From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineCBAM & Rising Slab Costs Fuel Bullish European Steel Plate Market: Monitor Aperam Activity

Europe’s steel market is experiencing bullish sentiment, primarily driven by the upcoming Carbon Border Adjustment Mechanism (CBAM) and its effect on import dynamics. According to “European heavy plate round-up: Bullish sentiment prevailed” and “High steel sheet prices in Europe are supported by CBAM price pressures, a large supply of slabs, and a lack of imports“, buyers are increasingly favoring domestic material due to anticipated price increases and limited availability from imports. “Europe heavy steel plate prices buoyed by CBAM cost pressures, strong slab offers, lack of imports” further highlights the impact of CBAM and increasing raw material costs on maintaining strong steel plate prices. Observed plant activity is mixed, and no direct relationship with the aforementioned news articles could be explicitly established.

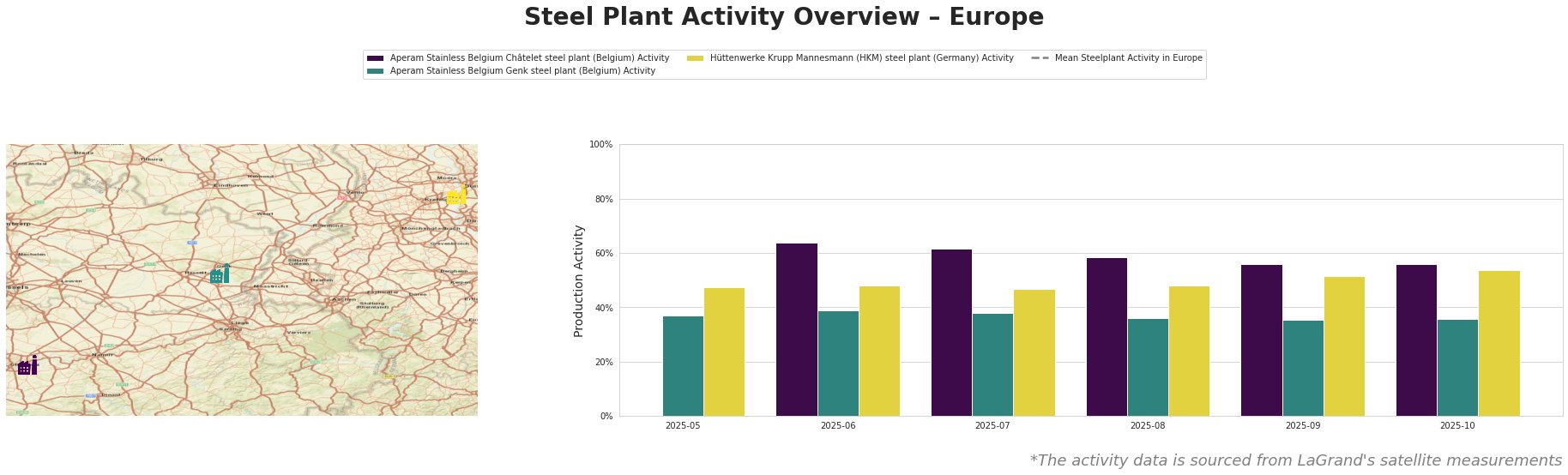

Monthly aggregated activities in % (0% = lowest ever measured, 100% = all time high):

The mean steel plant activity in Europe has fluctuated significantly over the observed period. Aperam Stainless Belgium Châtelet steel plant showed peak activity in June (64%) and a relatively stable activity between 56% and 62% in the following months. Aperam Stainless Belgium Genk steel plant shows a consistent activity between 35 and 39% over the observed months. Hüttenwerke Krupp Mannesmann (HKM) steel plant presents a gradual increase in activity, peaking in October (54%).

Aperam Stainless Belgium Châtelet steel plant, an EAF-based stainless steel producer with a capacity of 1 million tonnes of crude steel located in Wallonie, experienced an initial increase in activity to 64% in June but then stabilized around 56-62%. No direct connection between this specific activity pattern and the named news articles can be established.

Aperam Stainless Belgium Genk steel plant, also an EAF-based stainless steel producer with a slightly larger capacity of 1.2 million tonnes, shows a steady activity level throughout the period. No direct connection between this stable activity level and the named news articles can be established.

Hüttenwerke Krupp Mannesmann (HKM) steel plant, an integrated BF/BOF plant with a 6 million tonne crude steel capacity in North Rhine-Westphalia, shows a gradual increase in activity, reaching 54% in October. No direct connection between this upward trend and the named news articles can be established.

Based on the “European heavy plate round-up: Bullish sentiment prevailed” and “Europe heavy steel plate prices buoyed by CBAM cost pressures, strong slab offers, lack of imports,” the primary market implication is the potential for increased prices of domestically produced heavy plate due to CBAM and reduced import competition. The potential sanctions against Evraz PLC, highlighted in both “European heavy plate round-up: Bullish sentiment prevailed” and “High steel sheet prices in Europe are supported by CBAM price pressures, a large supply of slabs, and a lack of imports”, also add uncertainty to slab supply and prices.

Given this environment, steel buyers should:

* Prioritize securing domestic supply contracts for heavy plate: Given the bullish sentiment and anticipated price increases detailed in “European heavy plate round-up: Bullish sentiment prevailed” and the lack of imports detailed in “Europe heavy steel plate prices buoyed by CBAM cost pressures, strong slab offers, lack of imports”, proactively engaging with domestic suppliers is advised to mitigate potential price increases and ensure availability, especially if requiring ResponsibleSteel certified materials.

* Closely monitor developments regarding sanctions against Evraz: “European heavy plate round-up: Bullish sentiment prevailed” and “High steel sheet prices in Europe are supported by CBAM price pressures, a large supply of slabs, and a lack of imports” point to the potential impact of sanctions on slab availability. Buyers should actively track news and policy changes related to these sanctions to anticipate potential supply disruptions.