifying steel sources to mitigate risks associated with potential trade disputes or policy changes.

* Closely monitor trends at key producers: Continue to watch the activity of plants such as Fujian Dadonghai Industrial Group Co., Ltd. Given their observed continued high production activity, they may be a reliable source of supply.