From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineBrazil Steel Market: Mixed Signals as Prices Rise Amidst Seasonal Demand Slowdown

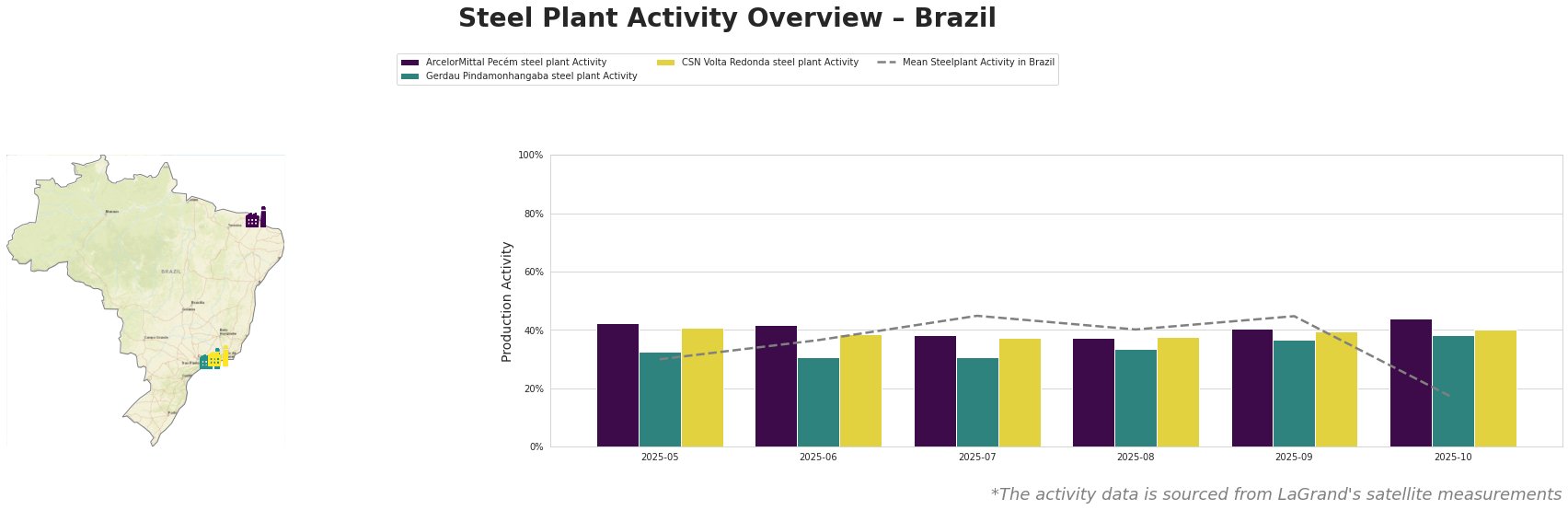

Brazil’s steel market presents a complex picture, with price increases juxtaposed against anticipated demand slowdowns. According to “Brazil’s steel demand to slow: Usiminas,” steelmakers anticipate reduced domestic sales and imports in Q4, driven by seasonal factors. The satellite-observed activity levels show a steep decline in October, potentially reflecting this anticipated slowdown, as steel production decreases while iron ore production increases..

The news articles “Steel demand in Brazil to slow down: Huciminas” and “Steel demand in Brazil to decline: Huciminas” echo this sentiment, with Usiminas forecasting stable steel prices in Q4 despite recent and potential future price hikes. Whether Usiminas’ projections are right remains to be seen. There is no direct link could be established between these price forecasts and the satellite-observed activity data.

The mean steel plant activity in Brazil demonstrates a downward trend, culminating in a significant drop to 17% in October. The activity was highest in July and September at 45%.

ArcelorMittal Pecém steel plant, an integrated BF/BOF facility in Ceará with a 3000 ttpa crude steel capacity, exhibited relative stability until October, rising to 44% during a period of decline. This increase in production is not directly explained by the news articles.

Gerdau Pindamonhangaba steel plant, an EAF-based facility in São Paulo with a 620 ttpa crude steel capacity focused on finished rolled products, showed stable activity increases from May to October, from 33% to 38%. This increased activity is not mentioned in any of the news articles.

CSN Volta Redonda steel plant, an integrated BF/BOF facility in Rio de Janeiro with a 6250 ttpa crude steel capacity, showed minor activity variation with a consistent activity around 40% but saw slight decreases in July and August. This stable activity does not directly correlate with any specific information in the provided news articles.

The anticipated slowdown in steel demand as indicated by “Brazil’s steel demand to slow: Usiminas” seems to already be affecting domestic steel production. Given the overall decline in mean steel plant activity in Brazil, particularly the steep drop in October, while price increase is still projected, steel buyers should consider the following:

- Near-Term Procurement: Given the anticipated Q4 slowdown and the recent decline in observed plant activity, buyers should closely monitor inventory levels and consider delaying large-volume purchases until clearer demand signals emerge. This is particularly relevant for steel products sourced domestically.

- Price Volatility Mitigation: Given the stated intent of steelmakers to implement further price increases even amidst a demand slowdown (“Brazil’s steel demand to decline: Huciminas”), buyers should explore hedging strategies or negotiate price adjustment clauses in contracts to mitigate potential price volatility.

- Supplier Diversification: Given the divergent activity trends among the three observed plants, buyers should diversify their supplier base to reduce reliance on any single plant. For example, if supply constraints were to emerge at CSN Volta Redonda, increasing allocation to ArcelorMittal Pecém could be a viable mitigation strategy. This strategy should not affect current purchasing plans, as there is no evidence that indicates that the demand slowdown will affect all plants equally.